SUNEQ needs to break through that 0.25 point... it's another BK play, went long earlier, still up at this point... we will see, probably selling today.

g

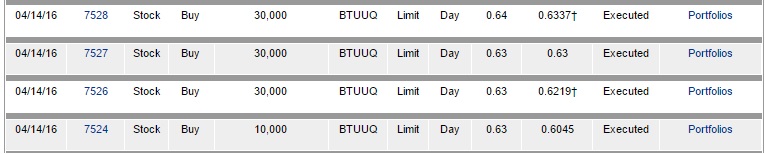

p.s. sold my BTUUQ WAAAY too early. LOL. made like 7K$, left 30K$ on the table. doh!

g

p.s. sold my BTUUQ WAAAY too early. LOL. made like 7K$, left 30K$ on the table. doh!

Comment