Here’s the average net worth of Americans ages 35 to 44

Net worth (your assets minus debts) tends to increase with age. CNBC Select breaks down the average net worth of people in their 30s and 40s.

Updated Wed, Feb 3 2021

Megan DeMatteo

Kemal Yildirim | E+ | Getty Images

The average American has $90,460 of debt, but the average net worth is $748,800.

Of course, averages can be skewed by extremes on both ends of the net worth spectrum. With many feeling the economic squeeze during the pandemic and resulting recession (not to mention the growing wealth gap), most people don’t have this kind of cash in their savings and investment accounts.

However, it’s still important to know your net worth so you can plan ahead for a healthy retirement and stay on top of your debt payoff and everyday budget.

Net worth — or the total amount of assets you have in your name, minus any debts — tends to increase with age. Higher earnings bring more opportunities to buy property and other assets that can grow in value over time and help people build wealth.

But there are other facts that impact net worth, like income level, employment status, cost of living and financial inheritances.

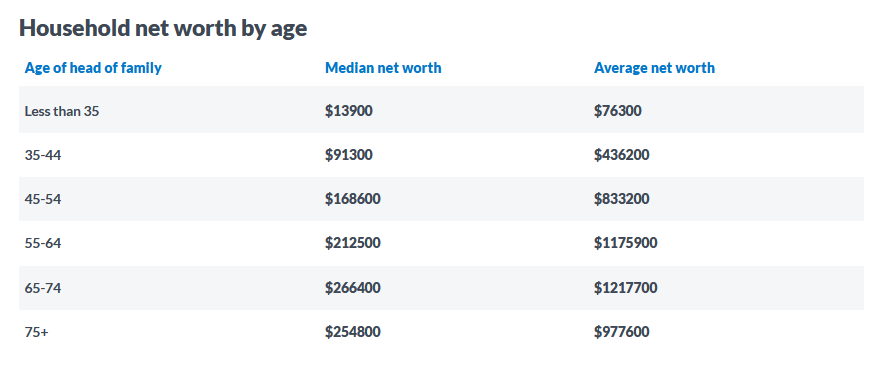

According to the Fed, the median net worth for people between ages 35 and 44 is $91,300. The average is $436,200. (Economists say that looking at the median is a better indicator of where most Americans fall on the net worth spectrum.)

Here’s a breakdown of both median and average American net worth by age, according to the Fed’s latest Survey of Consumer Finances from 2019.

What 30- and 40-somethings need to do to build their wealth

There are two ways you can grow your net worth: 1) by increasing your income and how much you save/invest 2) by reducing your debt. Both factors work hand-in-hand, since you can’t pay off debt without an income, and some might argue that you need certain kinds of debt (student loans, for instance) to earn more money.

By the time you’re in your 30s and 40s, you probably know about how much debt you have in your name. Millennials, on average, have about $78,396 of debt, between credit cards, installment loans and mortgages. Boomers, by comparison, average $135,841. (See the average American debt by age.)

While debt is common, it’s also important to borrow strategically. When you have more debt than total assets, your net worth can dip into the negative. And even borrowing smaller amounts can delay your ability to accumulate cash and meaningfully invest your money, whether in the stock market or real estate market.

If you have not already, plug your numbers into a budgeting app designed to help you manage long-term wealth building, like Personal Capital. This will allow you track your net worth in real time as you pay off debt and invest more. Experts say you should have 10 times your income saved by retirement age, which is easier to do when you can see all of your debt and savings in one place.

Next, switch from shorter-term planning to longer-term thinking. If you’ve been making minimum payments on your debts, crunch the numbers to see whether you can afford to pay it down faster. Calculate how much you’d save over time in interest, and how much your net worth would grow if you did.

It makes sense to be aggressive with debt repayment when you’ve got a high interest rate, and/or you’re not earning you any kind of equity or profit in return (like when you have a mortgage on a home that’s appreciating in value). Some financial experts argue that it’s OK to take your time with low-interest debt under 5% APR, but you should consider doubling-down on high-interest debt that costs you more when you carry a balance.

You might crunch the numbers and realize that, before you can get serious about building wealth, you need to increase your income. If that’s the case, think about negotiating for a raise, starting side hustle or finding ways to bring in passive income through investing or real estate so that you have a little more discretionary income to work with.

You may not build up to your dream net worth overnight, but with some planning you can make incremental progress that, over time, adds up.

