From the Wall Street Journal

---------------------------------------------------------------------------------------------------------

Interest-Rate Surge Ripples Through Economy, From Homes to Car Loans

By Orla McCaffreyFollow , Sam GoldfarbFollow and AnnaMaria AndriotisFollow

April 8, 2022 9:54 am ET

Fed’s moves to chill inflation drive up bond yields and many other borrowing costs linked to them

The market is finally getting the message that the era of cheap money is ending.

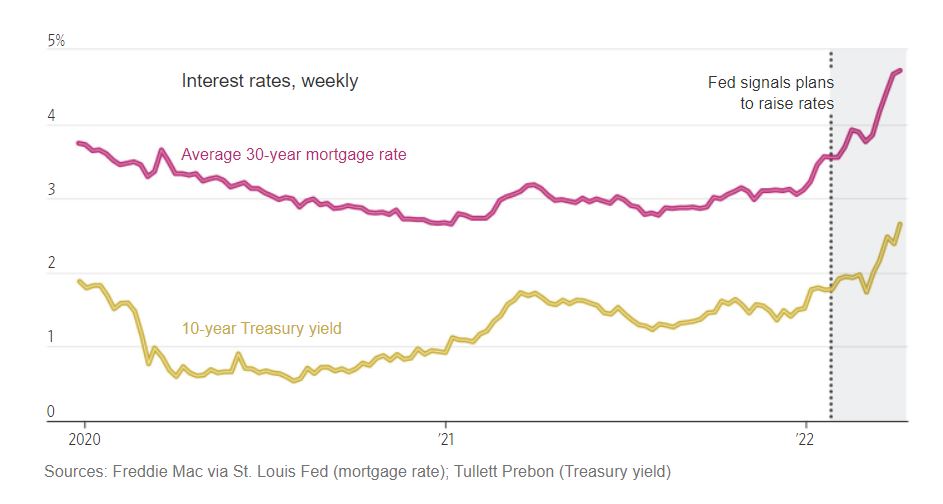

Just look at mortgage rates. At the beginning of 2022, the average interest rate on a 30-year mortgage hovered above 3%. Today it stands at 4.72%, according to Freddie Mac. That translates into sharply higher borrowing costs for Americans looking to buy a home—and it is only the beginning.

For the better part of the past 15 years, households and businesses paid very little to borrow. Americans could get cars and homes and the appliances to fill them at interest rates in the low single digits. Companies, especially profitable ones, could practically name their price in the credit markets.

The Federal Reserve, facing inflation that has climbed to its highest level in 40 years, has been signaling for months that these days of unfettered credit are numbered. Over the past few weeks, the market has responded in force.

As recently as December, investors were betting that prices would moderate largely on their own and the Fed would raise its benchmark federal-funds rate by about 0.75 percentage point this year, composed of three quarter-point moves. Now, investors are pricing in a rate that tops out at 2.5% by the end of this year and 3% next, its highest since before the 2008 financial crisis.

That has sent the yield on government bonds soaring in recent weeks. Treasury yields largely reflect investors’ expectations for short-term interest rates set by the Fed. When the Fed raises rates or signals it is about to, investors tend to sell government bonds, sending their yield higher. That is what is happening now, in dramatic fashion.

Rising Treasury yields, in turn, are cascading throughout the economy in the form of higher borrowing costs, squeezing households and businesses alike. Car loans, credit cards and corporate debt all stand to get more expensive as rates rise.

Consider Home Depot, Inc., which last month sold a $1.25 billion slug of bonds maturing in 10 years with a 3.25% interest rate. The retailer, which rode the pandemic home-renovation boom to big profits, sold 10-year bonds at a mere 1.875% rate roughly six months earlier.

