This posting is for all the lurkers and casual passers by on the forums.

If all you have is small amounts of money to work with, DON'T FEEL DISCOURAGED. Small amounts of money add up if you're consistent about managing it over time.

To share a personal example, a couple of years back, I saw that the Ford Motor Company paid a pretty good dividend - 60 cents a share - and was trading at around 10 dollars a share.

So, I started putting all my extra money into buying shares of the stock. At first it wasn't much at all. It was just $5 from doing surveys here, or $10 from selling my spare bandwidth or $15 from something I sold on Facebook Marketplace. But I just consistently plowed the money back into shares of Ford and reinvested the dividends. It took me about a year and a half, but I got a the number of shares I owned from 0 to about 350 today.

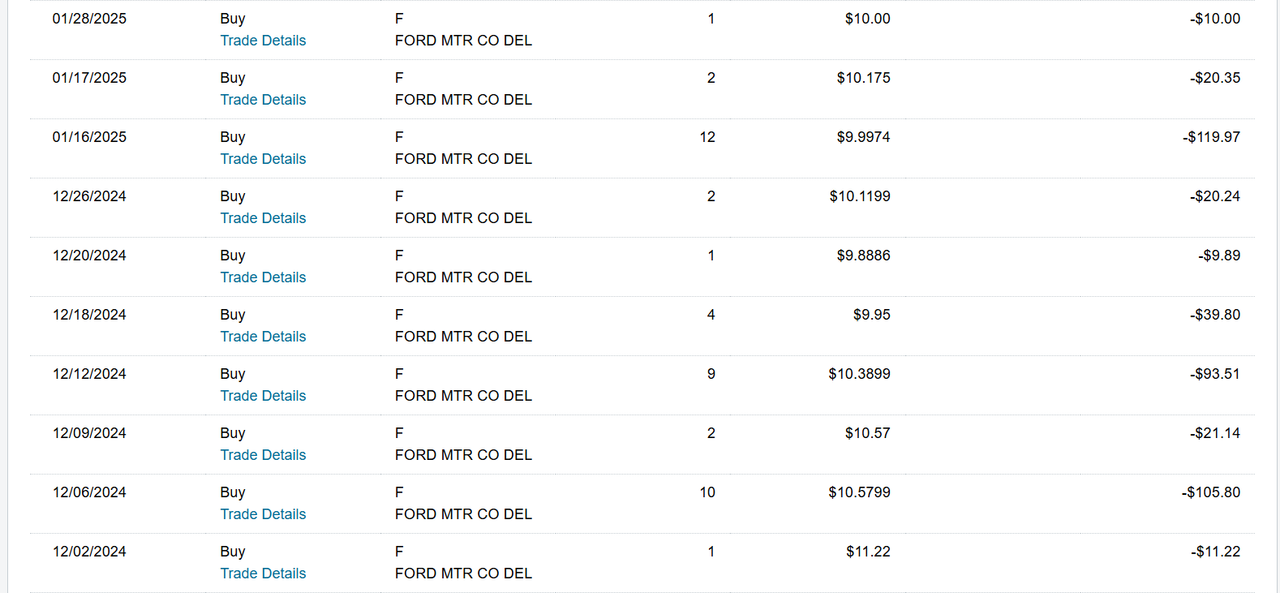

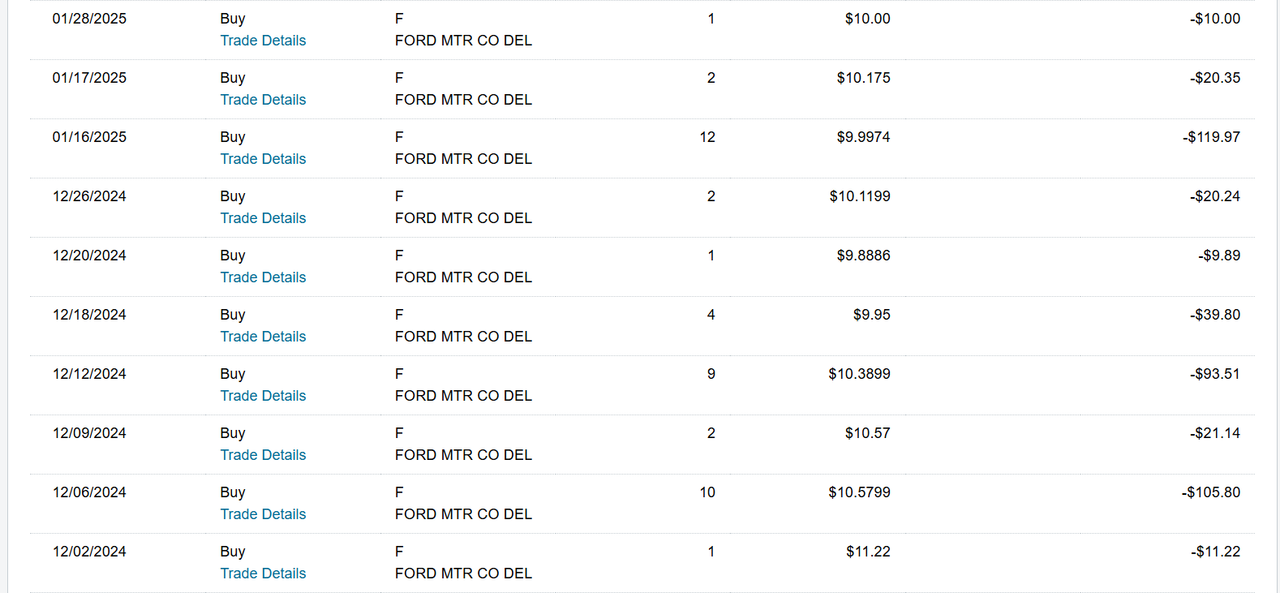

Here is an example of the transaction record:

So the bottom line here is that you can accomplish a lot with small amounts of money if you're consistent and motivated.

This works with investing as well as for any other finance goal - like putting money into a savings account, paying off your credit card or your other debts.

So, don't get discouraged, you can do it. All you need is some motivation and a goal you believe in.

If all you have is small amounts of money to work with, DON'T FEEL DISCOURAGED. Small amounts of money add up if you're consistent about managing it over time.

To share a personal example, a couple of years back, I saw that the Ford Motor Company paid a pretty good dividend - 60 cents a share - and was trading at around 10 dollars a share.

So, I started putting all my extra money into buying shares of the stock. At first it wasn't much at all. It was just $5 from doing surveys here, or $10 from selling my spare bandwidth or $15 from something I sold on Facebook Marketplace. But I just consistently plowed the money back into shares of Ford and reinvested the dividends. It took me about a year and a half, but I got a the number of shares I owned from 0 to about 350 today.

Here is an example of the transaction record:

So the bottom line here is that you can accomplish a lot with small amounts of money if you're consistent and motivated.

This works with investing as well as for any other finance goal - like putting money into a savings account, paying off your credit card or your other debts.

So, don't get discouraged, you can do it. All you need is some motivation and a goal you believe in.

He hasn't in like a decade but released a new album last year so there was speculation he might. He's been her favorite artist for years. I didn't say she was making responsible choices with it, just that its interesting how important some things are until they have a financial stake in it haha

He hasn't in like a decade but released a new album last year so there was speculation he might. He's been her favorite artist for years. I didn't say she was making responsible choices with it, just that its interesting how important some things are until they have a financial stake in it haha

Comment