The Chase Freedom card offers users a revolving calendar, allowing users to earn cash back on different shopping categories throughout the year. The calendar changes categories every three months on this no-annual-fee cash back credit card. The card stands out for its generous $100 sign-on bonus if you spend $500 in the first three months of carrying the card. You also earn five times the cash-back… if you know how to use the card to its fullest potential.

Basic Cash Back Benefits

The Chase Freedom® Card gives users one percent back on purchases throughout the year, and two percent back on Airlines and Hotels through the Ultimate Rewards program that is provided on the company’s entire line of personal credit cards. Cash back comes in the form of points, where each point is valued at one cent. You need at least 2,000 points to redeem cash back.

That means spending at least $400 on bonus categories or $2,000 on non-bonus categories before you can cash in. There is no annual fee, somewhat of a rarity on cash-back credit cards, but the real cash back comes when you take advantage of the Chase Freedom® Calendar. Happily, these points never expire, so you have all the time you need to accumulate enough to cash in.

The Rotating Calendar Bonus

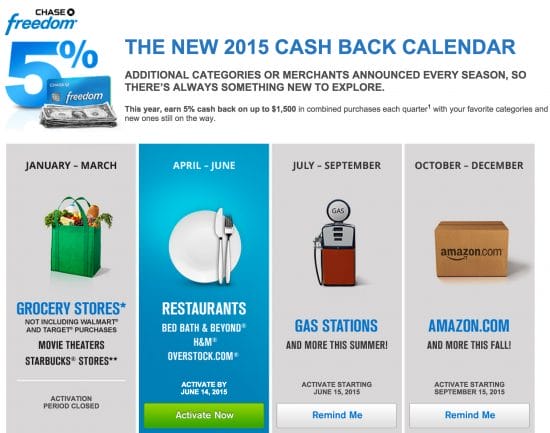

Every year, Chase publishes a different rewards calendar, usually in December of the prior year. Once you know the type of purchases that will earn the higher cash-back rate of five percent, you can plan your purchases around it. Understand that these rewards are limited to $1,500 of purchases per quarter (or $75 cash back). You still earn one percent on purchases that don’t fall under a bonus category, on top of your bonus rewards. It’s important to remember that you have to activate your rewards each quarter to earn five times the cash back under the bonus categories.

In 2015, the Chase Freedom® Calendar looked like this:

Jan 1 – Mar 31 Grocery Stores, Movie Theaters, Starbucks

Apr 1 – Jun 30 Restaurants, Bed Bath & Beyond, H&M, Overstock.com

Jul 1 – Sep 30 Gas Stations, Kohl’s

Oct 1 – Dec 31 Amazon.com and more

More Tips for Maximizing Rewards

Because the Ultimate Rewards program is included with other Chase cards, you can combine rewards points to reach your cash-back status more quickly. And because you get 15 months interest free to pay for the purchases you make, you gain more flexibility in your budget.

I’m a personal finance freelancer writer and website manager. Feel free to connect with me at firstquarterfinance.com.

Comments