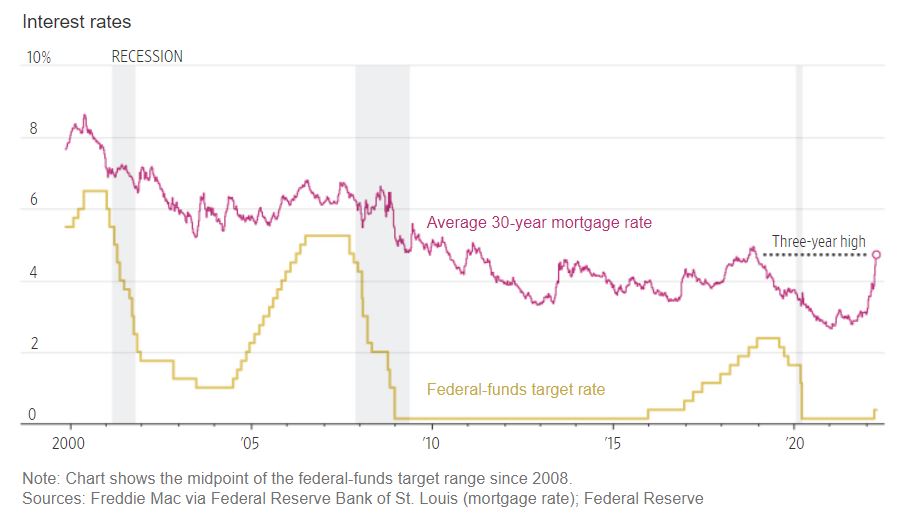

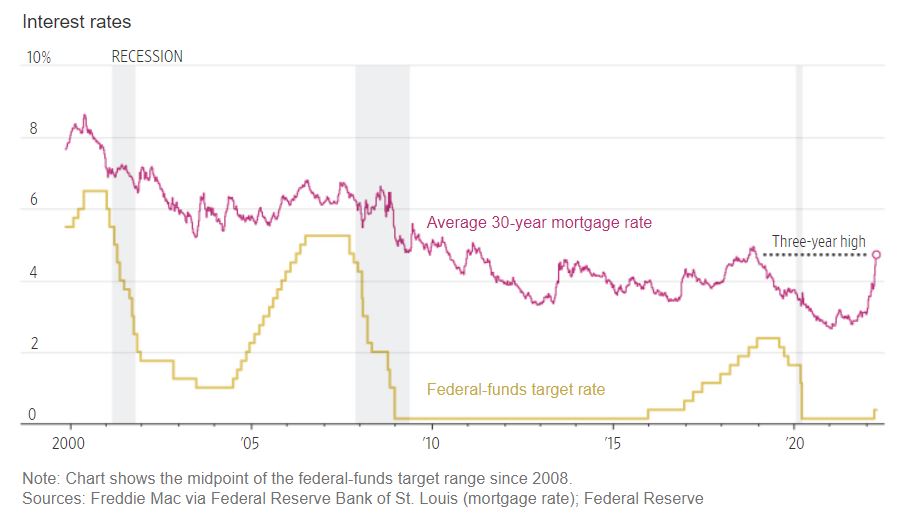

The Fed’s previous attempts to raise interest rates since the financial crisis have faltered. In 2013, then-Chairman Ben Bernanke said the Fed would eventually start slowing the bond purchases it was making to keep rates low. That was enough to induce panicked selling in bond markets. In 2018, the Fed raised interest rates four times. The stock market fell 6%, and the Fed turned around and began cutting rates the next year.

Note: Chart shows the midpoint of the federal-funds target range since 2008.

Sources: Freddie Mac via Federal Reserve Bank of St. Louis (mortgage rate); Federal Reserve

“Slowing economic growth is a risk, but that is a risk the Fed has to take,” said Greg McBride, chief financial analyst at Bankrate.com. “Inflation is at a 40-year high; it’s time to take the gloves off and get busy.”

No one is feeling the effects of higher borrowing costs quite like the American home buyer.

A house under construction in Fresno, Texas, in December. Rising mortgage rates threaten home affordability.

A house under construction in Fresno, Texas, in December. Rising mortgage rates threaten home affordability.

PHOTO: BRANDON THIBODEAUX FOR THE WALL STREET JOURNAL

When Jennifer Osorio began making plans to buy a house in Houston early this year, she thought she would end up with a mortgage rate close to 3.5%. By the time she was ready to make an offer last month, the lowest rate she could lock in was 4.99%.

