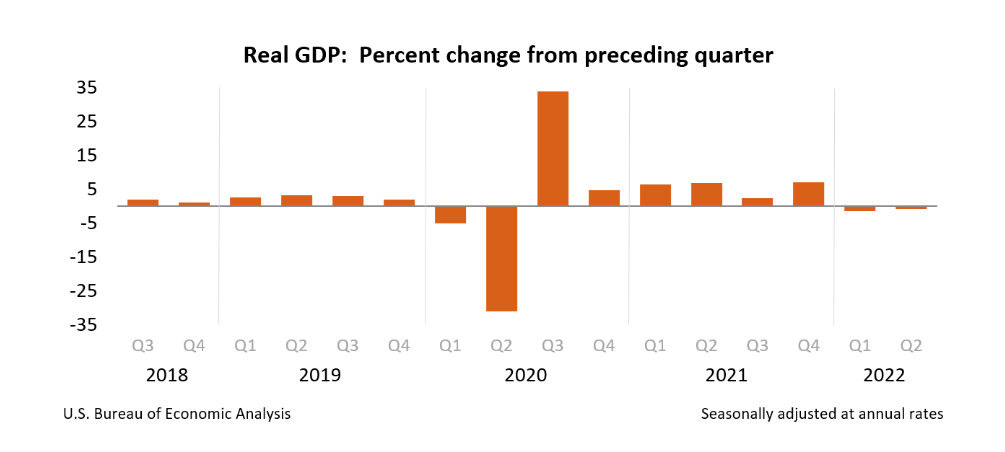

The American economy shrank from April through June for a second quarter in a row, contracting at a 0.9% annual pace and meeting the technical definition of a recession.

The declines reported by the Commerce Department on Thursday follow an annual decline of 1.6% between January and March. Two consecutive quarters of declining Gross Domestic Product meets the technical definition of a recession, according to the National Bureau of Economic Research.

The GDP report for last quarter pointed to weakness across the economy, with consumer spending slowing down and business investment falling. Inventories fell as businesses slowed their restocking of shelves, shedding 2 percentage points from GDP growth.

Higher interest rates, a result of the Federal Reserve’s recent rate hikes, limited home construction, which declined at a 14% annual rate. Federal and state government spending declined as well.

The GDP report coincides with a period of high inflation. Businesses and consumers have been struggling under the weight of high inflation and elevated borrowing costs. On Wednesday, the Fed raised its benchmark interest rate by .75% for a second straight month to help address the worst inflation numbers in four decades.

The United States aside, the European economy is also grappling with low growth and high inflation. This economic situation has been exacerbated by the Russian invasion of Ukraine which has sent food and energy prices soaring. Germany in particular is highly dependent on Russian natural gas and may be vulnerable to a recession as well.

Source: AP News.

James Hendrickson is an internet entrepreneur, blogging junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.

Comments