What is cFIREsim, exactly?

This is a free web-based tool used to calculate retirement planning. In fact, cFIREsim stands for Crowdsourced Financial Independence and Early Retirement (FIRE) Simulator. This calculator uses “historical stock/bond/gold/inflation data from 1871 to present” to determine how your financial portfolio would do over time, according to their website. With their basic simulator, you will be asked a few simple questions regarding your retirement plan. Then, with your answers, it imitates what your financial future is based on the performance of the market throughout history. It will create multiple simulations for you to compare and contrast based on how much you want to take out each year and so on.

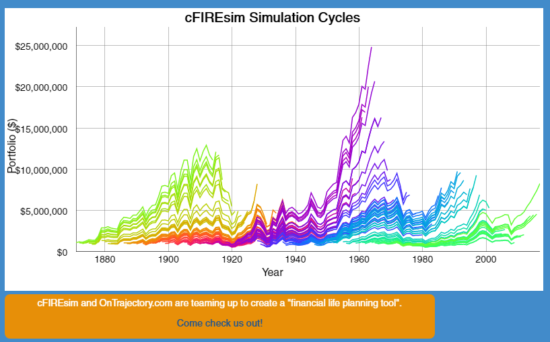

The financial calculator can also go beyond the basics and show you the success of your portfolio in a graph format based on a variety of determining factors, such as different types of inflation and market returns.

My cFIREsim review:

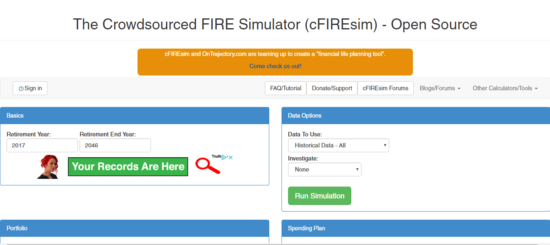

The cFIREsim site is fairly basic in design but gets straight to the point. You will find options to input information right away, which may appear confusing if you are unsure what to put.

But, basically, you start with the year you plan to retire and live off your retirement. For the retirement end year, you will enter how long you estimate you’ll for, also known as the year you think you will live until.

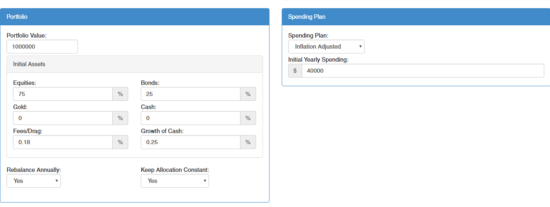

You will then enter your current retirement value across all accounts, not what you believe it will be when you actually retire. You’ll see defaulted information entered, but you should know how your money is distributed and can change this accordingly on the simulator. When trying, I kept the Keep Allocation Constant and Rebalance Annually the same.

After this section, you will find input options for pensions and social security, which also looks overwhelming if you are unsure of this information. But, cFIREsim notes in their FAQ that the above entries are enough to run a basic simulation.

When you run the simulator, you’ll see graphs that are initially confusing, since they provide information dating back to the 1800s. Initially, I thought I may have entered the wrong information when I ran this the first time, but after reviewing the FAQ, I realized they are simply trying to show you how well your portfolio would have done over the years dating back to 1871.

Is it worth trying?

Even though it can be a little confusing at first (the dates dating back to the 19th century threw me off), the basic simulator tool does provide some useful and helpful information regarding your financial future. If nothing else, it gives me an idea of what to expect and how much I should have in retirement if I want to live comfortably. The downside is that it does not incorporate tax rates so that can be difficult when wanting accurate results. Retirement planning can also be much more complicated than this, which is why I assume they stress the fact that is is a basic FIRE tool. Plus, even though there is a forum section, it does appear to be lacking activity in recent years, which is another downside. Their FAQ and Tutorials are not as descriptive as they could be.

With that being said, it at least gives me a starting point with my retirement and financial freedom planning if nothing else. I can also use it to review and evaluate the trends throughout history. I do realize, though, that there are some inaccuracies with the results, such as inflation rates only being yearly and the ability to take out my money monthly instead of just yearly.

Hopefully, you find this cFIREsim review to be helpful if you choose to use this simulator. What are your thoughts of cFIREsim?

James Hendrickson is an internet entrepreneur, digital publishing junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.

Comments