The all-caps are intentional. FIRE stands for Financial Independence Retire Early, and it qualifies as a small phenomenon after gaining a lot of momentum in recent years. In short, it refers broadly to younger people who save (and invest) an extraordinary percentage of their income for some period of time, and then retire – or “retire,” in quotes.

We use quotes because the “retire” part of the equation is somewhat fungible. Leaving a career is normally part of the equation, and working at anything full time (at least for one person, if it’s a couple) is too. But engaging in gainful employment on the side doing something you enjoy or have an interest in is still fair game.

Financial Independence Retire Early – The Trade-Off

The trade-off here is that, in exchange for sacrificing for a while, you can get out of the rat race (or stop working for “The Man,” or insert your own euphemism for working here) a lot sooner than most people – even in your 30s. This may mean committing (or condemning, some would say) yourself to living frugally for the rest of your life, and foregoing certain expenses or luxuries that others take for granted. But FIRE adherents say that the trade is worth making because of the freedom it affords them – the “independence” part. Financial security opens up new avenues for people interested in trying something new, whether it’s income producing or not, without being afraid of the opportunity cost (and the potential opportunities lost). Most have done the math and figure that if worst comes to worst, they could do something menial part-time and, between that income and a tiny draw-down on their investments, cover all or most of their living expenses.

On The Other Hand

That all sounds great. Living to work is out; working (as much as you need to) to live is in. The cost of consuming without considering what it means to your wealth is a big focus of the movement and something we happen to have written about too.

But we do have some concerns. Here are a few of them.

The next recession. The FIREd seem like a thoughtful bunch. We’ll give them the benefit of the doubt and assume they have considered, and even quantified, what an extended market downturn or an economic recession would do to their plans. All they need to do is be aware that it could happen and then stick to the plan.

That’s a lot easier said than done, though. Great money managers will tell you that until you’ve been through a bear market (or multiple bear markets), you don’t know how you’ll react (or if you’re cut out to be a money manager in the first place). Most of the FIRE crowd had barely reached an age to have even entered the workforce during the last recession, let alone started down the early retirement path. So they don’t really know if they’ll be able to handle the stress of watching the value of their investments drop by 30% or 40%.

To be sure, it’s probably a certain kind of person that undertakes early retirement in the first place. Self-motivated, frugal, flexible, detail oriented. All of these characteristics will help in case of emergency, and all else equal, such people should manage better than most. Even so, looking for work exactly at the time when there’s little work to be had is no fun for anyone.

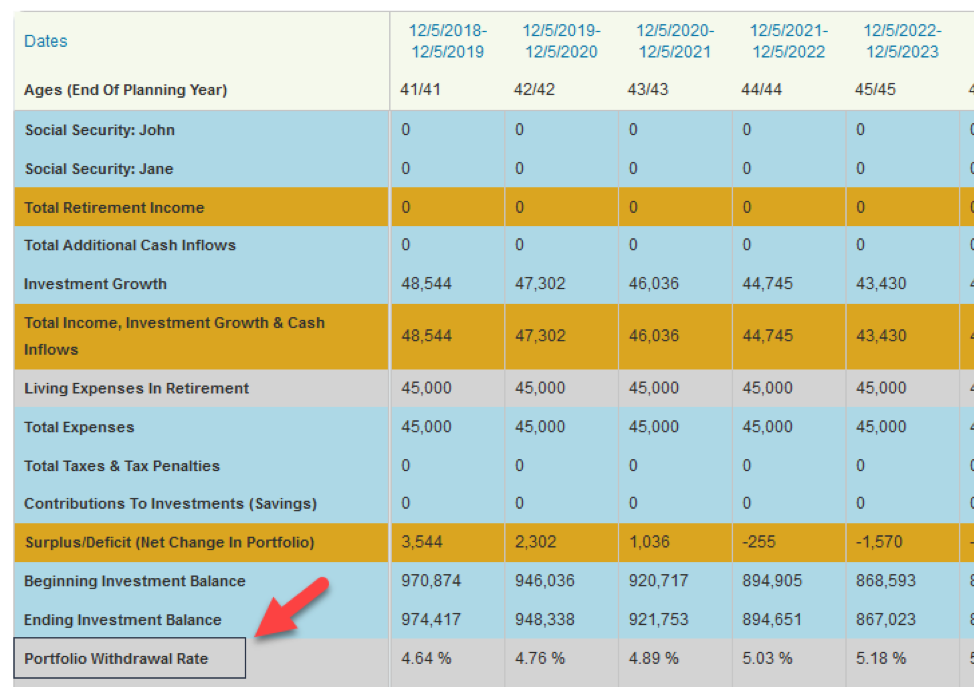

Uncertainty about spending for long stretches can be wrenching. A key piece of a lot of traditional retirement plans is scaling back on luxuries or vacations when times get tight. If you go into retirement with your eyes open about the possibility of having to do this (effectively lowering your portfolio withdrawal rate for certain periods), and you’re in your 60s or so, you can make a plan work that otherwise might not.

But that’s a different situation entirely than being, say, 40 years old, with a child or two, and having to cut back. That would be tough enough to prepare for financially; it’s almost impossible to prepare for mentally. It helps to have an awareness of your personality type. Could you ride out such a stretch without losing sleep or becoming a stressed-out wreck?

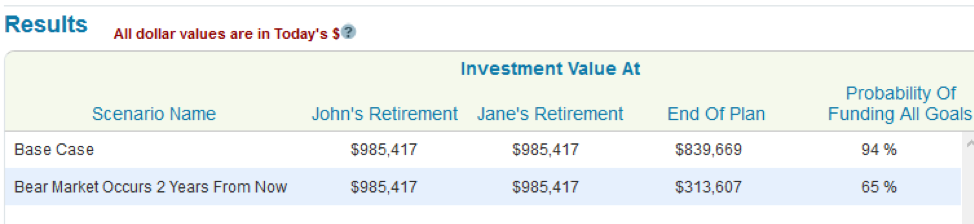

Past performance is no guarantee of future results. When we talk about planning for the future, we almost invariably start by looking to the past. Stuff like projecting asset class returns, running Monte Carlo simulations, and our bear market simulator (highlighted above) is based on the idea that the past will repeat itself to some degree.

That’s OK, to a point. After all, we have to start somewhere, and over time, the past probably will repeat itself, at least from a 40,000-foot view.

But the particulars can vary. And early retirees need to be looking at those particulars. The Four Percent Rule is a great example. Any 30-or-so-year retirement period should be able to handle a 4% withdrawal rate, it says, no matter the market environment.

Before the early nineties, though, a lot of planners thought it was more like 5%. More recently, as fixed income yields have been stingier, you hear 3% lot more often.

Might the rule change again? If so, it could certainly be unpleasant if you’re halfway through a long retirement and counting on a rule being a rule.

Leading By Example

We make compromises all the time, and maybe early retirement should be no different. Maybe if you hang it up professionally at 35 or 40 and have done the math and are comfortable with your projections, you’ll chalk up not being able to afford, say, traveling in luxury 10 years down the road to one of those compromises. You can’t live in the shadow of what-ifs all your life.

Even if you’re not ready to be that extreme about it, there’s a lot to learn here. Those who have taken the plunge offer insights that most of us can benefit from, whether we’re retiring early or going the more traditional route.

For a lot of us, maybe it’s simply another lens through which to look at something we already know to be true: If we live like we want to retire early by doing all the things we know we should be doing (maxing out the 401(k), watching our spending, and so on), we might actually be able to do so.

Read More

Don’t Outlive Your Retirement Fund

Saving for Retirement Early is Worth It

How Mutual Funds Impact Your Retirement

Comments