Are You Saving Enough?

American’s began saving more when the federal government started handing out stimulus checks in April 2020.

The two additional infusions led some economists to begin talking about “excess savings.” The term refers to saving more than you normally would have.

Now those “excess” funds have dwindled or disappeared for many. That has triggered a debate as to how much we should keep in savings. The answer varies according to your circumstances.

The answer can also vary by who you ask. As a result, an old adage is confirmed. It goes like this. If you laid all the economists in the world end-to-end, you still would not get a straight answer.

To simplify things, let’s look at a couple of tried and true saving strategies.

The Classic: Three to Six Months

The most common yardstick for savings is to keep three to six months in reserve. The idea is that most people can recover within three to six months if something catastrophic, such as job loss or illness, occurs.

There is another, more concrete reason to have at least three months of savings stashed away. It takes 90-days to collect disability if you are out of work due to injury or long-term illness.

Anti-Plastic Defense: 12 Months

This concept is designed to have enough at hand to avoid credit card debt to finance your daily living expenses. It embraces the idea that the road to financial ruin is paved with plastic.

“I used to recommend keeping three to six months of expenses in savings. Then the financial crisis hit. Since then, I have recommended 12 months of expenses.” says Thomas Rindahl, certified financial planner at TruWest Wealth Management Services.

Comfort Zone

This is a savings approach based on your personality. It embraces everyone from Zen masters to paranoid-schizophrenic speed freaks.

The idea here is to save what you will be comfortable with if you lose your income.

Just Essentials

Understand that emergency savings are there to cover vital expenses – not luxuries.

“Your essential spending is not every single thing you buy,” Jason McGarraugh, a financial advisor at Neal Financial Group, told Policygenius. “It is the minimum amount you could live on for a set amount of months.”

Bottom Line

Your essential expenses will be unique to you and your family. For instance, a two-income family may not need to cover as many months of expenses as a single-income family. That is because the second income may still cover a lot of family expenses if the first income is lost.

Now is a great time to examine your essential expenses and your savings needs.

Begin with your budget. Separate expenses that must be paid from all other expenses. What is left are your essential expenses.

Ask yourself how you would feel if all the money you could draw on covered those expenses for three months, six months, 12 months. Your answer will determine the right amount for you.

Facebook and Instagram Adding NFT Marketplaces

Meta Platforms, owner of Facebook and Instagram, is exploring ways for users to create and sell NFTs.

“The company’s Novi Wallet technology would be powering the service, according to insiders,” reports DPReview. “Instagram is exploring ways to display NFTs while Meta is supposedly working on a marketplace.”

An Idea In The Works

Meta CEO Mark Zuckerberg rebranded the company from FaceBook last year. His justification was a belief in the metaverse. Many brands are flocking to the metaverse where people use avatars to interact, conduct business, shop, and play.

NFTs serve as documentation of ownership in the metaverse. Think of NFTs as a digital title or deed in the metaverse.

Zuckerberg’s company announced in late October it will support NFTs.

“This will make it easier for people to sell Limited Edition digital objects like NFTs, display them in their digital spaces and even resell them to the next person securely,” Facebook Head of Metaverse Products Vishal Shah said at the time.

Function of NFTs

An NFT establishes digital ownership of things such as a jpeg, gif, music, or video clip on a blockchain.

Listing an NFT for sales does not automatically connect it to the metaverse. That has to be done through a metaverse platform.

More Companies Jumping on Board

Meta is not alone in developing NFT resources.

Both Twitter and Reddit are dipping their toes in the digital water. Twitter is exploring a way for users to display NFTs in their profiles and Reddit is developing its own NFT platform.

Market Moves to Value

Good economic news usually moves the stock markets upward. However, these are not usual times.

The economy grew by 6.9 percent according to the latest quarterly GDP report. In addition, jobless claims last week were 260,000, slightly lower than the 265,000 estimated. Conversely, stock futures continued to trade down at the end of the week.

Year-to-date, the Dow Jones Industrial Average was down 5.47 percent late Friday.

Nasdaq Bears Brunt

Things are even worse on the tech-heavy Nasdaq.

Year-to-date, the Nasdaq was down 13.31 percent.

Shift Not Crash

You may hear talks about bubbles and crashes. However, a shift or transition from growth to value is more likely.

Many of the largest tech stocks posted huge gains last year. Apple was up 32 percent, Alphabet (Google’s parent) jumped 65 percent, and Microsoft rose 52 percent. That kind of growth is difficult to maintain. For smaller, less established, growth stocks the economic headwinds of inflation and supply problems make it tough to get traction.

Fed Tightening

The shift away from growth and tech stocks and their price declines began as the Federal Reserve began signaling a change in policy.

Fed Chair Jerome Powell had characterized inflation as “transitory” for much of last year. However, he changed his view in the fourth quarter. The result is a shift in Fed policy leading to the prospect of higher interest rates.

Impact of Higher Interest

Higher interest rates make it harder for growth stocks to get loans and raise capital. That, in turn, makes it harder for those companies to grow.

Conversely, higher interest rates lead to higher bond rates and greater returns in value stocks. As a result, many investors are shifting away from growth to value investing.

Tapping down inflation is a primary concern for the Fed. Most analysts expect the Fed to begin raising rates soon. Many expect four rate hikes this year.

