If the current market correction is giving anyone a tummyache, take heart - things could be worse! For example, you could've just had your boss tell you that she's holding off opening a 401k for you because "the markets are in a free fall because of the coronavirus."

How did I get so lucky to have someone in my corner who knows the folly of buying low and is willing to prevent me from taking advantage of lower stock prices?

Logging in...

Anybody buying on this downturn?

Collapse

X

-

And quite frankly, a 20% correction only puts us back to late last year. The markets were approaching stupid and a reset for corona virus with a reasonably strong economy in an election year will keep us tracking back to record highs. I do wonder what will happen after the election. Trump has been spending like a drunk sailor. And the Fed has been pumping trillions of cash into the credit market. At some point, that will cause a sustained bear. But not today I think.

Leave a comment:

-

-

I understand, but the actual definition is simply a 20% drop. Duration isn't part of the definition.Originally posted by TexasHusker View Post

That could happen today, but I wouldn’t define such as bear. A bear is when there is sustained negative sentiment against the markets, where seemingly no news makes it rally. Energy has been in a multi year bear, as an example.

I think the negative sentiment is going to hang on until the Coronavirus situation settles down. It's having a broad effect on business and economic activity. Travel plans being cancelled. Professional meetings and conferences scrapped. Study abroad students returning home. Cruises, casinos, airlines, tech companies, manufacturing supply lines, etc. And it only seems to be getting worse with each passing day.

Leave a comment:

-

-

That could happen today, but I wouldn’t define such as bear. A bear is when there is sustained negative sentiment against the markets, where seemingly no news makes it rally. Energy has been in a multi year bear, as an example.Originally posted by disneysteve View Post

A bear market is simply a 20% drop from the recent high. It doesn't have to last any particular amount of time to be a bear market. It can recover quickly and still count.

Leave a comment:

-

-

A bear market is simply a 20% drop from the recent high. It doesn't have to last any particular amount of time to be a bear market. It can recover quickly and still count.Originally posted by TexasHusker View Post

A bear market is a protracted period of time when equities are mostly down, on average 9 months.

Leave a comment:

-

-

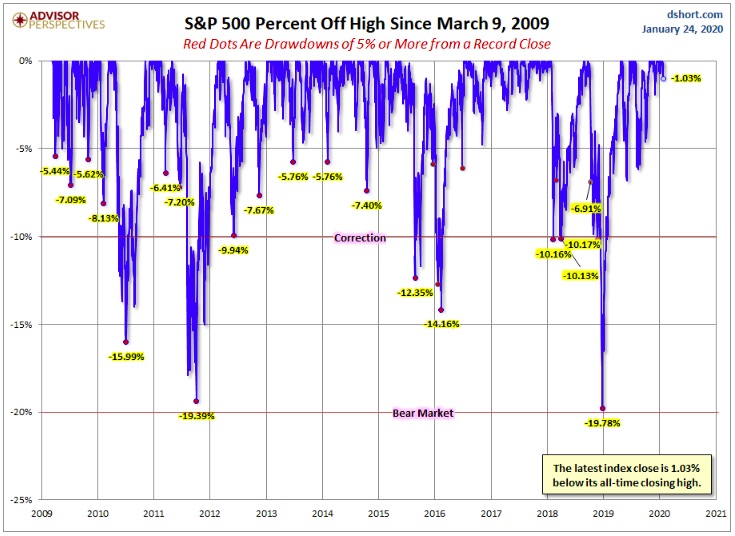

A bear market is a protracted period of time when equities are mostly down, on average 9 months. Bear markets can shed 30-40% of shareholder value and take 3-5 years to recover on average. We haven’t experienced that in many years.Originally posted by disneysteve View PostGreat chart. It shows that there hasn't technically been a bear market but we've gotten as close as 0.22% away from one so saying it's been an 11-year bull market is a little deceptive.

A correction is generally a “whipsaw” where the downturn is sharp and steep, but recovers within a few months.

The corona virus will not plunge the markets into bear territory, but another shoe of some sort dropping - geopolitical crisis, election of a socialist president, etc. - certainly could. Normally it takes two or three things to create a bear.

Bear markets can delay retirement plans for a decade or more. I’ve seen it before and I’ll see it again.

Leave a comment:

-

-

Great chart. It shows that there hasn't technically been a bear market but we've gotten as close as 0.22% away from one so saying it's been an 11-year bull market is a little deceptive.

Leave a comment:

-

-

I didn’t realize the correction from 2018. Fascinating. I think I have like $11K in the market in an old IRA somewhere. It’s probably $9500 now.

Leave a comment:

-

-

There have been a lot of corrections since 2008 and even 2 "bears". So the ride hasn't been all up. 2018 really sucked.

Leave a comment:

-

-

It will be interesting if all of the “buy on the dips” bit comes to fruition. 10% ain’t much correction though. The masses aren’t running for the exits just yet. If the Dow drops to sub 20K, we will have a new crop of millions of “never buy another stock again” investors.Originally posted by corn18 View PostCorrection territory now.

In bull markets, everyone boasts about annual averages since ________ (pick your date). This situation could be a painful reminder that it’s an average. If you are retiring next year and have your $$ in a S&P index fund, those historical averages aren’t very consoling today.

Leave a comment:

-

-

A lot of folks would argue that point with you. Disney has cut back or totally eliminated many things despite steadily raising prices. For example, there hasn't been a nighttime parade at Magic Kingdom for several years. They've eliminated a lot of street performers and entertainment. Plus, they've added more and more extra hard ticketed events, often closing the parks early to regular guests as a result. So people are absolutely paying more and getting less.Originally posted by Singuy View PostDisney is not exactly charging more and giving you less.

Which generates very little if any revenue for Disney. Now if you go in for dinner or drinks, they get a little out of you, but that's much different than a tourist who books a whole vacation package with tickets, hotel, meals, souvenirs, etc.My family goes about once a week, sometimes just to walk around after dinner.

Leave a comment:

-

-

Just placed an order for $1000....which is what I do each and every month. Order probably wont execute until Monday. Just so happens the market is down from its high.

Leave a comment:

-

-

The value proposition of an AP for people who are not from around FL or the city can only be made up by how you use it. On the other hand, AP is perhaps the cheapest investment I know of entertainment wise living just 15 mins away. Plus Disney is not exactly charging more and giving you less. They are practically building two brand new parks (Epcot 2.0 and Hollywood studios). My family goes about once a week, sometimes just to walk around after dinner.Originally posted by disneysteve View Post

No, I'm not. I've never been to one. I'd like to go someday.

Here's the problem, though. At some point, screwing the guest to eke out another dollar of profit will crash the system. I already know quite a few people who have been long time Disney World visitors, going 2 or 3 times per year, who have now reluctantly bowed out and have no immediate plans to return anytime soon. Last year guest attendance was down but revenue was up thanks to higher prices, but that formula only works for so long.

Personally, when I was planning our last visit back in August, I opted not to buy all 3 of us Annual Passes because it simply wasn't worth it anymore even though we've had them for several years. I did buy one AP for myself which still wasn't worth it but it came with a convenience factor of including parking, park photos, and a few discounts. Ironically, 3 days after I bought my AP, they hiked the price again. Had I waited, I would not have bought even the one AP at the new price so when mine expires, I won't be replacing it. We also have no trip planned which is very unusual for us, having gone at least once and often twice a year for the past 25-ish years.

Leave a comment:

-

Leave a comment: