How to Save $100 in a 30 Days

If you want to start slow or simply have a need for a quick $100, you can painlessly get the money you need with a 30-day quarter challenge. This approach is great for individuals who are living paycheck to paycheck, as the daily deposits never exceed $7.50.

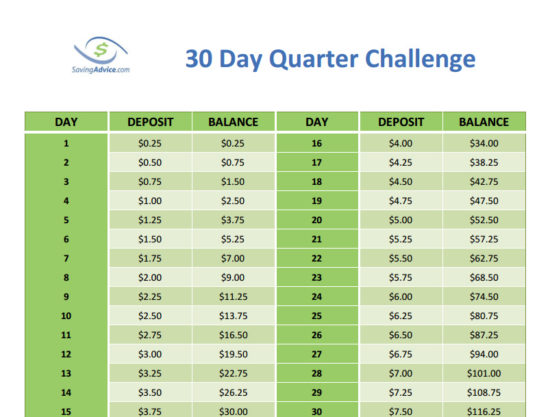

On day one, deposit $0.25 in your savings account, the value of one quarter. Then, on day two, you deposit two quarters instead of one, making your deposit into your savings account $0.50 and bringing your balance up to $0.75.

As you proceed with the challenge, you just add $0.25, or one quarter, to the deposit amount from the previous day. On day 10, your deposit will be $2.50. On day 20, you’ll reach $5.00. Finally, your day 30 deposit is only $7.50.

You can also remember the amount by recognizing that the number of quarters you deposit matches the day of the challenge. For example, on day 10, you would deposit 10 quarters, which have a value of $2.50.

At the end of the challenge, you’ll have $116.25 in your account. Plus, if you put the money in a high-yield savings account, you might even earn a little bit of interest too.

If you would rather do the challenge in cash, you can place the appropriate number of quarters into a jar at home instead. However, you won’t earn any interest this way, and you might have to wrap up your change in rolls before depositing it into a savings account.

Want to Save $500 in 30 Days Instead?

If you want to challenge yourself, and pull together almost $500 instead of $100, then use dollars instead of quarters. On day one, deposit $1.00. Then, deposit $2.00 on day two, $3.00 on day three, and so on until you finish the 30 days.

At the end of a 30-day dollar challenge, you’ll have $465 in the bank. Plus, your largest deposit is just $30, the cost of a single fast food meal for many families of four.

Benefits of the 30-Day Money Saving Challenge

While the biggest benefit of completing the 30-day challenge is increasing the balance in your savings account, you also get more out of it than that. Along the way, you are setting good savings habits, helping you create a solid financial cushion in case of an emergency.

Plus, there is nothing to say that you have to stop after 30 days. You could always keep going, increasing your deposit by $0.25 each day until you reach a particular savings goal or hit the end of the year. Alternatively, if you are living paycheck to paycheck, you can start over each month, using the date to guide the size of your deposit. That way, your largest daily deposit never exceeds $7.75, making it much more manageable for anyone with a tight budget.

Consider Money Saving Apps

A great way to supplement your savings is the automated approach with an application like Digit.

Simply sign up and let the program analyze your checking account. The app will then make automated withdrawals which don’t impact your spending and sweeps them to an account you control. It is a super easy way to save money without a lot of effort. Click here to check it out.

In either case, you are creating an easy way to bolster your savings, ensuring that you have a health emergency fund in place at all times.

Do you have a tip for saving $100 a month? Share it in the comments below.

Read More:

- Alternatives to the 52 Week Money Challenge

- Save Nearly $500 with the 30 Day Money Challenge

- Try the No Spending Challenge

If you enjoy reading our blog posts and would like to try your hand at blogging, we have good news for you; you can do exactly that on Saving Advice. Just click here to get started.

Jeffrey strain is a freelance author, his work has appeared at The Street.com and seekingalpha.com. In addition to having authored thousands of articles, Jeffrey is a former resident of Japan, former owner of Savingadvice.com and a professional digital nomad.

Comments