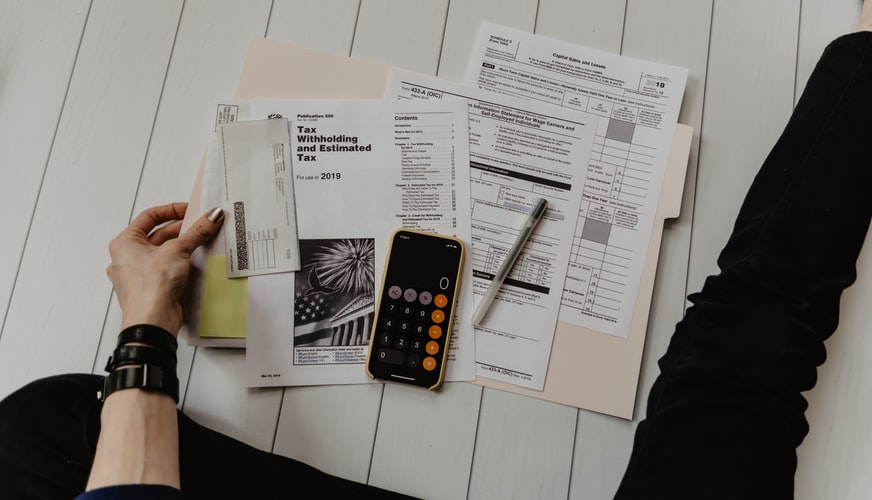

Ah, spring is around the corner….and that means tax season is here as well. If you haven’t filed your return yet, don’t wait! The deadline for filing your tax return is April 15, 2021. Fortunately, you can make this your smoothest tax year yet by taking a little time to get organized. Here are 5 tips for an easy tax return.

1) Make a List of All the Documents You Need

First thing is first – make a list of all the documents you need in order to file your tax return.

This likely includes documents, such as:

- W-2s from your employer(s)

- 1099-DIV, which reports dividends and capital gains from investment accounts

- 1099-INT, which reports interest earned on investments

- 1099-MISC, which reports any miscellaneous income you may receive

- 1098, which reports interest paid on student loans or on a mortgage

- Receipts from charitable contributions

- Receipts from business expenses

Depending on your tax situation, you may have more documents than included on this list. If you have a particularly complex situation, you may want to consult with an accountant on how to best proceed with your taxes.

2) Organize Documents by Type

Once you have a list of all of the documents you need, it’s time to gather them. Chances are, once you received a tax document in the mail, you likely threw it into a pile with various other forms. Take the time to organize your tax forms by type, and make note of any documents you may be missing. The list you created in step 1 can serve as a checklist to keep you organized throughout the process.

Organize your forms by categories, such as “income,” “business expenses,” and “other.” This little step will make it so much easier once you actually file your taxes, because you won’t have to be shuffling around to find the form you need.

File Your Taxes with H&R Block

3) Follow Up on Any Missing Documents

As you’re going through your checklist, you may find you are missing some key documents. You will want to follow up on these immediately, as you won’t want to miss the deadline for filing your taxes. If you file your tax return late, you will be subject to fees and interest payments….not ideal.

Start by logging into your accounts online. For instance, your bank account may upload interest forms to your account online instead of mailing them to you. If you still can’t find the forms you need, give the organization a call and ask them to securely email it to you. That way, you have the tax form immediately.

4) File Your Taxes

Once you have all of the appropriate tax forms, you can actually file your taxes!

To file your taxes, you can choose the tax software of your choice, go through an accountant, or file online through the IRS. The choice is up to you and will depend on how complex your tax situation is.

5) Organize for Next Year

Congratulations – you submitted your tax return! While it can be tempting to shove your tax documents in a folder to never view until the following year, take a few extra minutes to organize for next year.

Organize your forms nicely and keep them in a folder or binder. Keep the checklist you made so you can see what documents you used this year. Think ahead to next year’s return. Are there other documents you already know you can expect to receive? For example, if you plan to switch employers this year, you will need to make sure to get a W-2 from each employer. Jot that down so you are more prepared for next year.

Read More:

- How to Avoid Stock Investment Hype

- Invest or Trade – Is Day Trading an Option?

- Here’s What You Should Know About Investing in SOLO

If you enjoy reading our blog posts and would like to try your hand at blogging, we have good news for you; you can do exactly that on Saving Advice. Just click here to get started. Check out these helpful tools to help you save more. For investing advice, visit The Motley Fool.

Rachel Slifka is a freelance writer and human resources professional. She is passionate about helping fellow millennials find success with their finances and careers. Read more by checking out her website at RachelSlifka.com.

Comments