The higher rate would add a couple of hundred dollars to her monthly payment, which she hopes to keep around $1,200. Before rates took off, she was looking at homes priced up to $230,000. Now, she is looking for listings closer to $180,000. That mostly leaves condos, which are smaller than the house she was hoping for, or homes with longer commutes to the school where she teaches.

“It’s frustrating, but there’s not much I can do,” Ms. Osorio said. “I’m just going to have to hope the market crashes.”

To a large extent, this is all by design. The Fed is raising rates to clamp down on borrowing and thus slow the economy to fight inflation.

The Fed’s chief tool against inflation is interest rates. The central bank creates a floor for borrowing costs in the economy by setting a target for the federal-funds rate, which is what banks pay one another to borrow for a single night.

The Fed also holds bonds and mortgage-backed securities, and the speed at which it buys or sells those can affect rates in the wider economy, too.

When the Fed is trying to cool an overheated economy, as now, it increases the fed-funds rate, reduces its bondholdings and signals that it will do more of the same in the future. Those moves have an especially pronounced effect on mortgage rates.

Photo illustration: Tom Grillo/WSJ

The 30-year mortgage rate on offer is tethered to the yield on the 10-year Treasury, which is rising in anticipation of future rate increases. What’s more, the Fed’s decision to reduce its holdings of mortgage bonds means issuers must offer higher yields to attract investors—costs that lenders pass on to borrowers in the form of higher interest rates.

Economists expect higher rates to push some potential home buyers from the market and reduce demand. There are signs that’s starting to happen. Mortgage applications in the last week of March fell 9% from the same period a year ago, according to the Mortgage Bankers Association. Then, the average 30-year rate hovered around 3.18%. Refinance applications dropped 62% over the same 12-month period.

Higher rates will make monthly mortgage payments—already at the least affordable level since November 2008—even less so. A median American household needed 34.2% of its gross income to cover mortgage payments on a median-priced home in January, according to the Federal Reserve Bank of Atlanta. That is up from 29% a year earlier.

Then, it was largely a function of double-digit increases in home prices. Now, higher rates are weighing on affordability, too.

“Salaries and wages simply are not keeping pace with the double whammy of higher prices and rising mortgage rates,” said George Ratiu, senior economist and manager of economic research at Realtor.com. News Corp, parent of The Wall Street Journal, operates Realtor.com.

The Fed plays a decisive role in setting interest rates across the economy, but not all loans react in the same way to its actions.

Interest rates on some debt, such as credit-card balances and the kind of loans private-equity firms use to buy companies, rise in tandem with the fed-funds rate. Rates on those loans haven’t increased much yet. The Fed has raised its benchmark rate this year by only a quarter of a point, to a range between 0.25% and 0.5%.

A couple looked at a Chevy Equinox at Jim Butler Chevrolet in Fenton, Mo., last month.

A couple looked at a Chevy Equinox at Jim Butler Chevrolet in Fenton, Mo., last month.

PHOTO: WHITNEY CURTIS FOR THE WALL STREET JOURNAL

Many mortgages, auto loans and corporate bonds are influenced more by what investors think short-term rates will be in the future than what they are now. Those rates are rising faster, although they apply only to new loans and bonds rather than to existing ones.

The average rate on a new-car loan with a five-year term reached 4.21% in early April, according to Bankrate.com, up from 3.86% at the beginning of the year.

The average yield on investment-grade corporate bonds, a measure of the cost of new borrowing for businesses with strong balance sheets, is now around 3.8%, up from 2.3% at the start of the year.

Yields on lower-rated corporate bonds have climbed to 6.3% from 4.2%. These rates already have led to a sharp slowdown in borrowing among lower-rated companies.

Businesses issued $157 billion sub-investment-grade bonds and loans this year through March, down 53% from a year earlier and the lowest quarterly total since the end of 2019, according to Leveraged Commentary & Data, a research and news provider. The slowdown followed a surge of issuance in late 2020 and during 2021, driven largely by businesses paying down older higher-cost debt with new low-cost bonds and loans.

For now, the interest on lower-rated corporate debt remains quite low by historical standards. Based on the relatively modest extra yield investors demand to hold the bonds over Treasuries, they don’t seem worried that businesses are being threatened by a lack of access to funding.

