The appeal of electric vehicles (EVs) is continuing to grow. Couple that with emerging legislation. Such as the zero-emission vehicle executive order in California, and interest is only rising. This shift in sentiment makes investing in the EV niche enticing for many. ElectraMeccanica Vehicles (SOLO) is one of the options that is gaining attention. Giving people a way to snag a piece of the EV world for themselves. But does that mean that investing in SOLO is a good idea? If you’re considering adding SOLO to your portfolio. Here’s what you need to know.

Join Robinhood – Learn to invest. Win $20,000 towards tuition

The Current State of ElectraMeccanica

First, it’s important to understand that, in many ways, ElectraMeccanica is still a company in its development stage. While the company does have a flagship vehicle – a single-seat three-wheeled car called the SOLO – as well as some other designs in the works, its vehicle delivery rate is incredibly small at the moment.

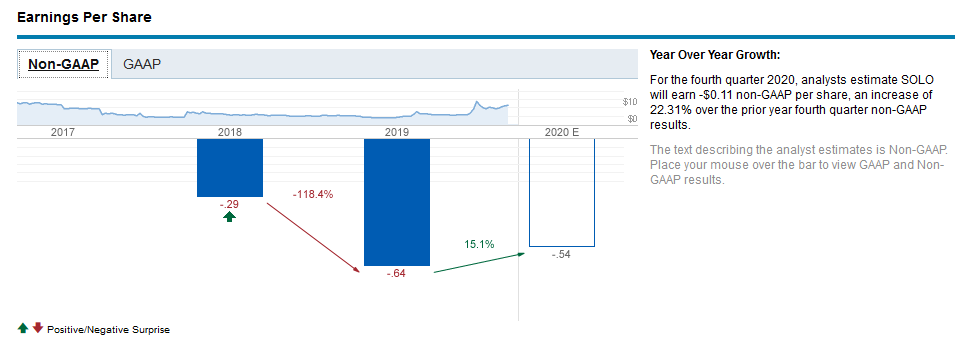

While the company does have sales, ElectraMeccanica’s net income is currently in the negative. Some experts also believe that SOLO may be overvalued, something that should give aspiring investors at least a moment of pause. In fact, Charles Schwab estimates that SOLO will take a net loss of 54 cents per share in 2020. From their website:

Source: schwab.com.

It’s also important to note that the company’s November earnings release did outperform expectations. However, that doesn’t mean ElectraMeccanica had a great performance. Expectations were, overall, pretty low. Additionally, earnings were below the $300,000 mark, and the net loss actually widened.

However, ElectraMeccanica’s vehicles are slated to be both quirky and affordable, something that could ultimately work in the company’s favor moving forward. The company also has plans to open an assembly facility in the United States, which may be a positive sign.

The Influence of Tesla and NIO on SOLO Stock

Recently, both Tesla (TSLA) and NIO (NIO) have experienced some dramatic highs. They are both benefiting from the increasing interest in EVs, causing their stock prices to experience substantial increases in recent months.

This led to some boosts to SOLO as well. In a way, the gains were based on SOLO’s association with a rising market, with some investors willing to bet that the company might become the next EV star. However, both Tesla and NIO are much more established, leaving much of the sentiment about SOLO to be, at least partially, speculative.

Trends such as this are regular occurrences. When a sector sees gains, some investors look for smaller companies in the same niche, hoping to snag a bargain at an opportune time. This often bolsters additional interest as others see the price of the lower-cost stock rise and assume it means the company is moving toward something big.

However, at times, this ultimately ends up being nothing more than hype. Once the shine wearers off, the stock price tumbles.

Is Investing in SOLO a Good Idea?

While it may seem like there’s a lot of doom and gloom surrounding SOLO, that doesn’t mean investing in it is an entirely bad idea. In reality, the company is still developing, and the push for EVs is likely to keep rising overall.

The biggest point to understand is that SOLO would be a fairly risky venture, considering the company’s current state. It isn’t necessarily an issue of volatility as it is one of uncertainty about whether the company will gain traction in major markets leading to a rise in demand.

Ultimately, if you aren’t risk-averse and are open to taking a chance in the EV market, SOLO could be a way to do that. The stock’s price has largely been below the $10 mark, so it could be a fairly affordable way to get into the sector. Just make sure you’re comfortable with the company’s current state before you jump in and that you’re prepared for potential losses as well as the chance for gains. If you’re in that category, then SOLO might be right for you.

Investing Platforms and Investing Advice

| Platforms: | Fees and Minimum: | Best for: |

|---|---|---|

| Robinhood | Free | Beginner investing |

| Acorns | $1 per month | Spare change investing |

| The Motley Fool | $99 for the first year. | Stock advising |

Do you plan on adding SOLO to your portfolio? Why or why not? Share your thoughts in the comments below.

Read More:

- 8 Stocks to Have in Your Portfolio for 2021

- Stock Trading: A Guide to Turn Your Savings into an Investment for Millennials

- 5 Stock Trading Strategies and Tips for Beginners

If you enjoy reading our blog posts and would like to try your hand at blogging, we have good news for you; you can do exactly that on Saving Advice. Just click here to get started. If you want to be able to customize your blog on your own domain and need hosting service, we recommend trying BlueHost. They offer powerful hosting services for $3.95/month!

Tamila McDonald is a U.S. Army veteran with 20 years of service, including five years as a military financial advisor. After retiring from the Army, she spent eight years as an AFCPE-certified personal financial advisor for wounded warriors and their families. Now she writes about personal finance and benefits programs for numerous financial websites.

Comments