Not many people use physical calendars anymore and it is a shame! Having a calendar handy can help you stay on top of your savings goals throughout the year. Here is how to save money using a calendar…

Download a FREE printable calendar here.

Things to Mark on Your Calendar

The first thing you should do before you plot out your savings goals on your calendar is to write down everything that will cost you money. For instance, if you have a car payment due you will want to note which day and how much the bill is. The same goes for social engagements. If you have plans to attend a wedding, for example, you’ll want to budget money for clothing, travel, a gift, and possibly lodging (depending on where the event is).

Then, color in the days you get paid. It is also helpful to jot down the amount you normally get paid minus 20%. This will help you get used to living on 80% of your salary and help you save even more. You can separate these into long-term savings, emergency savings, and a “saving for something” accounts.

After you’ve done this, mark down the additional amount you’d like to save. For instance, if you are participating in the 52-week money challenge, you can write in the weekly amount you “owe” yourself.

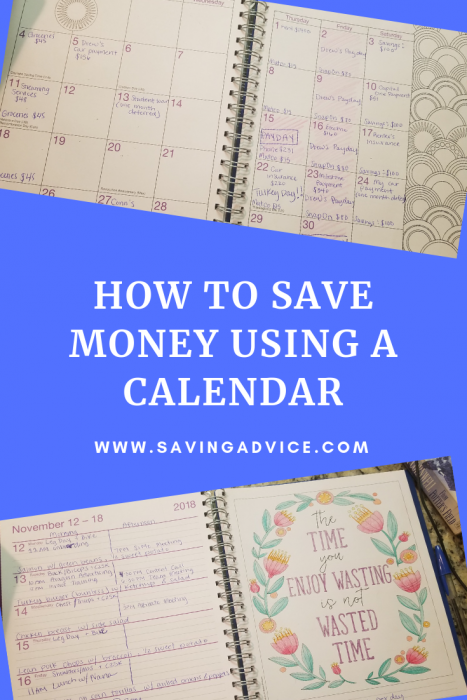

Here’s what my monthly calendar looks like…

Other Financial Items to Track on Your Calendar

You’ll also want to track a number of other things on your finance calendar. Make sure you note how much you spend on the following items as well.

- Errands: Note all of the errands you need to run throughout the week and month. This can help you complete the errands that are geographically near each other, which will save time and gas money.

- Groceries: Mark down how much you have budgeted for groceries on the day of the week you normally go shopping. Stick to this budget.

- Meals: Meal planning can help you save a ton of money. If you have a busy day, plan an easy meal. This will keep you from going out to eat.

I track these things on a weekly planner. As you can see, I have my workouts, meals, and engagements planned out. This helps me keep my work schedule, fitness schedule, social arrangements, and finances on track.

How to Save Money Using a Calendar

In reality, the key to saving money is keeping track of the cash you have coming in and going out. You’ll also need to set goals and standards for how much you are looking to save. As mentioned above, you should always try to save 20%. After that, set end-of-month (or end-of-week) savings goals for yourself. Marking this on your calendar can help remind you of your long-term goals and help you avoid purchases and behavior that will stop you from reaching your financial goals.

While a calendar may seem a little old-fashioned, it can be a great way to stay on top of things and keep it simple! Download a printable savings calendar here to get started tracking your finances and plan your way into better finances.

Read More

- Should You Be Using a Bill Calendar?

- How to Use the Chase Freedom Calendar

- Where to Score Free Calendars

- Is Being Disorganized Keeping You Broke?

Amanda Blankenship is the Chief Editor for District Media. With a BA in journalism from Wingate University, she frequently writes for a handful of websites and loves to share her own personal finance story with others. When she isn’t typing away at her desk, she enjoys spending time with her daughter, son, husband, and dog. During her free time, you’re likely to find her with her nose in a book, hiking, or playing RPG video games.

Comments