When discussing financial planning, common topics of discussion include but are not limited to: creating an emergency savings plan, putting money away for retirement, and paying off your debt. However, a large part of planning for our personal finances is also checking a credit report. Knowing how well your credit fares over time is important for keeping your money on track. Many online tools exist for checking such reports, with several options at no cost. One of these online credit reporting tools is Credit Karma. But, is Credit Karma legitimate?

How Credit Karma Works

Founded in 2008, Credit Karma provides a free credit reporting service as well as resources to help you better your finances. Like Credit Sesame, they do not require a bank account on file or charge for their basic reporting services. They do, however, make money on any loans or credit cards you sign up for through them, which they are very clear about on their website. Otherwise, there is no cost to use their service.

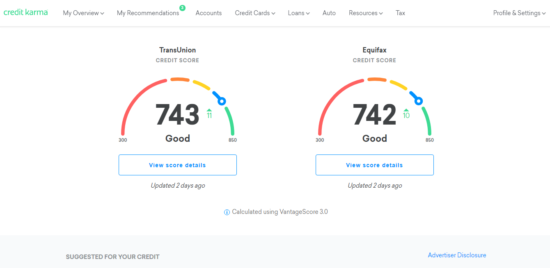

Once you create a login and enter in the information needed to run your report, Credit Karma uses scores and reports from TransUnion and Equifax, and sends you weekly updates so that you can work on (or maintain) your financial health.

What to Look for In a Credit Reporting System

A full credit report will not only include your credit score but also your credit history. The best systems typically also include options to monitor your credit as well as tips and tools to improve it.

According to AnnualCreditReport.com, the three national credit bureaus, Equifax, Experian, and TransUnion, are all required by law to give one free credit report to anyone who asks for it. Each of these uses the FICO score algorithm, which is the most widely used scoring system lenders use when evaluating your credit, as stated on MyFico.com. The site adds that the FICO score also keeps up with current lending trends and consumer behaviors, another reason why it is so trusted and popular.

When using a credit reporting system, it is best to use one that pulls information from a source with FICO scoring rather than what is called FAKO scoring, a system not commonly used by lenders and is not as accurate. VantageScore is an example of what people call a FAKO .

Is Credit Karma Legitimate?

Usually, when a company offers “free” credit reports, they reel you in by giving you a trial first. During these trials, you are required to provide your credit card information, and even though you are only entering it to get that initial report at no cost, you may end up getting charged for the service after you forget to remove your card on file from their system.

Credit Karma, on the other hand, does not do this yet still follows through on giving a free report. Although they give you your estimate TransUnion and Equifax scores, they actually calculate your credit report using VantageScore, or, as mentioned previously, the FAKO score. While this will affect some accuracy of the information provided, it does not mean that Credit Karma is not legitimate. They stand by their word of offering users a free service along with recommendations on consolidating loans, financial resources, and the like.

What are your thoughts? Is Credit Karma legitimate?

James Hendrickson is an internet entrepreneur, digital publishing junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.

Comments