It’s a fun thought, especially if you are in a good place mentally. What would you get? A car? A house? Stocks? Bonds? For most of us, $10,000 would be enough to build a strong emergency fund or pay off a big chunk of debt or make a dent in your debt. But, how do you save a large amount of money and how long should it take?

With focus and determination, you could be saving $10,000 a year.

Get Started Saving $10,000 a Year

The reality is that saving money usually isn’t done in a single action or two. For most people, you need to scrape the money together from a variety of sources over time and let it accumulate but how do you really get started when you’re trying to save $10,000 in a year?

It Doesn’t Have to Be Complicated

First, you don’t need a complicated plan, you just need to get started. Typically saving money means having a goal, then dumping a lot of income towards the goal – small amounts of money are just as good as large ones. Also, saving money generally involves a combination of methods. This includes finding extra money, a bit of hustle, automation and active cash flow management.

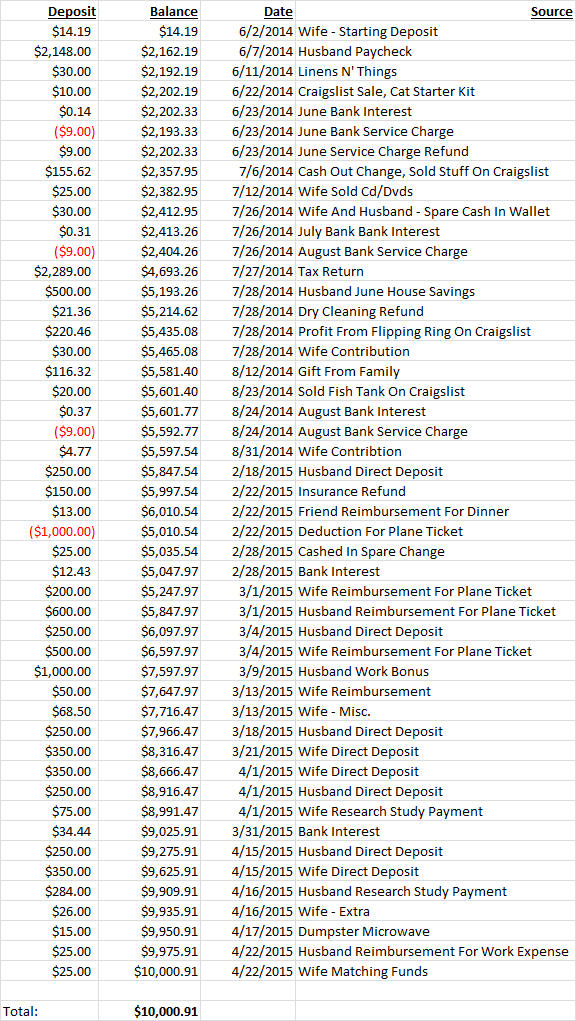

Below you’ll find a ledger of how my wife and I raised $10,000.00 over the course of roughly 12 months. For large savings projects like this, it is better if you have a partner to work with, romantic or otherwise. That way the two of you can work together, pool your income and encourage and support one another. Each of these methods works if you are single too, so don’t worry if you aren’t romantically attached.

How We Saved $10K in a Year

As you can see, my wife and I started out with only $14.19 for our initial deposit. At first, growing that to $10K seemed nearly impossible. With some focus, however, $10,000 stacked up in what felt like no time at all. To save $10,000 in a year, we took advantage of these great ways to save:

Automate Your Way To Saving $10,000 a Year

One thing that really helps when saving money is automation. You can easily make a payroll deduction which deposits a portion of your paycheck into a savings account. Other things you can do are set up your accounts to automatically deduct a small amount of money from a checking to a savings account. In the example above, we dumped $250 per paycheck into the savings fund. Automation is great because it removes opportunities to spend money.

Prioritize

One thing that important is saving is knowing what your priorities are. Once you’re clear on this, any money you have found, like tax return information, gifts from family, checks from class action lawsuits, etc. can all go towards your priority. If you scan the example transactions above it, you can see we put all our tax return money, family gifts and all the extra money we earned into our savings.

Earn Extra Money or Find Extra Money

One great way to save is to make more money and put it into your savings plan. Classic ways to do this are:

- Participating in research studies or doing surveys

- Selling things on eBay or on Amazon.com

- Selling used stuff on Craigslist or Facebook Marketplace

- Following up on rewards or rebate programs

- Starting a small business

- Buying stocks or bonds for passive income

In the ledger above, we were able to earn extra money through Facebook Marketplace and Craiglist sales. Although it may only be $20 here, $30 there, it adds up over the span of a year.

A Bit of Hustle

There are lots of ways to find money to save. For example one thing we did was dumpster diving. We found a microwave next to the trash in our apartment building, cleaned it up, tested it out and resold it. It wasn’t a ton of money, but it was $15 dollars closer to our $10,000 goal. If you put in a bit of extra effort and creatively find stuff that has an economic value you can move the needle a bit.

Active Cash Flow Management

Banks are not necessarily your friend. In some cases terms of service change, fees emerge, interest rates change or the like. In addition, people can make mistakes. Even you could make a mistake in your account, overdraw an account, miss a fee, etc. Anyone attempting to save money will want to actively keep an eye on your savings to be sure the bank doesn’t start charging you or that you mess up a deduction. In the example above, we borrowed from the house savings to fund a work trip and needed to replace the money to make the saving $10,000 a year goal. So, in this case, you’d want to exercise some basic management and keep track of how much you borrow and how much you needed to pay back.

On a similar theme, interest rates are really low right now. But you have some alternatives if you really want to get more than pennies. For example, you might find alternatives such a bond fund if you’re looking for higher interest rates. Vanguard has some good funds that pay 3%.

Get your FREE trial of Simplifi by Quicken. You work hard for your money. Now let’s make it work hard for you.

Can You Save $10,000 a Year?

Saving $10,000 a year is a serious goal and it’s not unrealistic. If you focus, keep track of your goals and manage your cash well – you will do great. Don’t forget to remind yourself why you to want to save and regularly take a moment to think about the benefits of achieving your savings goal. Once you have everything set up and going, you’ll probably save more and do it much more quickly than you thought you ever could.

For more on how to save money, read our articles on:

James Hendrickson is an internet entrepreneur, digital publishing junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.

Comments