One of the widest choices most individuals will ever make is purchasing a home. There is a lot at stake, both financially and emotionally, so you must choose wisely to prevent regrets.

The process of purchasing a property is complicated and subject to several factors. It’s easy to get ahead of yourself and overlook something crucial that might cause you to fall behind severely.

This manual aims to guide you step-by-step through the procedure and ensure you have all the knowledge necessary to assess and make the best decisions.

If you faithfully follow this advice, whether you’re a first-time house buyer or haven’t bought a home in a while, you should be well on your way to becoming a homeowner.

Buying A Home: The Main 9 Steps

Financially astute millennials are purchasing homes throughout Canada, understanding that it’s one of the finest long-term investments they can make.

Buying a house, condo, or townhouse may be a challenging process, and you might not know where to begin. To close the deal with confidence, read our step-by-step guide to buying your first home in Canada.

Select The Neighborhood And Style Of The Property

You may purchase a house that is still being built, one that is brand new and ready to move into, or one that is being sold again. Although pre-construction houses are often less expensive than comparable resale or ready-built homes, they do have benefits and downsides. You may obtain a more accurate idea of some of the extra expenses paid by working with a realtor and a lawyer.

While researching different neighborhoods, consider your necessities (such as transportation and schools), lifestyle choices, and budget. You can relocate to a rural location, a smaller town, a metropolis, or even an urban or suburban neighborhood.

Know the Costs Associated with Purchasing a Home

Lenders must be convinced that you can responsibly handle all of your present financial commitments, in addition to your new mortgage and other home-ownership-related expenditures. Even in the event of an unforeseen setback like unemployment or the presence of a debt that you took fast in Quebec before lending you hundreds of thousands of dollars.

Lenders look at three separate broad indications of financial health concerning the kind of property, its price, and the area where it is located when determining your creditworthiness.

Calculate Your Down Payment

Calculate your down payment after you have a rough estimate of how much you can borrow. You will be responsible for paying that amount out of pocket toward the cost of the home. Your mortgage loan will be used to cover the remainder.

The required minimum down payment is typically 5% of the purchasing price. For instance, a $400,000 home will need a minimum down payment of $20,000.

If you put down 20% or more on your house, you may get a conventional loan and avoid paying mortgage insurance.

Investigate Your Mortgage Choices And Get Approval

A mortgage pre-approval lets you know how much your lender is willing to loan you based on your credit score, income, and obligations, among other variables. Additionally, the lender guarantees the existing interest rate for up to 120 days (the length of time may vary depending on the lender), providing you the confidence to look for a home while knowing that interest rate rises are unlikely. Your promised rate should decrease if rates do. Make care to consider the terms of the mortgage in addition to the interest rate.

Start Looking for Properties

You may start searching for houses now that your finances are in order. You may have already looked at a few homes online, but you should still hire a real estate agent who can help you every step of the way with the process of purchasing a property.

It might be difficult to find a decent agent, so ask your friends and relatives for recommendations. In general, you want someone with whom you have a strong relationship and who is knowledgeable about the areas in which you are interested.

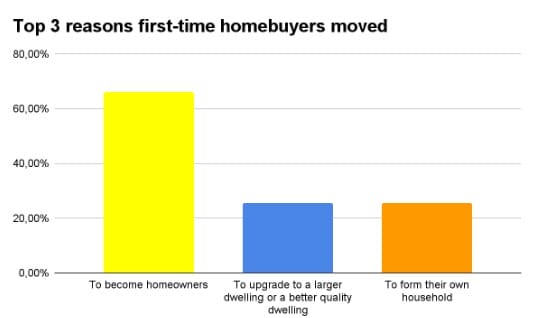

It is very important to choose the accommodation that fully suits your requirements. Top 3 reasons to buy a home in Canada can help you decide.

- More than 66% have moved into their homes to be independent.

- More than 25% to improve your quality of stay and have more space.

- More than 25% to start your own family and live separately.

Source: https://www150.statcan.gc.ca/n1/pub/11-627-m/11-627-m2019091-eng.htm

Make a Proposal

Have you found a house you like? Making an offer is the next stage.

Once accepted by the seller, an offer is a formal, enforceable contract to buy the property. Offers may be subject to conditions that include financing or a house inspection. Even if the seller has already accepted it, you are free to back out if any of the terms are not satisfied. You may also provide a solid, unconditional offer as an alternative.

Real Estate Inspection

Making a house purchase offer subject to a home inspection is a practice that is on the rise. The property’s quality, safety, construction, or functioning are all factors that the sellers have no incentive to reveal, and not all flaws are readily visible.

Before entering into a purchase agreement, a home inspection is meant to find any possible flaws in the house, its systems, its parts, and the surrounding land.

Complete the Mortgage Approval Process

Your mortgage advisor will work with you to complete your mortgage approval before the deadline for your Condition of Financing after the seller has accepted your offer and its conditions. There shouldn’t be any surprises at this point if your mortgage pre-approval was handled professionally and the home you’ve picked complies with all lender standards.

Transfer Services, Update Utilities, And Change Your Address

Keep a record of all regular mail, standing orders, magazine subscriptions, utility and credit card bills, and anything else you get at your existing address during the closure time. Before your closing date, let them know the new location.

Don’t forget to call your dentist and physician as well. It’s simple to send a change of address card to family and friends through mail or email, but notifying government organizations requires a few more procedures.

Conclusion

Anyone might find the process of purchasing a first home to be intimidating. Before you can begin the fun part—looking for your dream house—you must first manage your finances, get pre-approved for a mortgage, and hire a real estate agent, a lawyer, and other professionals.

Comments