Did you know banks are offering new customers hundreds of dollars in bonuses? However, before you run off to open a new account, you should consider a few things. Here’s how to make sure you get the highest and most valuable bank sign up bonus.

How Much is the Bank Sign Up Bonus Really Worth?

First, to get the highest bank sign up bonus, there are some things you should consider (besides what you’ll be spending your extra cash on.

Weigh the Cost vs. the Bonus

Banks not only offer huge bonuses for opening new accounts, but they can also include costly expenses. Make sure you read through the fine print and calculate how much extra your new account will cost you in the long run.

Will it cost you an additional $15 a month just to have the account? If so, maybe the $50 bonus isn’t so valuable to you.

The Cost of Convenience (Or Inconvenience)

Although there are tons of online banking options that don’t require you to ever step foot in a bank, you might have personal reasons for preferring to step inside a bank once in a while. Ask yourself a couple of questions first.

- Will you have to drive an extra 50 or more miles to get to your new bank?

- Is it difficult to reach someone in customer service if you need help or have questions?

Withdrawing Money and ATM Access

This goes along with both costs and convenience. Before opening an account, you want to make sure it isn’t going to cost you a lot in either fees or access to get your money when you need it. If your new bank doesn’t have an ATM anywhere near you, you’ll have to use expensive out-of-network ATMs.

Plus, there’s nothing worse than not being able to get to your money when you need it.

Bank Promotion Requirements

Although banks offer big sign up bonuses just to open a new account, there are often requirements that you have to meet to qualify.

For instance, you might need to make sure you have a certain amount of money in the account for a specific period of time. It’s important to be sure you can meet these requirements. Don’t waste your time going through the hassle of opening a new account for nothing.

4 Banks with High New Customer Promotions

Both online and traditional banks offer new account promotions from time to time. If you’re looking for a new account, make sure you check the most current offers before signing.

The following four banks currently offer a high bank sign up bonus.

Chase

Chase often has different offers for new customer promotions. Right now, you can get one of the highest bonuses of $350, if you open a checking account and a savings account. You get $200 when you open a Chase Total Checking account and set up direct deposit. You also get $150 when you open a Chase Savings account and deposit $10,000 or more in new money.

Citi

Citi also runs various promotions. Right now, you can earn $400 if you open a checking and savings account in the Citibank Account Package and deposit $15,000. Further, if you open a new checking and savings account and deposit $50,000 new-to-Citibank funds, you can earn $600. While this limits those with lower balances, Citi does offer other promotions for new account holders from time to time.

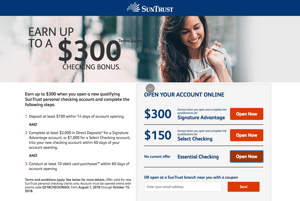

SunTrust

SunTrust currently offers an opportunity for new account holders of up to $300, if you deposit at least $100, complete at least $2,000 in direct deposits for a Signature Advantage account, and make at least 10 debit card purchases. There is also a lower offer of $150 if you open and complete the qualifications for a Select Checking account.

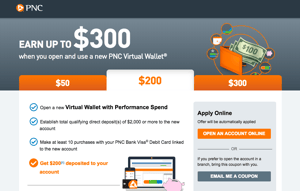

PNC Bank

If you open an account with PNC Bank, you can earn up to $300. At the lowest threshold, you earn $50 when you open a new Virtual Wallet, establish direct deposits of at least $500, and make at least 10 purchases with your debit card linked to the account.

What do you look for in a new bank account? Let us know in the comments below.

Give the gift of savings! Learn more

Read More

How Long Does it Take to Open a Checking Account

Reasons to Use Costco Checks

Does Closing a Checking Account Hurt Your Credit?

52 Week Savings Challenge

365 Day Quarter Challenge

Ways to Make Extra Money

Christina Majaski has more than a decade of media experience, including editing and writing for numerous online and print publications. Her work has appeared in MSN, Investopedia, Forbes, and CBS. In addition to being a recognized personal finance expert, Christina holds a degree from Rasmussen University and is based in central Minnesota, where she lives with her daughter, Chloe and her dog, Monty.

Comments