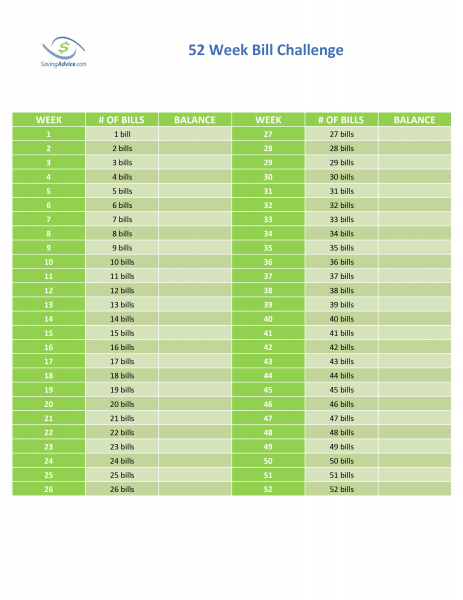

The bill challenge is basically the adult version of the 52 week coin challenge. Instead of focusing on a set amount each week such as $1, $2 or $5, the bill challenge focuses on the number of bills saved each week. If you decide to only save $1 bills, you would end the challenge with the exact same amount of money ($1,378) as you would with the standard challenge. The twist with this challenge is that you don’t only have to save $1 bills. You can choose any denomination or combination of denominations each week.

Bill Challenge (click on image to print)

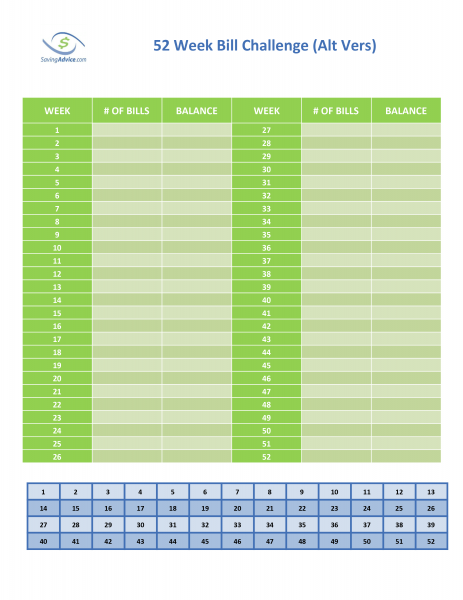

The alternate version of this challenge gives you even more flexibility. In this version, you choose the number of bills to cross off from the bottom of the chart each week. Once a number has been crossed off, you can’t use it again. All fifty-two numbers will be crossed off after a period of one year. For example, you may start the challenge off by crossing of the largest amounts first with only $1 bills. As the year progresses, if you find that you’re still able to save a good amount of money and the number of bills that you need to save each week is getting lower and lower, you may want to increase the bill denominations you save. At this point you can start mixing in $5 bills, $10 bills and even $20 bills if you desire. On the other hand, if the year ends up being financially unpredictable, you can continue to use only $1 bills throughout the entire year. This challenge simply gives you the option to save even more money if it makes sense as the year progresses.

Bill Challenge Alternate Version (click on image to print)

Bill Challenge Not For You? Try This

These types of challenges aren’t for everyone. However, it’s important to find a savings method that works for you. Another option you might consider is a savings app like digit.co. This app basically analyzes your account, and puts away small amounts to help you build a savings account, without requiring much effort on your part. This can either accompany the savings you’re building with the money challenge, or it can be a great alternative. You can sign up for digit.co here.

Jeffrey strain is a freelance author, his work has appeared at The Street.com and seekingalpha.com. In addition to having authored thousands of articles, Jeffrey is a former resident of Japan, former owner of Savingadvice.com and a professional digital nomad.

Comments