In the digital age, the security of personal information has become paramount. Among the various details that require safeguarding, your insurance policy number stands out as a crucial piece of information. This number isn’t just a reference; it’s a gateway to your personal and financial details.

This article will explore effective strategies to protect your insurance policy number and prevent identity theft.

Understanding The Importance Of Your Insurance Policy Number

Your insurance policy number is a unique identifier issued by your insurance company. It tracks your policy details, claims, and personal information. Given its significance, it’s vital to understand the risks associated with its exposure. If this number falls into the wrong hands, it could lead to fraud, identity theft, and unauthorized access to your personal data.

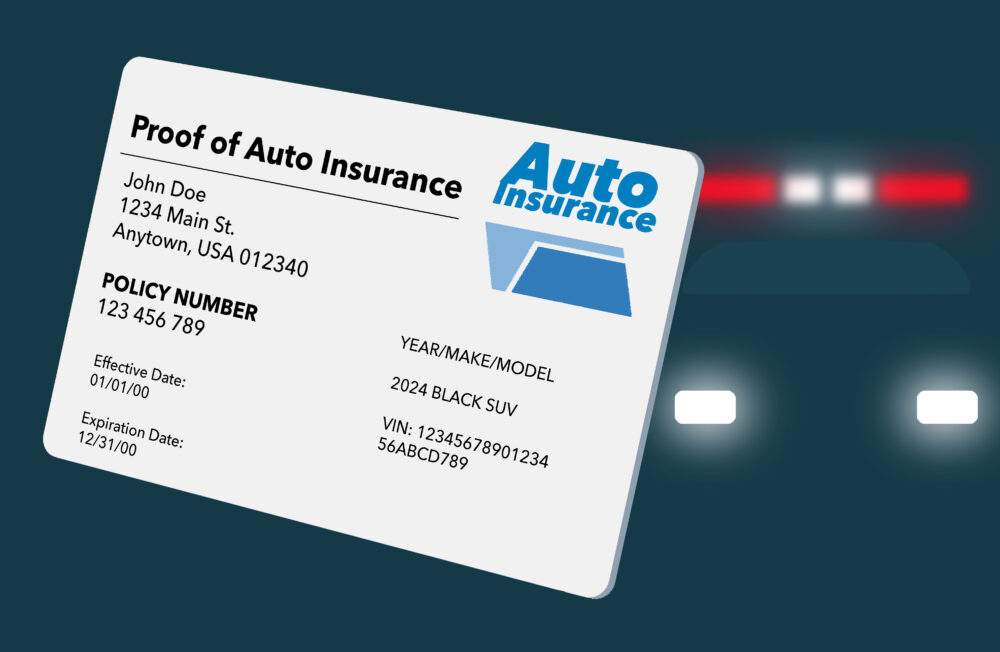

Because of this, knowing how to find insurance policy number is crucial. In most cases, locating the number is straightforward. It’s typically found on your insurance card, policy statements, or online accounts. Ensure you have this number handy for legitimate purposes but be cautious about sharing it.

Ways To Protect Your Insurance Policy Number

Given the importance of the insurance policy number, safeguarding it should be a priority. Some ways to protect your policy number may include:

Secure Your Insurance Documents

One of the important ways to safeguard your policy number is to keep your insurance documents safe. You can do this in the following ways:

Physical Security: Securing physical insurance documents is crucial to prevent unauthorized access. Store them in a locked file cabinet or safe in a discreet, secure area of your home or office. This minimizes the risk of theft, loss, or damage due to unforeseen circumstances like break-ins or natural disasters. Regularly check storage to ensure the documents remain intact and are accessible only to authorized persons.

Digital Security: When digitally storing insurance documents, prioritize their security using encryption and strong password protection. Encryption converts the documents into a code, preventing unauthorized access. Use robust, unique passwords for your digital files and change them periodically. Also, consider using a secure cloud service with two-factor authentication for extra security. Regularly update your software to protect against the latest cyber threats, ensuring your sensitive insurance information is safely guarded.

By considering these options, you can ensure the safety of your insurance documents, particularly your policy number.

Be Cautious With Phone Calls And Emails

Be vigilant against phishing attempts where fraudsters impersonate insurance representatives via phone calls or emails. Verify the caller’s or sender’s identity thoroughly before sharing personal details. Be skeptical of unsolicited requests for your insurance policy number or personal information. Use contact details from official sources for any callbacks or email replies, and never click on suspicious links or attachments in emails.

Use Secure Networks For Online Transactions

Always ensure a secure, private internet connection when dealing with insurance transactions online. Public Wi-Fi networks, lacking robust security, are hotspots for cybercriminals intercepting personal data. Use a virtual private network (VPN) or a trusted home network for maximum protection. Regularly update your firewall and antivirus software to shield your sensitive insurance information from potential online threats.

Conduct Regular Monitoring And Reporting

Regular monitoring of insurance statements is crucial for early fraud detection. Scrutinize each statement for unauthorized transactions or changes. If you spot anomalies, such as unfamiliar claims or policy adjustments, contact your insurance provider immediately. Prompt reporting can prevent further unauthorized activities and protect your financial integrity. Staying alert can also help maintain the security of your insurance information.

Update Your Contact Information Regularly

Keeping your contact information current with your insurance provider is crucial. Updated contact details ensure prompt notifications about policy changes or transactions. This proactive approach can help early detection of any unauthorized activity on your account. Regularly check and update your phone number, email, and mailing address to maintain seamless communication with your insurer.

Educate Yourself About Insurance Fraud

Being knowledgeable about various types of insurance fraud equips you with the tools to recognize and avoid scams. Familiarize yourself with fraudulent schemes like fake policies, inflated claims, and identity theft. Stay informed about new fraud tactics by regularly consulting resources provided by your insurance company or consumer protection agencies. This knowledge is a powerful defense against being victimized by fraudsters.

Be Mindful Of What You Share on Social Media

Exercise caution in what you share about your insurance policy and personal life on social media. Fraudsters can exploit information such as policy details, travel plans, or personal data. Oversharing can inadvertently provide scammers with the tools to impersonate you or engineer fraud. It’s wise to keep your social media profiles private and be selective about your online audience.

The Bottom Line

Protecting your insurance policy number is an essential step in safeguarding your identity. By following these guidelines, you can significantly reduce the risk of identity theft and maintain the confidentiality of your personal information. Remember, staying vigilant and informed is your best defense against fraud.

Comments