It’s Not the Answer

Dear Dave,

I just finished paying off my credit card bills from last Christmas, and I’ve made a resolution that it’s the last time I’m going into debt for the holidays. With that in mind, how do you feel about using layaway programs when it comes to buying Christmas gifts, instead of putting purchases on credit cards?

Marty

Dear Marty,

Here’s a good rule of thumb for pretty much all spending, not just Christmas gifts. If you can’t buy it with cash up front, you can’t afford it. The only thing I generally give folks a little wiggle room on is when it comes to buying a house. Very few people have enough money set aside to write a check for a home.

Now, sometimes there might be cases when certain popular items are on sale, and you can set them aside through layaway if you don’t have cash at the moment. I don’t have a huge problem with this sort of thing, as long as it’s not habitual behavior. But in general, I’m not a big fan of layaway programs. I know they seem harmless to most folks, but some stores attach hidden fees and other “gotchas” to their layaway programs. On top of that, they’re not the best answer to the problem of running up a mountain of debt at Christmas.

Think about it. Christmas comes at the same time every year, right? I mean, it’s not like it sneaks up on you. So, wouldn’t it be a better to start living on a written budget, and saving up money for Christmas ahead of time? Set aside a little bit each month leading up to December, and by the time Christmas 2025 rolls around, you’ll have a big pile of cash just waiting to be turned into Christmas gifts. And the best part? No financial hangover in January and February from all the debt you piled up.

So, if you’re not already doing this, Marty, I want you to start living on a budget. Give every dollar you bring in a job to do, on paper, before the upcoming month begins. Include Christmas spending in your budget, too.

And always remember, Christmas is about God’s love for us. Not about impressing people by spending money you don’t have!

— Dave

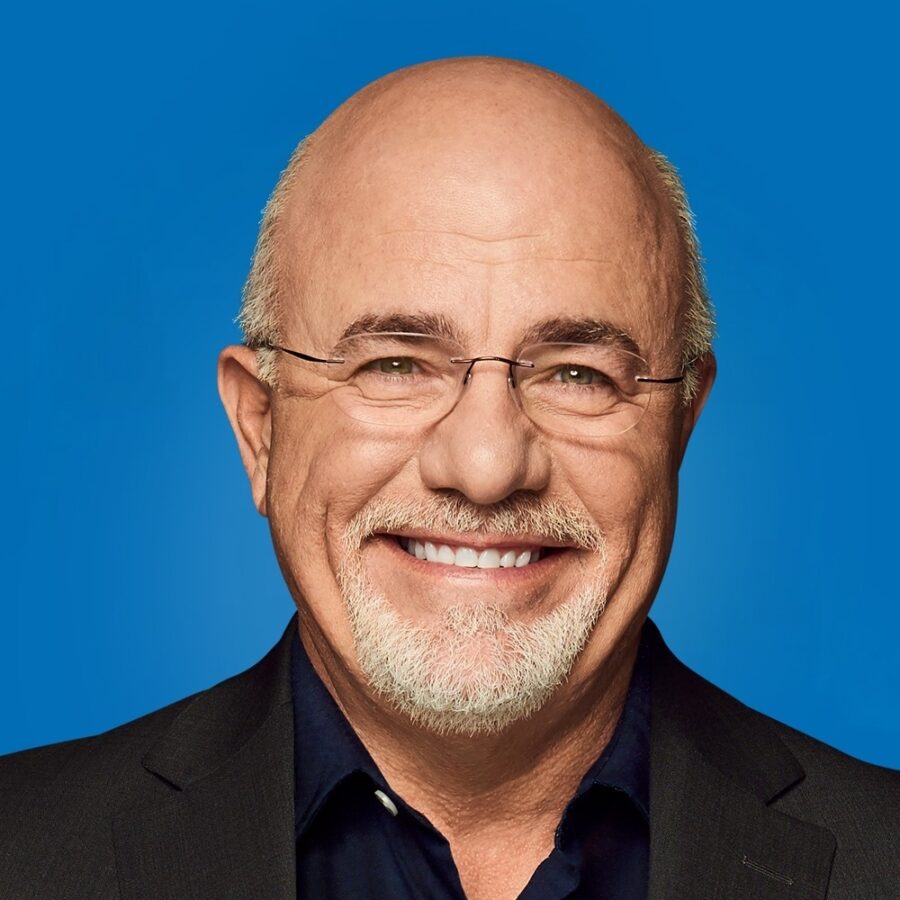

Dave Ramsey is an eight-time national bestselling author, personal finance expert, and host of “The Ramsey Show.” He has appeared on “Good Morning America,” “CBS This Morning,” “Today,” Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth, and enhance their lives. He also serves as CEO of Ramsey Solutions and is the author of numerous books including Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth–and How You Can Too.

Comments