There has always been importance placed on saving money, but why? If you have enough money to pay for what you need, then why do you need “excess” money to put aside? Well, everyone saves for different reasons, and if you are still looking for one, here are a few reasons you should be saving right now.

Vacation

What better reason to save than for a vacation? If you’ve wanted to go away for a while, go on a cruise or visit a city you’ve never been to, it takes some planning (and saving). You can have fun with your money, but you have to save to be able to do that.

Retirement

Even if you are young, it is never too early to start saving for retirement. No one wants to work forever, and most people aren’t able to work once they get older. Putting aside money so that you’re able to retire is important. This is often hard because you won’t see this money for many years, but it will be well worth it.

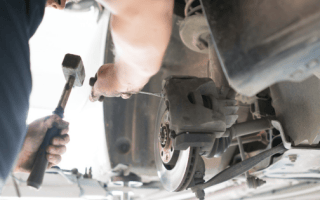

Emergency Fund

Everyone needs to have a savings account where they set aside money for emergencies. Whether it is an unexpected flat tire, car repair, medical bill or even unexpected charge on your bank account, you should always have some extra money set aside for emergencies. If you do not, many people use their credit cards if they do not have an emergency savings account, which leads to more debt, which is not ideal. Usually, you’ll want to have about $1,000 set aside in this account just in case. This will cover most car repairs and many other emergency situations. Once you use it, you need to work to save it back up.

Buying a House

Another reason to save is so that you can buy a house. Renting a home or an apartment is practically like throwing money out of the window. Sometimes, renting is all someone can afford or all they can get with their current situation, which is fine. However, if you are able to, you should save for a down payment on a home. Owning a home will pay off in the long run, so your saving efforts and the amount you spend on a home will be well worth it.

New Car

Just like a house, you can save to buy a new car, or save to pay off your car. If you currently have a car payment, your budget can become a lot more free if you set aside some money to pay off your car (or buy a car in full if you don’t have one yet). Usually, if you have the full amount to put on the car, the dealership will also strike you a deal, which is another great reason to save.

These five reasons to save are only a few. Everyone has their own reasons for saving, so it is important to discover what means the most to you. Whether it is having an emergency fund, buying a car or saving for retirement, savings is extremely important when it comes to how you are able to spend your time (and your money).

Amanda Blankenship is the Chief Editor for District Media. With a BA in journalism from Wingate University, she frequently writes for a handful of websites and loves to share her own personal finance story with others. When she isn’t typing away at her desk, she enjoys spending time with her daughter, son, husband, and dog. During her free time, you’re likely to find her with her nose in a book, hiking, or playing RPG video games.

Comments