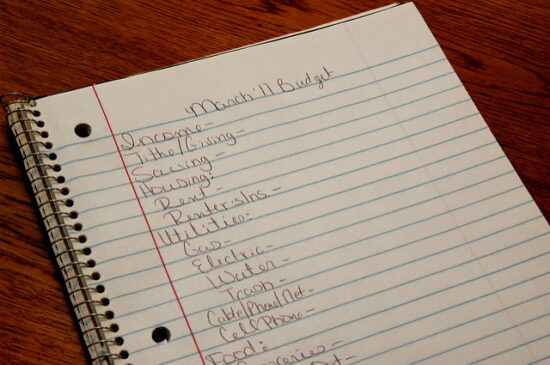

To find your personal budget percentages you can identify the average spending percentages nationally. For instance, if the average American spends 24 percent of their monthly income on housing you can use that percentage in your budget as a guideline. You can also track your spending and create percentages off what you already spend. So, how should you go about setting up your personal budget percentages?

Setting Budget Percentages

The amount of money you need for the “perfect” budget depends on a number of factors. Where you live, if you have small children, health issues, etc. For example, a married couple with no kids will spend far more money on clothing and entertainment than a married couple with three children. Also, lower income families tend to spend more money on food than higher income families. Spending from family-to-family and even between individuals varies by income level, family size and your overall location. Since these three things can differ greatly from situation-to-siutation there is no truly perfect combination of budget percentages.

Average Budget Percentages

Average budget percentages across the United States are figured out by taking a look at the budget percentages of everyone in America. These percentages include individuals as well as families in the U.S. Here are the national average budget percentages in the U.S.:

| Category | Percentage of Overall Spending |

|---|---|

| Housing | 24% |

| Utilities | 8% |

| Food | 14% |

| Clothing | 4% |

| Medical | 6% |

| Donations | 4% |

| Savings/Insurance | 9% |

| Entertainment | 5% |

| Transportation | 14% |

| Personal/Debt Payments | 12% |

The percentages in the table were gathered from the U.S. Bureau of Labor Statistics Consumer Expenditure Survey. These numbers are simply the national average. They may not work for everyone’s personal budget. Along with family, location and overall income, your other personal finance goals may come into play. For instance, if you are trying to pay off debt your budget may look a lot differently than someone who holds no debt. What budget percentages should you use if you are trying to get out of debt? Dave Ramsey, hailed a financial guru, weighed in on the budget percentages and how much each category should be allocated. Here are his numbers:

| Category | Percentages |

|---|---|

| Housing | 25-35% |

| Utilities | 5-10% |

| Transportation | 10-15% |

| Healthcare | 5-10% |

| Food | 5-15% |

| Investments | 5-10% |

| Debt Payments | 5-10% |

| Donations | 5-15% |

| Entertainment | 5-9% |

| Personal | 2-7% |

How to Create Budget Percentages

Budgeting Apps

There are a few budgeting apps and other tools readily available to you that may help with your budget. One of the most popular apps, Mint, helps you create a budget with personalized percentages. It gives you alerts to areas where it thinks you can trim your budget and it will also give you alerts when bills are due. You can get the Mint app for most devices (both Android and Apple products). If you don’t like the Mint app there are a number of other apps you can use to help create a budget for yourself and your family.

What budget percentages do you use? Do you think these percentages are accurate? Let us know in the comments.

Photos: CafeCredit.com and jridgewayphotography

Amanda Blankenship is the Chief Editor for District Media. With a BA in journalism from Wingate University, she frequently writes for a handful of websites and loves to share her own personal finance story with others. When she isn’t typing away at her desk, she enjoys spending time with her daughter, son, husband, and dog. During her free time, you’re likely to find her with her nose in a book, hiking, or playing RPG video games.

Comments