Quality Over Quantity

Apple makes some quality products, there is no doubt about that. However, Jobs’ “quality over quantity” approach may also be able to help you in your financial life. If you buy a higher quality item you may spend more money at first, however, you won’t be spending it continually down the road because you’ll still have that first great product that you bought.

Keep It Up

Another lesson everyone can take from Jobs it to keep at it. He hit a lot of bumps in the road, as people often do. If you hit a financial bump in the road, take it in stride. It is not likely the end of the road. Pick up where you left off and keep plowing forward. Whether you are paying down your student loan debt, credit card debt, saving for something, you can do it. Just keep moving forward.

Minimize Distractions

Of course, no matter what your financial goals are, there will be distractions. Jobs was always great at getting rid of whatever distractions were in his way. Let’s say you are saving for a new car but your friends want to go away on a road trip. It is okay to let your friends know that you are saving for a new car. This will help both them and yourself minimize any temptation or distractions from your financial goal.

Do What You Love

This seems to be a continuing theme across the board when it comes to financial advice. Successful people do what they love to do. Of course, this doesn’t always work for everyone. Sometimes you have to take the job because it is a job that will pay your bills and not necessarily the job you love to do. Jobs made it clear that he never did what he did for the money (although, at the time of his death he was worth hundreds of millions). He did what he did because he loved it and he just so happened to make a living at it.

You Can Fail

Failing in life is a given sometimes. You don’t always have everything just right and it can be rough, but prepare yourself to just get back up and try again if it happens. This is the same for finances. When it comes to your bank account and personal finances, things can happen. However, Jobs pointed out that instead of lingering on your mistakes, you should take the lesson and move on. You will be able to fix it in time.

Hold Yourself Accountable

When it comes down to it, Jobs always held himself accountable. When you are trying to reach a specific financial goal, you need to hold yourself accountable. Set small goals and when you reach them, set another goal. If you hold yourself accountable, you will be in better control of your finances.

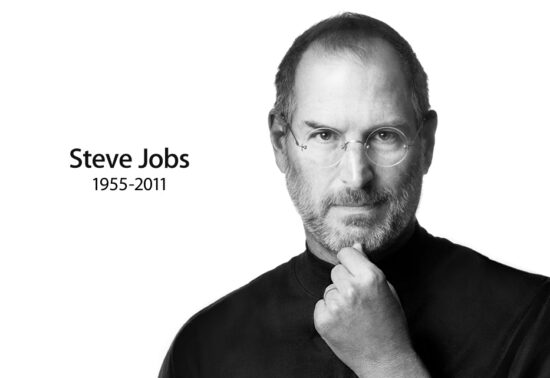

Photo: Flickr: tenz1225

Comments