That could change, Bank of America strategists said in a recent note, if the pace of bond issuance doesn’t pick up by mid-May, making investors more concerned that businesses are being priced out of the market and deprived of cash.

People and businesses wanting to take out new loans feel the effects of rising rates most keenly. But borrowers who have already locked in their loans are vulnerable, too, if their rates are floating, meaning they rise and fall with short-term rates or Treasury yields.

Credit cards are pegged to the prime rate, which closely tracks the fed-funds rate. The annual percentage rate borrowers usually pay on their card balances consists of the prime rate plus a margin tacked on by lenders. The average credit-card APR stood at 16.4% on April 6, according to Bankrate.com. It was 16.3% on Jan. 5.

That doesn’t mean people with credit-card debt won’t feel the sting of higher rates.

Rates and consumer prices are likely to rise in tandem, at least for a little while, said Brian Riley, director of credit advisory services at Mercator Advisory Group, a payments research and advisory firm. Consumers, in turn, could start putting more on their credit cards to cover a shortfall between what they’re bringing in and what they’re paying out, compounding the effect of rising rates.

That could prompt lenders to tighten credit, Mr. Riley said. “Lenders have to be much more conservative,” he said. “They’re not going to lend blindly into a storm.”

Write to Orla McCaffrey at orla.mccaffrey@wsj.com, Sam Goldfarb at sam.goldfarb@wsj.com and AnnaMaria Andriotis at annamaria.andriotis@wsj.com

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved.

Appeared in the April 9, 2022, print edition as 'Surging Interest Rates Start To Ripple Through Economy.'

Source: Wall Street Journal.

---------------------------------------------------------------------------------------------------------

Interest-Rate Surge Ripples Through Economy, From Homes to Car Loans

By Orla McCaffreyFollow , Sam GoldfarbFollow and AnnaMaria AndriotisFollow

April 8, 2022 9:54 am ET

Fed’s moves to chill inflation drive up bond yields and many other borrowing costs linked to them

The market is finally getting the message that the era of cheap money is ending.

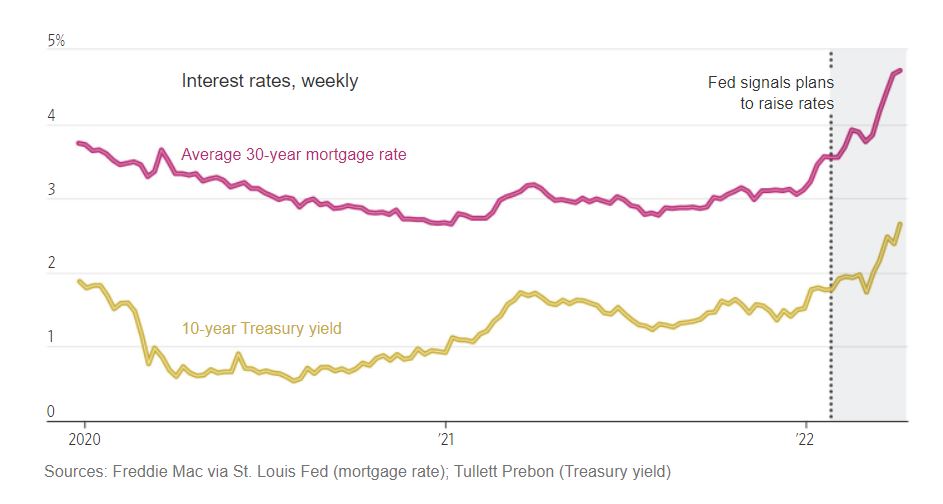

Just look at mortgage rates. At the beginning of 2022, the average interest rate on a 30-year mortgage hovered above 3%. Today it stands at 4.72%, according to Freddie Mac. That translates into sharply higher borrowing costs for Americans looking to buy a home—and it is only the beginning.

For the better part of the past 15 years, households and businesses paid very little to borrow. Americans could get cars and homes and the appliances to fill them at interest rates in the low single digits. Companies, especially profitable ones, could practically name their price in the credit markets.

The Federal Reserve, facing inflation that has climbed to its highest level in 40 years, has been signaling for months that these days of unfettered credit are numbered. Over the past few weeks, the market has responded in force.