Looking Ahead

Moving from growth stocks to value is a general trend. There will be some farsighted investors who pick a healthy growth stock and reap great rewards down the road.

Information technology, for example, holds great promise. Advances in artificial intelligence, cloud computing, robotics, network interfaces, and more rely on information technology.

The key is to be aware of a trend and not get swept away by it.

To that end – diversification is vital. A balanced portfolio that meets your goals is still the most effective strategy for most people.

Read More:

- Change Your Life With The 52 Week Mega Money Challenge

- Do This If Your Job Doesn’t Come Back After the Pandemic

- 5 Non-Traditional Ways to Make Up for Unemployment Shortfalls

Come back to what you love! Dollardig.com is the most reliable cash-back site on the web. Just sign up, click, shop, and get full cashback!

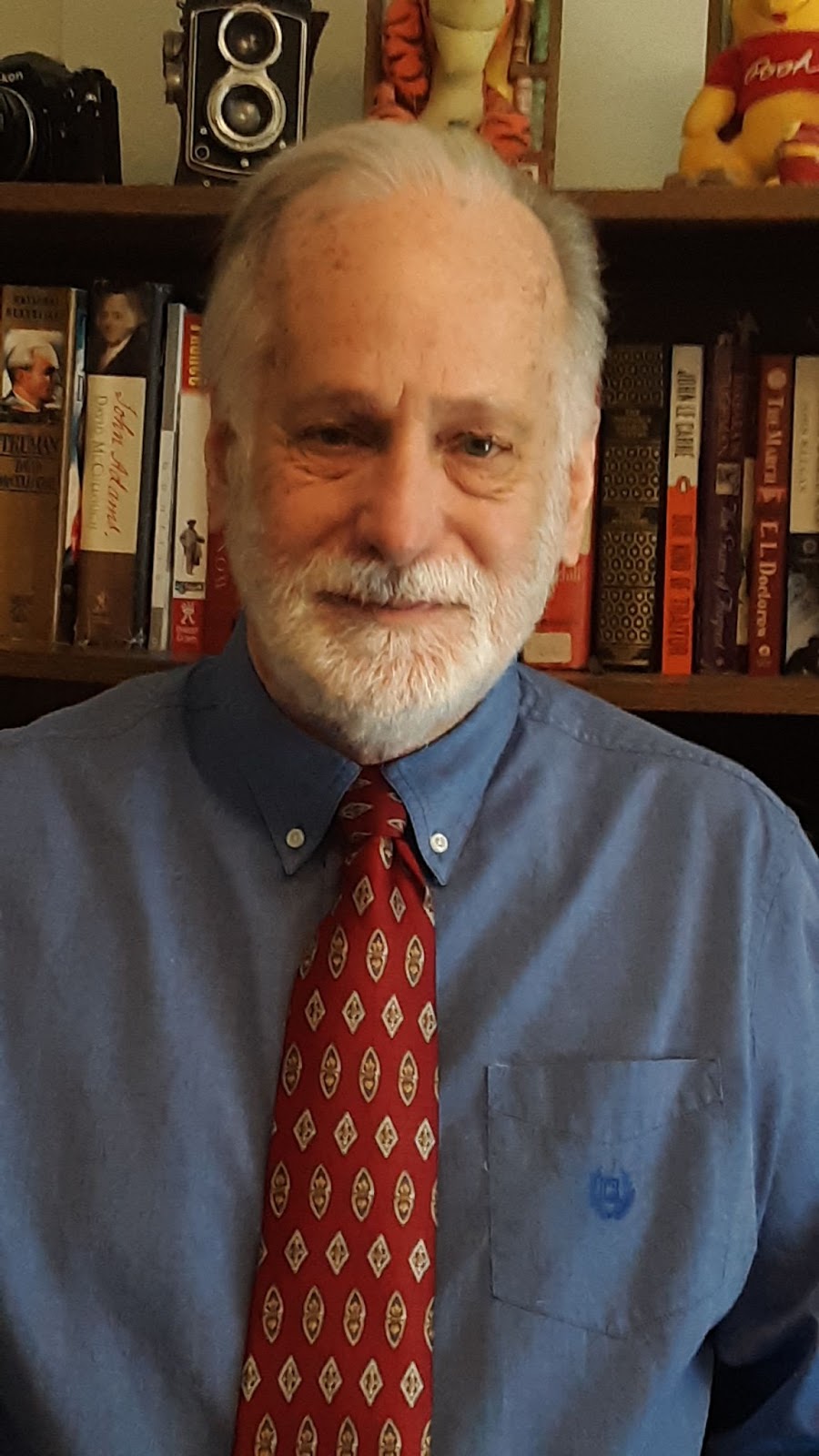

Max K. Erkiletian began writing for newspapers while still in high school. He went on to become an award-winning journalist and co-founder of the print magazine Free Bird. He has written for a wide range of regional and national publications as well as many on-line publications. That has afforded him the opportunity to interview a variety of prominent figures from former Chairman of the Federal Reserve Bank Paul Volker to Blues musicians Muddy Waters and B. B. King. Max lives in Springfield, MO with his wife Karen and their cat – Pudge. He spends as much time as possible with his kids, grandchildren, and great-grandchildren.

Comments