If you’re looking to save a bit more money this year, an easy way to accomplish this is to do a $1 a day savings challenge. There are a lot of different challenges out there that try to catch your attention but even when they aren’t that complicated, they still aren’t nearly as simple as the $1 a day savings challenge. The concept is easy and straightforward. All you need to do is put away one dollar a day and at the end of the year, you’ll have an extra $365 in the bank. That’s all there is to it.

In fact, the hard part of this challenge is figuring out where to get an extra dollar a day. This shouldn’t be too difficult to figure out for most, but if you’re having trouble, using a random making money idea generator can help you come up with ideas to create that extra dollar a day.

This challenge is actually too simple for a lot of people. It’s so straightforward and easy that they don’t see a challenge in it. There are certainly a number of different ways to adapt this challenge to make it seem more complicated, but we hope you can learn how to embrace the simplicity that comes with this savings plan. Learning to relish the simple ways to save will make saving money a lot easier for every aspect of your life in the long run. In fact, while saving money is important, far more important is getting into the habit of saving a little bit (in this case, $1 a day) and forming that habit.

How Dollars Can Add Up

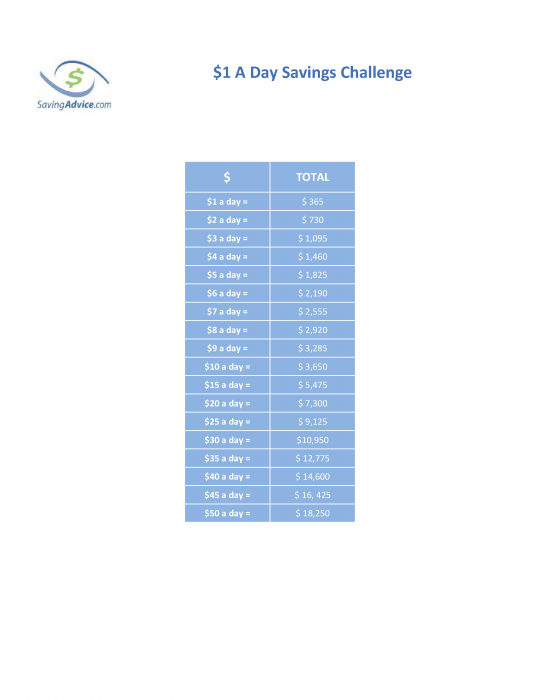

If you want to save more money, you can adjust the daily amount saved to increase your overall savings. If you opt for a $2 a day savings challenge you’ll end up with $730 at the end of the year.

Still not enough? The $3 a day savings challenge will net you $1,095 at the end of the year and the $4 a day savings challenge will put an extra $1,460 into the bank after a year. You can even try the $5 a day savings challenge to end the year $1,825 richer. There’s no need to stop there if you want to save even more money.

As mentioned above, while this truly is the easiest fashion to save money, there are some people who need a little something extra or some type of twist to make saving money more of a challenge. A couple of good examples are the 365 penny a day challenge that will save you nearly $668 at the end of the year and the classic 52 week money challenge that will help you save $1,378. If you’re looking for a $1 a day savings challenge more along these lines, that’s certainly possible as well.

From The $1 A Day Savings To The 52 Week Money Challenge

If you want to save approximately $2,000 for the year, there’s a simple way to accomplish this.

Just combine the $1 a day savings challenge and the 52-week money challenge together. In this case, you would save $1 a day for 5 weeks, $2 a day for 5 weeks, $3 a day for 5 weeks, $4 a day for 5 weeks, $5 a day for 5 weeks, $6 a day for 5 weeks, $7 a day for 5 weeks, $8 a day for 5 weeks, $9 a day for 5 weeks and $10 a week for 5 weeks. Those 50 weeks will help you save $1,925 and then you can determine how much you want to save for the final two weeks of the year ($5 a week for the final two weeks will get you to $1,995 and $6 a week for the final two weeks will make your yearly savings $2,014).

This $1 a day savings 52-week money challenge is far more complicated than the $1 a day money challenge, but as we mentioned, there are some who find having to save different amounts each week more of a challenge. This is when it’s important to understand what motivates you most when saving money. Both of these are year-long challenges which means you’ll need a lot of dedication and motivation to see them through. Choosing the challenge option that can best appeal to what motivates you most will be essential to successfully complete either challenge.

Need Money To Save?

So, a lot of people can’t save money because they don’t have enough income. The good news is finding a dollar a day to save is pretty easy – there are lots of microwork apps out there that will give you enough money to meet this challenge. Here some better ideas:

Take Surveys: By and large taking surveys is a slow grind. The return on your time is typically really low, with most apps paying less than minimum wage. The one exception this is 1Q. It pays 25 cents per QUESTION. So, some longer surveys can give you $1, which is enough to meet the challenge. 1Q is a super easy to download smart phone app. You can find it here.

Sell Your Browsing History: A lot of people don’t like the idea of being tracked online, but the reality is big tech companies like Google and Facebook are tracking you anyways, so you might as well get paid for your data. There are two companies that will pay you for your data and are legitimate, easy to start, hassle free, and compensate reliably.

Nielsen is basically the digital version of the Nielsen ratings, they pay about $5 per month and Savvy Connect will give you $3 per month.

Finally, there are lots of other ways to make extra money to save. Reddit’s r/beermoney or r/sidehustle are a great sources if you need more ideas.

Read More Great Money Challenge Articles

- $5 Bill Money Challenge

- Kickstart Your Savings With The Original 52 Week Money Challenge

- Printable Monthly Money Challenge Chart

Jeffrey strain is a freelance author, his work has appeared at The Street.com and seekingalpha.com. In addition to having authored thousands of articles, Jeffrey is a former resident of Japan, former owner of Savingadvice.com and a professional digital nomad.

Comments