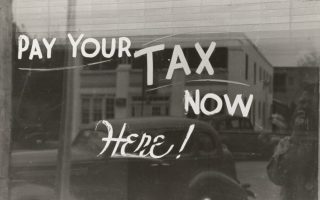

Estate taxes—often called the “death tax”—have long been a contentious issue in American politics. For seniors, the debate is more than theoretical. Proposed changes to federal and state estate tax laws could dramatically affect how much wealth heirs actually receive. Families who assume their assets are safe may be in for a surprise. The battle over estate taxes is heating up, and retirees must act now to protect their heirs.

The Shifting Landscape of Policy

Estate taxes apply when wealth is transferred after death. While exemptions exist, thresholds may change depending on political priorities. Seniors with homes, retirement accounts, or small businesses could see significant portions of their estates taxed. For heirs, this means reduced inheritances and potential financial strain. Estate taxes matter because they directly impact family legacies.

Lawmakers are debating whether to lower exemption thresholds, increase tax rates, or expand coverage. Some states already impose estate or inheritance taxes on top of federal rules. Seniors living in these states face double exposure. Policy shifts are unpredictable, leaving retirees uncertain about how much of their wealth will remain intact. The shifting landscape underscores the urgency of planning.

Data from the IRS shows that while only a small percentage of estates currently pay taxes, proposed changes could expand coverage dramatically. Analysts estimate that lowering the exemption could affect tens of thousands more families each year. Seniors who believe they are exempt may suddenly find themselves subject to taxation. The numbers highlight that this is not a distant issue—it is a growing risk.

Estate Tax Anxiety

Policy failures contribute to the crisis. Lawmakers often delay reforms, leaving retirees in limbo. Exemptions and thresholds change with political cycles, undermining stability. Seniors are left vulnerable to sudden shifts that can erase years of planning. Without a consistent policy, retirees cannot plan effectively. Reform is needed to provide clarity and fairness.

For retirees, uncertainty about estate taxes creates stress and anxiety. Seniors want to leave legacies, not burdens. Families worry about losing homes or businesses passed down for generations. The emotional toll is compounded by the fear of the government taking what was earned through decades of work. Estate taxes are not just financial—they are deeply personal.

Steps You Can Take Today

Despite the uncertainty surrounding estate tax laws, seniors can take proactive steps right now to safeguard their heirs.

- Consulting with experienced estate planners is often the first and most important move, as these professionals can identify strategies tailored to individual circumstances and minimize exposure to taxation.

- Establishing trusts is another powerful tool, allowing retirees to shield assets from estate taxes while ensuring smoother transfers to loved ones.

- For those who want to reduce taxable estates, gifting assets early—whether through financial contributions or property transfers—can be an effective way to pass wealth on while still alive.

- Staying informed about policy changes is critical, since thresholds and exemptions can shift quickly depending on political priorities.

By combining professional guidance, smart financial tools, and ongoing awareness, seniors can transform uncertainty into security and ensure their legacies remain intact for future generations.

Families play a critical role in estate planning. Open conversations reduce surprises and ensure heirs understand potential risks. Children and grandchildren can assist in identifying strategies and supporting decisions. By working together, families strengthen legacies and reduce vulnerability. Estate planning is not just about wealth—it is about unity and foresight.

The Estate Tax Battle

The estate tax battle reflects broader challenges in retirement security. Seniors face rising costs, shrinking benefits, and policy uncertainty across multiple fronts. Estate taxes add another layer of complexity. The bigger picture reveals that retirement is increasingly marked by financial struggle and unpredictability. Reform is essential to restore stability and protect legacies.

Legacies are built over lifetimes, but policies can reshape them overnight. When legacy meets policy, awareness becomes essential. Seniors must demand clarity, families must provide support, and policymakers must act. Only then can retirees ensure their heirs inherit security, not uncertainty.

Have you or your family taken steps to prepare for estate tax changes? Leave a comment below and share your experience.

You May Also Like…

- How Remote Life Complicates Estate Planning

- Secure Your Legacy: The Urgent Checklist for New Estate Rules

- Why Estate Executors Are Making More Mistakes Than Ever Before

- The Elder Law Loophole That Can Cost You Half Your Estate

- Why Adult Siblings Are Fighting Over Their Parents’ Estate More Than Ever

Teri Monroe started her career in communications working for local government and nonprofits. Today, she is a freelance finance and lifestyle writer and small business owner. In her spare time, she loves golfing with her husband, taking her dog Milo on long walks, and playing pickleball with friends.

Comments