As recently as December, investors were betting that prices would moderate largely on their own and the Fed would raise its benchmark federal-funds rate by about 0.75 percentage point this year, composed of three quarter-point moves. Now, investors are pricing in a rate that tops out at 2.5% by the end of this year and 3% next, its highest since before the 2008 financial crisis.

That has sent the yield on government bonds soaring in recent weeks. Treasury yields largely reflect investors’ expectations for short-term interest rates set by the Fed. When the Fed raises rates or signals it is about to, investors tend to sell government bonds, sending their yield higher. That is what is happening now, in dramatic fashion.

Rising Treasury yields, in turn, are cascading throughout the economy in the form of higher borrowing costs, squeezing households and businesses alike. Car loans, credit cards and corporate debt all stand to get more expensive as rates rise.

Consider Home Depot, Inc., which last month sold a $1.25 billion slug of bonds maturing in 10 years with a 3.25% interest rate. The retailer, which rode the pandemic home-renovation boom to big profits, sold 10-year bonds at a mere 1.875% rate roughly six months earlier.

The Fed’s previous attempts to raise interest rates since the financial crisis have faltered. In 2013, then-Chairman Ben Bernanke said the Fed would eventually start slowing the bond purchases it was making to keep rates low. That was enough to induce panicked selling in bond markets. In 2018, the Fed raised interest rates four times. The stock market fell 6%, and the Fed turned around and began cutting rates the next year.

Note: Chart shows the midpoint of the federal-funds target range since 2008.

Sources: Freddie Mac via Federal Reserve Bank of St. Louis (mortgage rate); Federal Reserve

“Slowing economic growth is a risk, but that is a risk the Fed has to take,” said Greg McBride, chief financial analyst at Bankrate.com. “Inflation is at a 40-year high; it’s time to take the gloves off and get busy.”

No one is feeling the effects of higher borrowing costs quite like the American home buyer.

A house under construction in Fresno, Texas, in December. Rising mortgage rates threaten home affordability.

A house under construction in Fresno, Texas, in December. Rising mortgage rates threaten home affordability.PHOTO: BRANDON THIBODEAUX FOR THE WALL STREET JOURNAL

When Jennifer Osorio began making plans to buy a house in Houston early this year, she thought she would end up with a mortgage rate close to 3.5%. By the time she was ready to make an offer last month, the lowest rate she could lock in was 4.99%.

The higher rate would add a couple of hundred dollars to her monthly payment, which she hopes to keep around $1,200. Before rates took off, she was looking at homes priced up to $230,000. Now, she is looking for listings closer to $180,000. That mostly leaves condos, which are smaller than the house she was hoping for, or homes with longer commutes to the school where she teaches.

“It’s frustrating, but there’s not much I can do,” Ms. Osorio said. “I’m just going to have to hope the market crashes.”

To a large extent, this is all by design. The Fed is raising rates to clamp down on borrowing and thus slow the economy to fight inflation.

The Fed’s chief tool against inflation is interest rates. The central bank creates a floor for borrowing costs in the economy by setting a target for the federal-funds rate, which is what banks pay one another to borrow for a single night.

The Fed also holds bonds and mortgage-backed securities, and the speed at which it buys or sells those can affect rates in the wider economy, too.

When the Fed is trying to cool an overheated economy, as now, it increases the fed-funds rate, reduces its bondholdings and signals that it will do more of the same in the future. Those moves have an especially pronounced effect on mortgage rates.

Photo illustration: Tom Grillo/WSJ

The 30-year mortgage rate on offer is tethered to the yield on the 10-year Treasury, which is rising in anticipation of future rate increases. What’s more, the Fed’s decision to reduce its holdings of mortgage bonds means issuers must offer higher yields to attract investors—costs that lenders pass on to borrowers in the form of higher interest rates.

Economists expect higher rates to push some potential home buyers from the market and reduce demand. There are signs that’s starting to happen. Mortgage applications in the last week of March fell 9% from the same period a year ago, according to the Mortgage Bankers Association. Then, the average 30-year rate hovered around 3.18%. Refinance applications dropped 62% over the same 12-month period.

