When it comes to New Year’s resolutions and wanting to save more money, many people fail to take the first important step to make sure the resolution is accomplished. They don’t take the time to form a habit of saving money. Think about it. If you are living paycheck to paycheck, and you don’t have an emergency fund, a big reason is you have never formed the habit of saving money. Until you form this new habit, you’re going to have a difficult time accomplishing the goal of saving your target amount for the year.

The different types of money challenges are helpful in this regard since most of them require you to save money over a period of time long enough for you to form a money saving habit. For example, the 52-week money saving challenge has you saving some amount of money 52 times during the course of a year. The 365-day money challenge has you doing the same thing for 365 straight days. Even the 30-day money challenge will help you form the habit. There is just one pitfall all of these challenges have.

They designate an amount you have to save before you have established the saving money habit.

Building

While the conventional wisdom is that it takes 21 days to form a new habit, new research says that it can take anywhere from 18 days to 254 days depending on the complexity of the habit you’re trying to instill into your daily routine. That is until doing something is routine rather than you having to force yourself to do it. How long it will take for you to form the saving money habit will vary from person to person, but most people will be well on their way after 30 days. If you still don’t feel the habit of putting a little money away is routine, then do it for another 30 days until it does. Once it does become routine, you can then challenge yourself to try and save larger amounts than you have been.

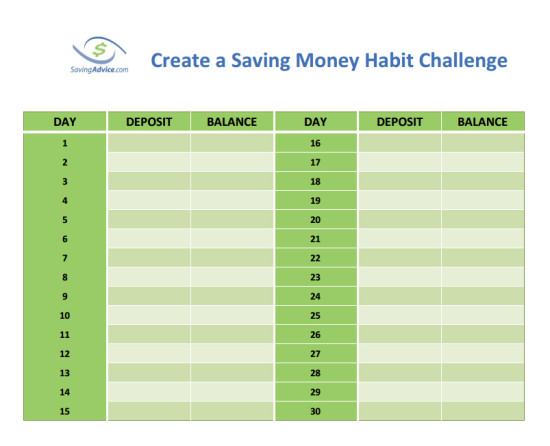

The key difference of the 30 days create a saving money habit challenge as compared to the other money challenges out there is that there is no pressure to save a certain amount each day. The focus is on creating the habit. It doesn’t matter if you put in a penny or a hundred dollar bill, as long as you save something. The goal should be to save as much as you can, but the most important aspect is you take the action of saving money each day.

Once you add money, mark it on your challenge sheet. Do this on a daily basis and soon you’ll have formed the habit. In addition, you will want to open up a separate banking account specifically to deposit the money you save. You can choose how often you deposit, but making it consistent will help (every Friday or the last day of each month). This is important to make sure the money goes towards savings, and it doesn’t get mixed up with your other money and is accidentally spent on something else because the money was in the same account.

If you have tried money challenges in the past and failed, give this a try. Once you have the habit created, you’ll be in a position to conquer any of the other money challenges, and you’ll also have a good idea of what you can save, taking into account your current financial situation.

If you’re already working on creating money saving habits, but are having some trouble, here are three helpful articles.

James Clear, author of Atomic Habits, has a nice write up of some of the behavioral psychology of how to start & maintain a habit.

Here is an article from Harvard Business Review on what it actually takes to build a new habit.

Scott Young at lifehack.org has 18 tricks to make new habits stick.

Jeffrey strain is a freelance author, his work has appeared at The Street.com and seekingalpha.com. In addition to having authored thousands of articles, Jeffrey is a former resident of Japan, former owner of Savingadvice.com and a professional digital nomad.

Comments