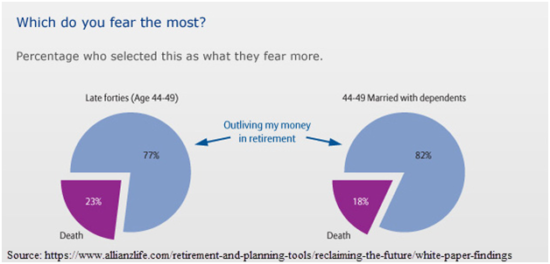

Here’s a great question for a trivia game: What is the number one fear of people between 44 and 49 years old? Most people think it’s dying early. But that’s not right. In fact, it is not even close. By far the number one fear for people in this age group is running out of money in retirement.

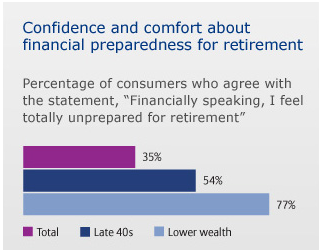

Not Prepared For Retirement

Not surprisingly, most people in this age group feel like they are not prepared for retirement.

As a country, this is a major problem. If we have these many people who cannot approach retirement confidently, we are going to see a lot more people working for the rest of their lives. We will also see many more people on government programs such as Medicaid, which is already one of the biggest contributors to our federal deficit and debt.

People, Take Control!

We can all get our heads out of the sand now. There is wonderful technology available that can help anybody figure out what they need to do to get to a good spot for retirement.

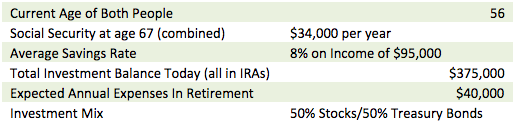

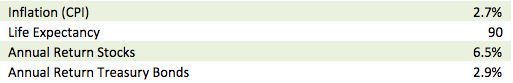

Let’s look at a case study of a couple who is afraid they will never be able to retire. I recently talked to this couple and here is their situation:

What Can They Do?

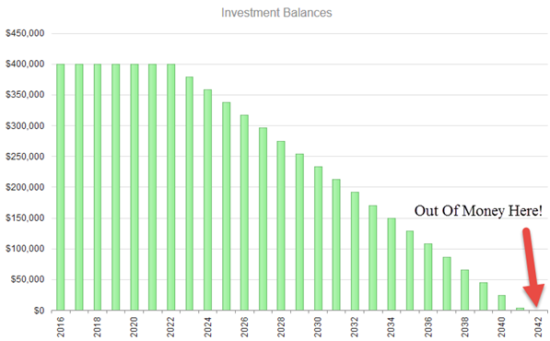

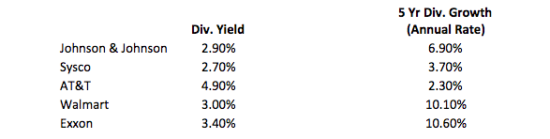

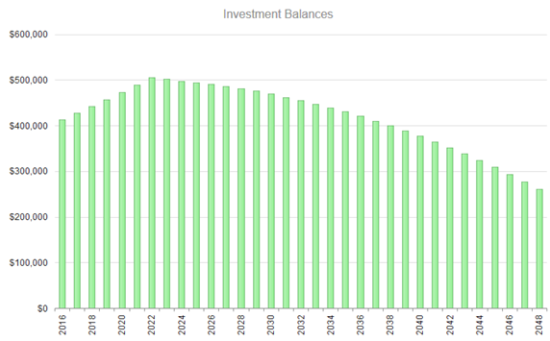

The key for many people in retirement is to make sure their retirement income covers their retirement expenses. Otherwise, you are racing against the clock. With bond yields still very low, I always recommend finding solid dividend paying stocks that have a long history of never cutting their dividends. Some of my favorites are below:

Model Income Vs. Expenses

It is of utmost importance to project out retirement income vs. expenses. This will help anybody understand when they can retire and what they need to do to get there. Perhaps they need to start saving more. Maybe they need to reduce their spending. But in order to figure this out, we have to start by making the projections to figure out what it will take to have a successful retirement.

Should you consider postponing your retirement? More and more Americans are doing it…

James Hendrickson is an internet entrepreneur, digital publishing junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.

Comments