Higher rates will make monthly mortgage payments—already at the least affordable level since November 2008—even less so. A median American household needed 34.2% of its gross income to cover mortgage payments on a median-priced home in January, according to the Federal Reserve Bank of Atlanta. That is up from 29% a year earlier.

Then, it was largely a function of double-digit increases in home prices. Now, higher rates are weighing on affordability, too.

“Salaries and wages simply are not keeping pace with the double whammy of higher prices and rising mortgage rates,” said George Ratiu, senior economist and manager of economic research at Realtor.com. News Corp, parent of The Wall Street Journal, operates Realtor.com.

The Fed plays a decisive role in setting interest rates across the economy, but not all loans react in the same way to its actions.

Interest rates on some debt, such as credit-card balances and the kind of loans private-equity firms use to buy companies, rise in tandem with the fed-funds rate. Rates on those loans haven’t increased much yet. The Fed has raised its benchmark rate this year by only a quarter of a point, to a range between 0.25% and 0.5%.

A couple looked at a Chevy Equinox at Jim Butler Chevrolet in Fenton, Mo., last month.

A couple looked at a Chevy Equinox at Jim Butler Chevrolet in Fenton, Mo., last month.PHOTO: WHITNEY CURTIS FOR THE WALL STREET JOURNAL

Many mortgages, auto loans and corporate bonds are influenced more by what investors think short-term rates will be in the future than what they are now. Those rates are rising faster, although they apply only to new loans and bonds rather than to existing ones.

The average rate on a new-car loan with a five-year term reached 4.21% in early April, according to Bankrate.com, up from 3.86% at the beginning of the year.

The average yield on investment-grade corporate bonds, a measure of the cost of new borrowing for businesses with strong balance sheets, is now around 3.8%, up from 2.3% at the start of the year.

Yields on lower-rated corporate bonds have climbed to 6.3% from 4.2%. These rates already have led to a sharp slowdown in borrowing among lower-rated companies.

Businesses issued $157 billion sub-investment-grade bonds and loans this year through March, down 53% from a year earlier and the lowest quarterly total since the end of 2019, according to Leveraged Commentary & Data, a research and news provider. The slowdown followed a surge of issuance in late 2020 and during 2021, driven largely by businesses paying down older higher-cost debt with new low-cost bonds and loans.

For now, the interest on lower-rated corporate debt remains quite low by historical standards. Based on the relatively modest extra yield investors demand to hold the bonds over Treasuries, they don’t seem worried that businesses are being threatened by a lack of access to funding.

That could change, Bank of America strategists said in a recent note, if the pace of bond issuance doesn’t pick up by mid-May, making investors more concerned that businesses are being priced out of the market and deprived of cash.

People and businesses wanting to take out new loans feel the effects of rising rates most keenly. But borrowers who have already locked in their loans are vulnerable, too, if their rates are floating, meaning they rise and fall with short-term rates or Treasury yields.

Credit cards are pegged to the prime rate, which closely tracks the fed-funds rate. The annual percentage rate borrowers usually pay on their card balances consists of the prime rate plus a margin tacked on by lenders. The average credit-card APR stood at 16.4% on April 6, according to Bankrate.com. It was 16.3% on Jan. 5.

That doesn’t mean people with credit-card debt won’t feel the sting of higher rates.

Rates and consumer prices are likely to rise in tandem, at least for a little while, said Brian Riley, director of credit advisory services at Mercator Advisory Group, a payments research and advisory firm. Consumers, in turn, could start putting more on their credit cards to cover a shortfall between what they’re bringing in and what they’re paying out, compounding the effect of rising rates.

That could prompt lenders to tighten credit, Mr. Riley said. “Lenders have to be much more conservative,” he said. “They’re not going to lend blindly into a storm.”

Write to Orla McCaffrey at orla.mccaffrey@wsj.com, Sam Goldfarb at sam.goldfarb@wsj.com and AnnaMaria Andriotis at annamaria.andriotis@wsj.com

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved.

Appeared in the April 9, 2022, print edition as 'Surging Interest Rates Start To Ripple Through Economy.'

Source: Wall Street Journal.

Comment