The truth is that you can begin the 365 day penny challenge any day you want during the year. Yes, beginning on January first wraps it neatly into a single year time period, but there is nothing that says you have to start then. The fact is that the challenge has been specifically created so that you can start at any point during the year. You simply have to pick a day to begin and you’ll be done 365 days later.

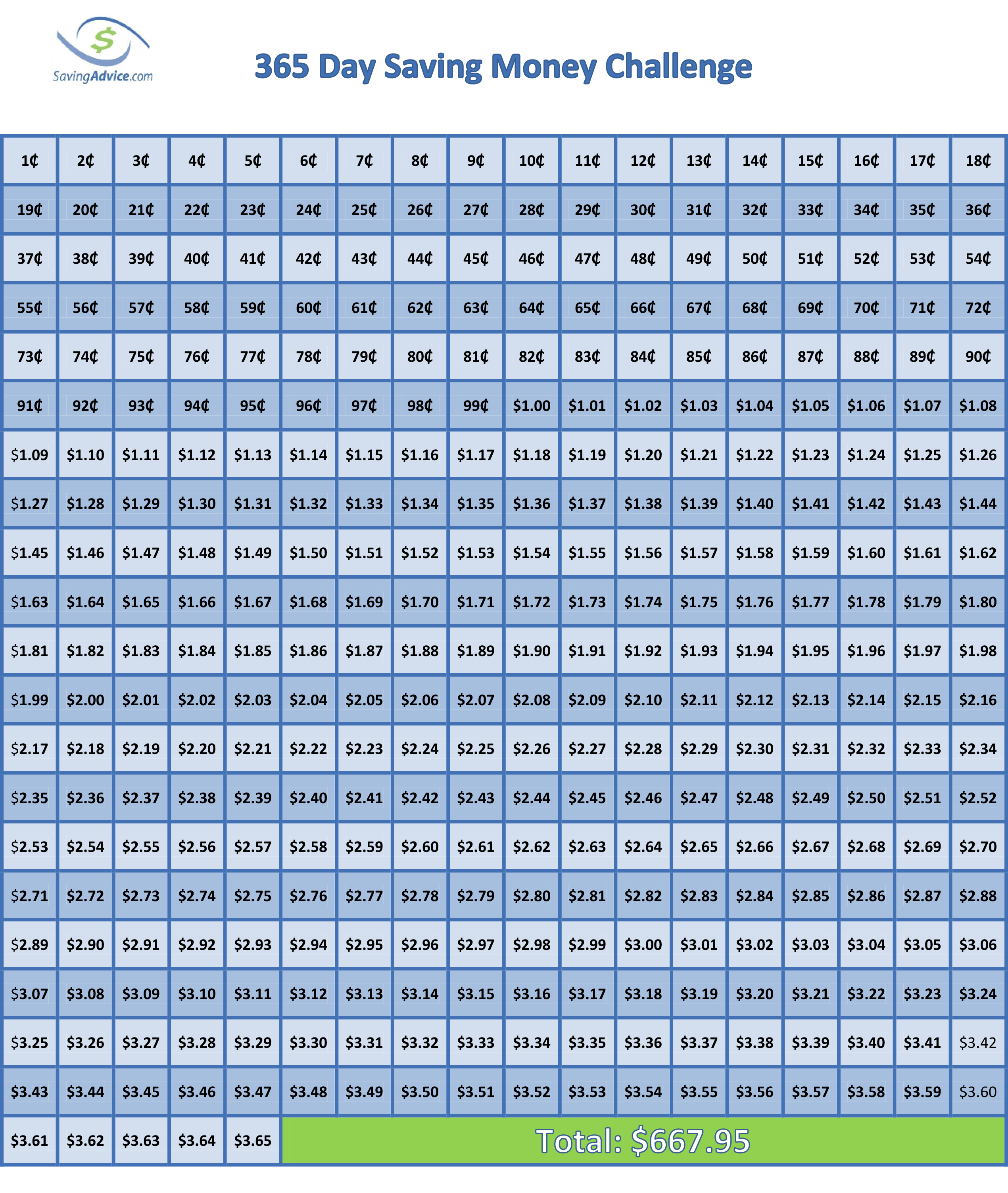

365 Day Penny Challenge (click on image to print)

The penny challenge is one of the easier challenges to understand. Each year has 365 days, and on each of these days you need to pay yourself first. It can be as little as a penny, and as much as $3.65. Once you have paid the amount, you cross it off the challenge sheet, and the next day pay one of the remaining amounts still available on the chart. At the end of 365 days, you will have saved just under $668.

Another important part of this challenge is that you should physically place the amount you’re saving each day into a jar (or other container). So you don’t accidentally forget, the jar should be in a place you’ll see each day. You can then place the accumulated money into a dedicated bank account every week or so. This way you have your savings all in a single place where you know it’ll be each day, and it will help ensure that you make the savings payments daily.

The big advantage of this challenge over the 52 week savings challenge is that it requires you to make a payment to your savings each and everyday. The goal is not only to get you to save the $668, but also to instill the habit of saving money, even small amounts, so that it becomes a part of your daily routine. Once the habit is formed, you should be able to continue it with even bigger challenges in the future.

Aut0mate Your Savings

Savings apps like digit.co are great alternatives or supplements to money challenges. Basically, the app analyzes your account, and puts small amounts into savings for you. Automating your savings account can make it a lot easier to build that emergency fund or vacation fund you’ve been planning to start. You can sign up for digit.co here.

So what are you waiting for? The day to begin is today, and there really is no excuse not to. If you started another challenge this year but have already stopped for some reason, it’s time to begin again. If you know someone who procrastinates, tell them to try this challenge. You have nothing to lose except the fear of not having an emergency savings account. And for those of you who are saying to yourself that you like the idea, but don’t know where you would begin to find the savings, you can’t even give that as an excuse. Here are thirty-one savings tips that will ensure that you’re able to make it through the first month of the penny challenge.

(Photo courtesy of Sh4rp_i)

Jeffrey strain is a freelance author, his work has appeared at The Street.com and seekingalpha.com. In addition to having authored thousands of articles, Jeffrey is a former resident of Japan, former owner of Savingadvice.com and a professional digital nomad.

Comments