People playing options has nothing to do with bubbles. It's a lotto ticket aimed to strike it rich with over 80% the possibility of losing it all. The odds are in the favor of the option sellers, while the buyers will most likely lose every cent they invest. However due to the pandemic, everyone is playing stocks due to the flash crash+ recovery. Lots of people bought the dip and made out big. However the market is not the dot com bubble even though everyone loves to allude to it.

1. Fed is pumping liquidity into the market.

2. Treasure yield during the dot com bubble was 6%, currently we are sitting at 0.67%

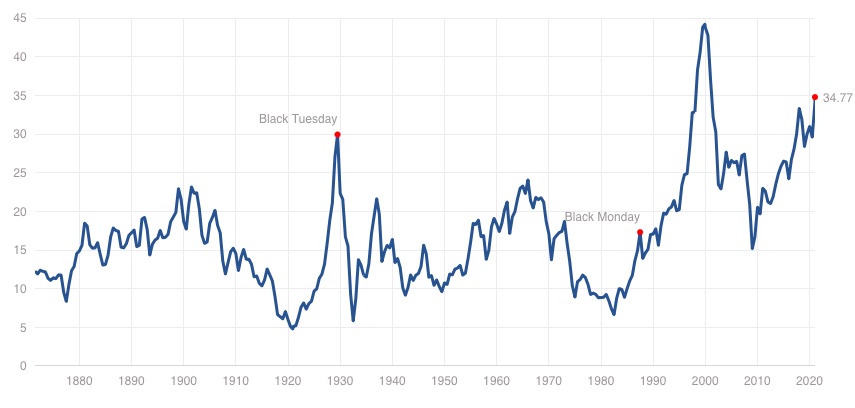

3. The P/E ratio of the entire market is at 28.8, while during the dot com bubble we were sitting at 44.

So all sign points to a continue bull market where the only down side risk is if you are conservative with your money. When interest rate is essentially zero, and bond rate is near zero, you will 100% lose if you stay cash heavy vs going S&P or something. Many of you guys have witnessed this already. Hell the biggest loser of 2020 is probably Warren Buffet. Can't believe he was fearful when everyone was fearful..how the mighty have fallen.

Go back and read all my post prior to the covid crash. I have advocated that the market is fine and just because it's due for some kind of year long market crash doesn't mean it'll happen. So even an economic standstill, a looming recession and a humanitarian crisis of the highest magnitude didn't prevent the market from hitting all time highs in 2020.

https://ofdollarsanddata.com/no-this...ot-com-bubble/

1. Fed is pumping liquidity into the market.

2. Treasure yield during the dot com bubble was 6%, currently we are sitting at 0.67%

3. The P/E ratio of the entire market is at 28.8, while during the dot com bubble we were sitting at 44.

So all sign points to a continue bull market where the only down side risk is if you are conservative with your money. When interest rate is essentially zero, and bond rate is near zero, you will 100% lose if you stay cash heavy vs going S&P or something. Many of you guys have witnessed this already. Hell the biggest loser of 2020 is probably Warren Buffet. Can't believe he was fearful when everyone was fearful..how the mighty have fallen.

Go back and read all my post prior to the covid crash. I have advocated that the market is fine and just because it's due for some kind of year long market crash doesn't mean it'll happen. So even an economic standstill, a looming recession and a humanitarian crisis of the highest magnitude didn't prevent the market from hitting all time highs in 2020.

https://ofdollarsanddata.com/no-this...ot-com-bubble/

Comment