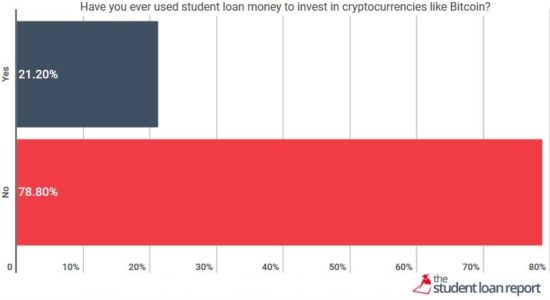

So much for the starving student stereotype: Apparently 1 in 5 financial aid recipients put the proceeds into cryptocurrencies like Bitcoin, according to the Student Loan Report.

Apparently student loan debtors borrow more money than they end up needing for any given semester, and lenders’ policies specifically allow for additional proceeds to go toward living expenses.

After the borrowers’ loan proceeds pay tuition, the schools’ financial aid offices send the remainder of the funds to students for their use on said living expenses.

No formal system can conduct surveillance on whether the borrowers are using the rest of the money on college-specific expenditures or other things. And even if there were something like that in place, you’d be able to evade it as soon as you put the financial aid proceeds in cryptocurrencies, since they’re largely anonymous and mostly untrackable.

Financial Aid Proceeds in Cryptocurrencies

That said, it seems like one of the most likely motives for putting financial aid funds into cryptocurrencies may be an attempt to earn investment profits that would go toward repayment of the debt.

Unfortunately, while this strategy might have been highly successful in previous semesters — when the currencies’ values were trending up — more recently it could have generated capital losses.

The value of cryptocurrencies have generally been coming down from massive peaks since the tail end of 2017. However, this wouldn’t necessarily make them a bad investment, and not just because you could capture an opportunity at a low price. Rather, any capital losses incurred on them could written off on a tax return instead of used to repay student debt balances.

Report Capital Losses

Actually, reporting capital losses on cryptocurrency transactions that originated with student loan proceeds might prove to be a very welcome strategy for 2018 due to the erosion of the deductibility of interest on student loans under the Tax Cuts and Jobs Act.

Although the combination of student financial aid proceeds and cryptocurrencies may sound surprising at first, perhaps only the prevalence of this practice should come as that surprise: Young people tend to be the earliest adopters of new technologies; then you have student loans reaching such epic proportions that — well, who can blame the indebted from getting extra creative.

Readers, what do you think about all this? Are you surprised to learn about students putting their financial aid proceeds in cryptocurrencies? How should lenders react to this trend, if at all?

Read More

If you’re interested in learning more about student loans, Bitcoin, taxes — or all three topics — please check out our abundant archives.

- When Do You Pay Taxes on Bitcoin and Other Cryptocurrency?

- Forgive Student Loan Defaults, Add $1.5 Billion to Economy

- How To Pay Off Your Student Loans in Less Than 10 Years

- How to Use Online Resources to Save on Your Student Loans

- Who is Betsy DeVos and What Does She Want to Do to Your Student Loan Debt?

- Do These Things Before Repaying Your Student Loans

- Important Things to Know About Private Student Loans

- Dude, Where’s Your State Income Tax Refund?

- How Long Can You Postpone Your Taxes?

- Tax Withholding Calculator Debuts on IRS Website

- Beware of Fraudulent Tax Return Scams`

- Will There Be More IRS Audits Under the New Tax Law?

- When Do You Pay Taxes on Bitcoin and Other Cryptocurrency?

- What’s the Deal with the New Tax Law?

- Attention, Shoppers: 2018 Sales Tax Holidays

- Should You Prepay Property Taxes Now?

- Which Country Has the Highest Taxes?

Jackie Cohen is an award winning financial journalist turned turned financial advisor obsessed with climate change risk, data and business. Jackie holds a B.A. Degree from Macalester College and an M.A. in English from Claremont Graduate University.

Comments