Article & Image Sources: CNBC.

Net worth (your assets minus debts) tends to increase with age. CNBC Select breaks down the average net worth of people in their 30s and 40s.

Updated Wed, Feb 3 2021

Megan DeMatteo

Kemal Yildirim | E+ | Getty Images

The average American has $90,460 of debt, but the average net worth is $748,800.

Of course, averages can be skewed by extremes on both ends of the net worth spectrum. With many feeling the economic squeeze during the pandemic and resulting recession (not to mention the growing wealth gap), most people don’t have this kind of cash in their savings and investment accounts.

However, it’s still important to know your net worth so you can plan ahead for a healthy retirement and stay on top of your debt payoff and everyday budget.

Net worth — or the total amount of assets you have in your name, minus any debts — tends to increase with age. Higher earnings bring more opportunities to buy property and other assets that can grow in value over time and help people build wealth.

But there are other facts that impact net worth, like income level, employment status, cost of living and financial inheritances.

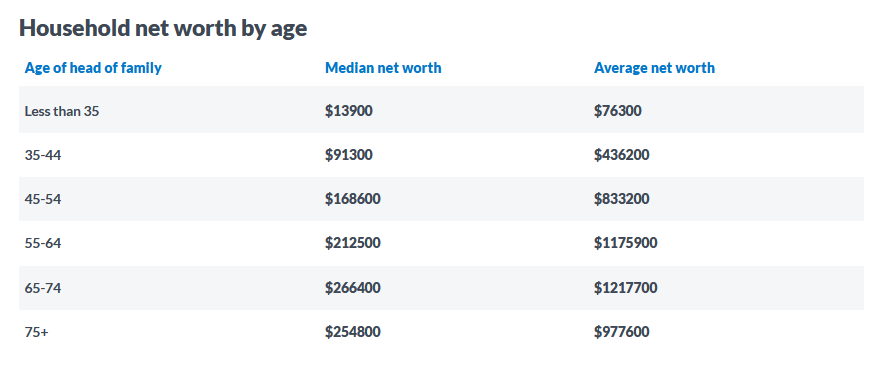

According to the Fed, the median net worth for people between ages 35 and 44 is $91,300. The average is $436,200. (Economists say that looking at the median is a better indicator of where most Americans fall on the net worth spectrum.)

Here’s a breakdown of both median and average American net worth by age, according to the Fed’s latest Survey of Consumer Finances from 2019.

What 30- and 40-somethings need to do to build their wealth

There are two ways you can grow your net worth: 1) by increasing your income and how much you save/invest 2) by reducing your debt. Both factors work hand-in-hand, since you can’t pay off debt without an income, and some might argue that you need certain kinds of debt (student loans, for instance) to earn more money.

By the time you’re in your 30s and 40s, you probably know about how much debt you have in your name. Millennials, on average, have about $78,396 of debt, between credit cards, installment loans and mortgages. Boomers, by comparison, average $135,841. (See the average American debt by age.)

While debt is common, it’s also important to borrow strategically. When you have more debt than total assets, your net worth can dip into the negative. And even borrowing smaller amounts can delay your ability to accumulate cash and meaningfully invest your money, whether in the stock market or real estate market.

If you have not already, plug your numbers into a budgeting app designed to help you manage long-term wealth building, like Personal Capital. This will allow you track your net worth in real time as you pay off debt and invest more. Experts say you should have 10 times your income saved by retirement age, which is easier to do when you can see all of your debt and savings in one place.

Next, switch from shorter-term planning to longer-term thinking. If you’ve been making minimum payments on your debts, crunch the numbers to see whether you can afford to pay it down faster. Calculate how much you’d save over time in interest, and how much your net worth would grow if you did.

It makes sense to be aggressive with debt repayment when you’ve got a high interest rate, and/or you’re not earning you any kind of equity or profit in return (like when you have a mortgage on a home that’s appreciating in value). Some financial experts argue that it’s OK to take your time with low-interest debt under 5% APR, but you should consider doubling-down on high-interest debt that costs you more when you carry a balance.

You might crunch the numbers and realize that, before you can get serious about building wealth, you need to increase your income. If that’s the case, think about negotiating for a raise, starting side hustle or finding ways to bring in passive income through investing or real estate so that you have a little more discretionary income to work with.

You may not build up to your dream net worth overnight, but with some planning you can make incremental progress that, over time, adds up.

Article & Image Sources: CNBC.

Comment