New Year’s resolutions are being made throughout the world as 2015 comes to a close and 2016 offers a fresh start. Many people make resolutions to be fit, eat healthily, lose weight or save money. One savings challenge has gained popularity as a resolution in recent years.

The 52-week savings challenge has been gaining popularity each year as a New Year’s resolution or even just a good way to save some extra cash. For those who haven’t tried it yet, the concept is pretty simple. The standard version has you putting aside the number of dollars which correspond to the week number of the year. For example, in week one you put aside $1. During week two, you put aside $2. During week ten you put aside $10 and during the last week of the year you put aside $52. If you do this the entire year, you will have saved $1,378.

There are a few noticeable flaws in the original plan though. Of course, each week you save an extra dollar throughout the year, and if you follow it, it is pretty effective, but the plan has you save MORE money during the holidays than during the beginning of the year (when most people have a little more disposable income).

So, why not try the savings challenge in reverse? This would make it so that you are saving $52 the first week of the year, and only $1 the last day of the year. This way, during the stressful time of the holidays, you aren’t completely ignoring your savings plan buying gifts, etc.

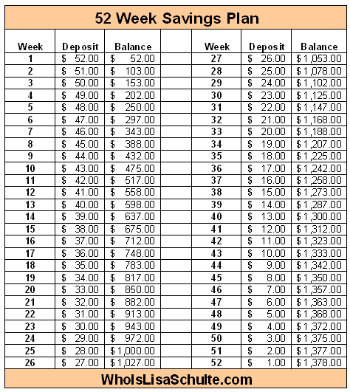

Here is how the money-saving challenge works in reverse:

(Photo: Pinterest)

You still save practically $1,400 over the span of a year, which is great, but it doesn’t put as much stress on saving at the end of the year when most people are stressing about money. If this seems like too much money to save for you, there are different variations on the savings plan that include saving change, so you can participate in the challenge along with millions of others this year.

There are a lot of other great ways to save money, too. Remember that you should budget a savings plan into your daily, weekly and monthly budget. Also, if you are on a strict savings plan, save any “extra” money you come into. For example, if you get a bonus at work, this money would go directly into savings, or even a gift (cash).

Savings is never easy, but some of the savings plans and different tools can make it easier for you. The best advice when it comes to saving and if you are thinking about taking part in this challenge is just to do it. Once you’ve started the process and have gotten in the mindset of saving, it will be much easier to just save your money in the long term.

Consider Automating Your Savings

If you are hard core about saving money and want both an active approach and a passive approach do two things. Supplement your savings with a “fire and forget” automated approach. A great way to implement this automated approach is to go with an application like digit.co or acorns.com.

Digit.co is a favorite because its super easy to use. All you need to do is sign up and let the program analyze your checking account. Once the program is completed, it makes automated withdrawals which don’t impact your spending and sweeps them to an account you control. It is a super easy way to save money without a lot of effort. Click here to check it out.

Give the gift of savings! Learn more

Amanda Blankenship is the Chief Editor for District Media. With a BA in journalism from Wingate University, she frequently writes for a handful of websites and loves to share her own personal finance story with others. When she isn’t typing away at her desk, she enjoys spending time with her daughter, son, husband, and dog. During her free time, you’re likely to find her with her nose in a book, hiking, or playing RPG video games.

Comments