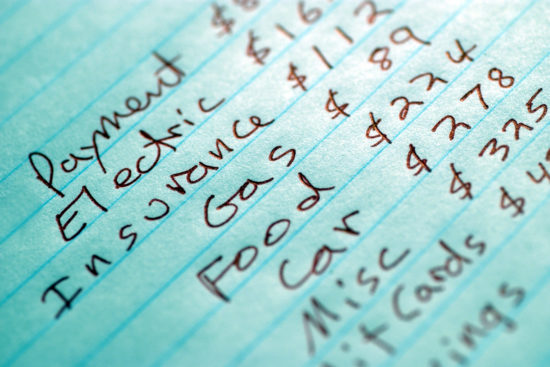

This may be because some of the best budgeting methods seem outdated next to budgeting apps, like Mint. Maybe things have become too automated? As grandma always said, “If it’s not broke, don’t fix it.” So, here are some of the best “outdated” budgeting methods that still work today.

Get your FREE trial of the Best Budgeting App, Simplifi by Quicken

Envelope Budgeting Method

If you’ve ever chatted about finance with your grandparents you may have heard them talk about this budgeting method. Essentially you have an envelope for each category in your budget. You label them “utilities,” “groceries,” “rent,” etc. Then you place cash in each envelope for said budget item out of each check.

The best example of this would have to be my great aunt. She was blessed with five (yes, five) boys and she didn’t work. Her husband gave her a weekly allowance and she was to buy groceries and everything they needed for the house. (I’m pretty sure it was something like $10). She would go out and shop the deals and save some of her allowance each week. Then she would divide the extra money between five envelopes (one for each kid). When a holiday came around she used the money in each envelope for new clothes and gifts.

Cash-Only Spending

Using only cash when you spend money is another great budgeting method. Paying in cash makes many people more aware of the money they are spending. You can also physically set it aside. So, if you need $400 from each check to pay rent you can take the cash and put it away.

Many people who use a cash-only spending budgeting methods also participate in online money challenges like the $5 Bill Challenge or the 52 Week Money Challenge. Because you’ll always be given change paying cash you’ll have plenty for your piggy bank.

50/30/20 Budgeting Method

Percentage budgeting methods are nothing new but they are still affective. The 50/30/20 rule is a great one to follow too. This budgeting method simply makes sure that you aren’t spending more than you should on certain things. Only 50 percent of your take home should go to necessities (utilities, rent, food, etc). Thirty percent should be dedicated to entertainment and the last 20 percent should go straight to savings.

This budgeting method takes a little more number crunching than the previous two but it pays off. Read more about budget percentage categories here.

Snowball Budgeting Method

Snowball budgeting is for those who have debt to pay off. If you are working within a snowball budget you will throw every bit of extra cash you have at your debt. You’ll also create your budget around paying that debt off.

For instance, if you are working with a snowball budget you will scale down your spending in every area possible. Many people tend to try and trim their grocery bill and other bills (like electric) that they can control. Then you point your focus towards paying off whatever debt you may have.

Try a Reverse Budgeting Method

A reverse budgeting method is simply a budgeting method that is focused towards saving money instead of breaking even (as most budgets do). The 50/30/20 rule works great for many people but what if you want to save even more? Instead of focusing on keeping your spending at a certain level focus on building your savings up and spending little-to-nothing at all.

Whether you try one of these older budgeting methods or you want to try out an app, budgets are necessary! Learn how to create a budget and start your path to financial peace today.

Join us in the forums for more budgeting tips and conversation.

Photo: Money Management International

James Hendrickson is an internet entrepreneur, blogging junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.

Comments