The marijuana industry continues to attract the attention of investors. Many are looking for companies that may be worth investing in. These investments allow you to potentially capitalize on the increased acceptance of cannabis in the United States, Canada, and other countries across the globe. ACB Aurora Cannabis Inc (NYSE: ACB) is one company garnering a lot of attention, but is it worth investing in Aurora Cannabis?

Why ACB Aurora Cannabis Inc is Worth Considering

At peak capacity, Aurora Cannabis could offer more production potential than any other grower in Canada. After acquiring ICC Labs, Aurora Cannabis went from a production capacity of about 570,000 kilograms to about 700,000 kilograms. This is a significant jump in what they are able to grow. The ICC acquisition gave Aurora Cannabis an extra 92,000 square feet of grow farms and another 1.1 million square feet of developing greenhouse space.

By becoming the leader in production potential, Aurora Cannabis becomes a more viable choice for markets looking for reliable, long-term supply deals. The company may also garner additional interest from tobacco, pharmaceutical, and beverage companies looking for a partner in the marijuana industry.

Additionally, Aurora Cannabis does more than operate in the dried cannabis flower space. They also produce alternative cannabis products, such as a recently launched line of oil capsules. Plus, they bring in more revenue through Larssen – a company that designs and builds greenhouses around the globe – which Aurora Cannabis owns.

Aurora Cannabis currently has a presence in almost two dozen countries, and that number could grow in 2019.

Why You Might Want to Avoid Aurora Cannabis

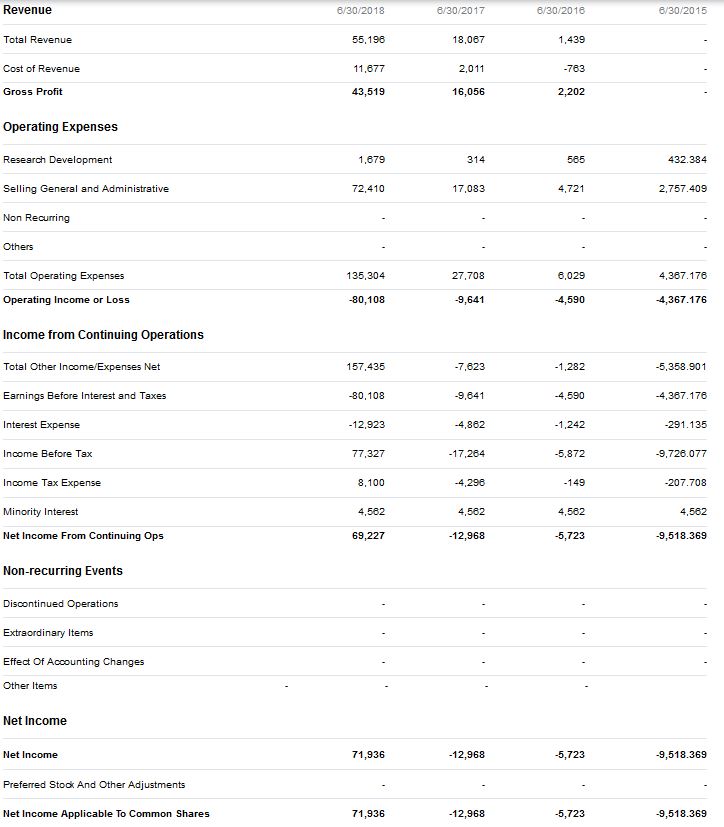

While Aurora Cannabis has a lot of good points, there are also some drawbacks to examine before you invest. First, the company has struggled to generate a recurring operating profit, and that is hard to ignore.

Additionally, Aurora Cannabis has several expansion projects in the works. This means the company is dealing with large expenses and could prevent the company from generating a profit for a significant period if they do not gain access to additional one-time benefits.

Aurora Cannabis also tends to increase its outstanding share count. This isn’t always ideal for investors, especially those who are concerned about the impacts of dilution. The company has even used stock to acquire other businesses, a reflection of their growth-at-any-cost mindset.

Finally, considering the size of Aurora Cannabis’ operations, it is a bit worrisome that the company has yet to secure a partner. A brand-name partner could catapult Aurora Cannabis forward, and its inability to find one could mean that their asking price is too high or that the company isn’t as strong as they would want people to believe. While those points are speculative, there has to be a reason behind the lack of a partnership, and it is wise to consider that before investing your hard-earned money.

Aurora Cannabis Earnings Analysis

While Aurora Cannabis is expected to increase their revenue numbers substantially in 2019 and into 2020. Some analysts believe that revenue could even get near or cross the CA $1 billion mark by 2020, which is substantially higher than the CA $268 million to CA $357 million estimates for 2019.

However, the earnings picture isn’t necessarily so bright. Analysts appear to be divided when it comes to whether earnings will rise or fall in 2020, and they are largely predicting losses in 2019. If there current earnings is any indicator, you may want to take a wait and see attitude.

Should You Invest in ACB Aurora Cannabis Inc.?

Ultimately, the decision to invest in Aurora Cannabis is a personal one. The company’s propensity for diluting shares should be a concern even if some of that occurred as a result of acquiring other companies and increasing production capacity.

However, Aurora Cannabis does have the potential to excel as the marijuana industry grows and more states and countries legalize. The sheer size of Aurora Cannabis’ operations could make them a reliable source of cannabis flowers and alternative products, making it easier to meet demand.

It is important to note that cannabis is still a contentious issue legally, particularly in the United States. While individual states are choosing to legalize marijuana, including for medicinal and recreational purposes, it is still illegal on a federal level. Should the federal government decide to act, they could wreak havoc on the U.S. cannabis market, impacting Aurora Cannabis’ profitability.

Have you invested in ACB Aurora Cannabis Inc or any other marijuana stock? Tell us about your experience in the comments below.

Read More:

- 5 Tips for Finding Hot Cannabis Stocks in Which to Invest

- New FDA Approved Cannabis Drug Reflects Investor Interest

- What is the Impact of Cannabis on Mental Health?

If you enjoy reading our blog posts and would like to try your hand at blogging, we have good news for you; you can do exactly that on Saving Advice. Just click here to get started.

Tamila McDonald is a U.S. Army veteran with 20 years of service, including five years as a military financial advisor. After retiring from the Army, she spent eight years as an AFCPE-certified personal financial advisor for wounded warriors and their families. Now she writes about personal finance and benefits programs for numerous financial websites.

Comments