This summer Fidelity announced it was launching two exchange traded funds (ETFs) that have no annual cost at all. Most funds charge an annual expense fee to pay for the variety of costs that go into managing a mutual fund or ETF. But Fidelity is using these funds as loss leaders in order to get more people to invest with them.

This summer Fidelity announced it was launching two exchange traded funds (ETFs) that have no annual cost at all. Most funds charge an annual expense fee to pay for the variety of costs that go into managing a mutual fund or ETF. But Fidelity is using these funds as loss leaders in order to get more people to invest with them.

The two funds are the Fidelity Zero Total Market Index ETF (FZROX) and the Fidelity Zero International Index ETF (FZILX). These are just the beginning. Fidelity has already said they plan on introducing more cost-free funds to consumers soon.

In addition to adding no-cost funds, Fidelity also decided to no longer require any minimum investment to open an account with them.

Index Funds Are Still Your Best Bet

The two funds mentioned above are index funds. This means there is no active management of them except the buying and selling necessary to keep them the same as the index they follow.

Index funds have been proven to be the best way to invest over the long run time and again. Their low fees always end up beating market timers and funds that charge a hefty fee for active management. Actively managed funds also have much higher turnover, which can increase your tax bill and eat up your investments due to more trading fees.

Warren Buffet has said many times that index funds are a person’s best bet when investing. We can’t all be Warren Buffet in terms of picking stocks, so index funds are the way to go for the majority of us.

Fees and Your Retirement

Over a long period of time, even a small reduction in fees can do wonders for your retirement portfolio.

If you are trying to maximize your wealth at retirement, there are several financial planning tools available today that will show you how big of an impact fees can have.

The changes in an investment portfolio over time due to lower fees is exponential. The savings might start out small, but because those savings are reinvested, the amount grows larger and larger over time.

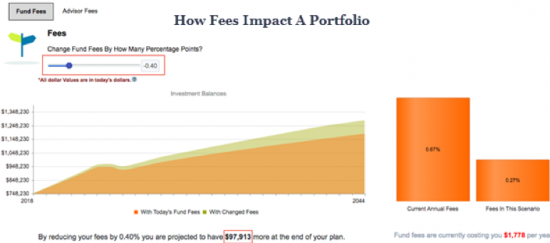

Let’s look at an example of this. I used WealthTrace to show how a portfolio can change over time as we decrease the fund fees a person is paying.

This is a $740,000 portfolio. I reduced the fees paid on fund investments by 0.40%. This saves them over $1,700 per year. More importantly, over several years it saves them nearly $100,000! This is the power of compounding that I mentioned earlier as the savings are reinvested.

At the same time, higher fees mean a lower portfolio balance. I ran the same portfolio with fees that are just 0.20% higher and I found that they would have nearly $45,000 less at the end of their retirement plan.

The difference in fees can make or break a retirement plan. That is why it is a great strategy to seek out low-cost index funds, or even no-cost funds like Fidelity now offers. It can mean an earlier retirement with less stress and more money to spend.

Read More

How Mutual Fund Fees Affect Retirement

Investing in ETFs for Beginners

Emperor Investments Robo-Advisor Review

Comments