Dear Dave,

I’m a senior in high school, and I’m enrolled in a personal finance class. From your perspective, should I be worried about the national debt being over $30 trillion, and should this affect a person’s overall personal finance strategy?

Chris

Dear Chris,

I’m sorry you have to worry about such things at your age. I, personally, have a long history of fretting about, and alternately being angry about, the national debt being out of control. This is mainly because it represents a Congress that’s out of control, and the fact that the American people don’t seem to have enough backbone to vote these clowns out. So, they keep spending like there’s no tomorrow. There’s probably a tipping point somewhere, but the good news is it hasn’t happened yet.

I’m with you on this when it comes to being concerned, though. I think the entire situation represents a lack of discipline on the American people’s part and on the part of our elected officials. It’s pitiful, and it’s outrageous. Now, does it affect my investing? Not one bit. I invest based on good long-term track records, because the national debt has been out of control for as long as I’ve been alive.

Here’s the thing. If everything did finally fall in on itself, there’s nothing at all you could’ve invested in from a financial point that would protect you. So, if I were you, I wouldn’t worry too much about it, or walk around scared that I was suddenly about to lose everything. In my mind, it’s going to take more than a crop of inept, or dishonest, politicians—and there have been bunches of those, from both sides of the aisle—to sink this thing called America. I believe the country, and its people, are much more resilient than that.

You’re a thoughtful young man, Chris. But I want you to remember one very important thing. What happens in your house carries much more weight in your life than what happens in Washington, D.C., or the White House. That means being personally responsible for yourself and your money. Live on a written budget, save money and stay away from debt. If you do those things, I think you’re going to be okay!

— Dave

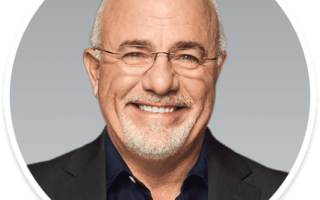

Dave Ramsey is an eight-time national bestselling author, personal finance expert, and host of “The Ramsey Show.” He has appeared on “Good Morning America,” “CBS This Morning,” “Today,” Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth, and enhance their lives. He also serves as CEO of Ramsey Solutions and is the author of numerous books including Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth–and How You Can Too.

Comments