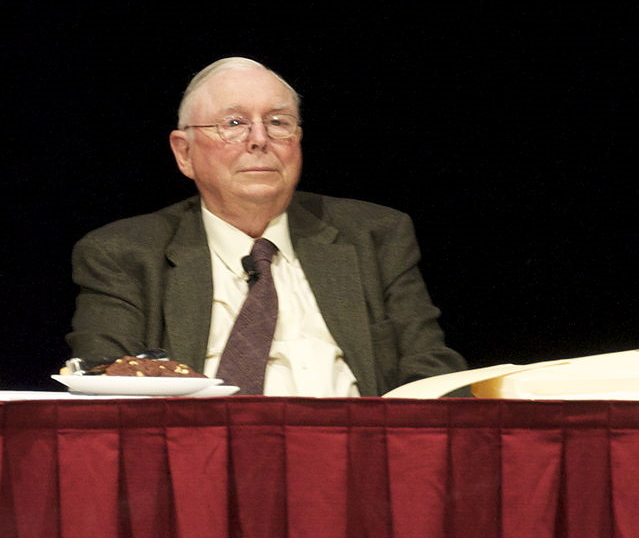

Investing luminary Charlie Munger, renowned as Warren Buffett’s close confidant and partner, passed away at the age of 99 on November 28th at a California hospital (1).

Charles Thomas Munger was born in January. 1, 1924, in Omaha to Florence and Al Munger. His grandfather had been a federal judge and his father was an attorney.

Munger, a financial titan in his own right, played a pivotal role in the success of Berkshire Hathaway. Beyond his vice-chairmanship, he wore various hats as a real estate attorney, chairman of the Daily Journal Corp., a Costco board member, philanthropist, and even an architect.

Despite an impressive fortune estimated at $2.3 billion in early 2023, Munger’s wealth was dwarfed by his partner Warren Buffett’s staggering $100 billion. Munger’s influence extended to reshaping Buffett’s investment strategy, emphasizing quality over low-priced yet mediocre companies. A testament to this shift was Berkshire’s purchase of See’s Candies in 1972, a move guided by Munger that has since yielded over $2 billion in sales.

Born in Omaha in 1924, Munger’s journey from the military to meteorology studies at the California Institute of Technology marked the early chapters of his life. His partnership with Franklin Otis Booth in real estate ventures contributed to his financial ascent, leading to the founding of the law firm Munger, Tolles & Olson in 1962.

Munger’s legendary collaboration with Buffett began in 1959, characterized by an extraordinary alignment of thinking. Described by Buffett as “smart” and “high-grade,” Munger’s impact transcended the financial realm. The duo’s philosophy centered on value investing, valuing a business to determine stock value.

Not just a financial wizard, Munger was a philanthropist who generously contributed to educational institutions, including the University of Michigan, Stanford, and Harvard Law School. His architectural preferences even influenced building designs in exchange for sizable donations.

Charlie Munger’s Investing Wisdom

Charlie Munger’s wisdom echoes through the hills of wealth-building. According to him, the first $100,000 is the Everest of financial ascent. In Munger’s view, it requires a high degree of sheer determination. Making that first million? Well, that’s the next summit, and it demands consistent underspending of income.

In the currency of time, $100,000 in 1960 translates to the purchasing power of $1,039,000 today. Perhaps in our era, the narrative shifts to the first million is the steepest hill to climb.

Munger famously shared a snippet about his net worth journey: The initial 13 years of law practice brought in $300,000. At the end of it, he had a house, two cars, and $300,000 in liquid assets. His secret? Understanding compound interest and viewing every saved $10 as a future $100 or $1,000.

Munger’s financial acumen was founded on the belief that saving $10 today was an investment in a future fortune. His shift from law practice to self-employment was fueled by a conviction that he could outperform his clients.

Munger’s narrative is a testament to the enduring principles of wealth creation and his legacy will certainly live on.

Read More:

15 Inspiring Warren Buffett Investing Quotes

Come back to what you love! Dollardig.com is the most reliable cash back site on the web. Just sign up, click, shop and get full cash back!

James Hendrickson is an internet entrepreneur, digital publishing junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.

Comments