Below are some of the reasons that he feels timeshares are one of the biggest scams in the vacation industry:

They’re Not Affordable

For the mass majority of people who are targeted by marketers to buy timeshares, they’re not consumers who can really afford one. There are quite a few expenses that come with owning a unit, and these expenses are perpetual. In fact, they can increase over time. Just because the sales person who’s trying to sell you a unit tells you that you can afford it, that doesn’t make it reality. They’re an expensive vacation option, and the truth is that most people’s finances are not in good enough shape to be able to afford one.

They Don’t Make Financial Sense

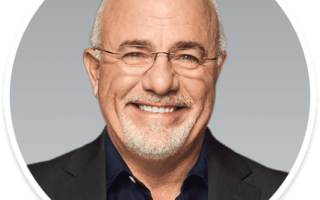

Even if you have your finances in order and can afford to buy one, Ramsey points out that it still doesn’t make financial sense to do so. The average cost the timeshare is about $15,000 these days. It makes much more sense for you to invest this money than buying a vacation resort unit. The calculations become even worse if you have to borrow money to buy the unit, because you’ll likely end up paying double-digit interest rates to do so. Ramsey points out that if you invest that $15,000 instead of buying a unit with it, it would be worth over $1 million in 40 years.

Terrible Investment

There are still far too many people who believe that purchasing a timeshare is a good investment. Ramsey wants to make it clear to everyone that a timeshare is not an investment. What you’re actually doing when you buy a unit is prepaying your future hotel expenses each year for the rest of your life. Even worse, you’ve prepaid this amount whether you end up using it or not. Combine all this with the fact that they’re a depreciating asset, which will lose its value year after year (much like a car does), and it means that if you do end up buying one, you’re going to end up losing a lot of money in the end.

Selling Them Is Difficult

Another important reason to avoid buying one of these units is due to how difficult they are to sell when you no longer want one. The law of supply and demand rears its ugly head for anyone who owns a timeshare. There are far more people who want to sell than those who are interested in buying. This can mean that in some instances, you won’t be able to sell even if you want to, forcing you to continue to pay yearly maintenance fees.

It can even be difficult to give yours back to the resort, which is what Ramsey suggests owners try to do. Even if you offer it to them at no cost, the resorts have little incentive to do so if they still have inventory, since keeping you as an owner will mean you have to continue to pay the yearly maintenance fee. The bottom line is, when you want to sell, you’re going to have a difficult time, and if you are ultimately successful in selling your unit, you’re going to lose a lot of money doing it. The Federal Trade Commission (FTC) notes that you also need to be careful of the many reseller scams that are out there.

Don’t fall for the marketing tactics which resorts will use to try to convince you that buying a timeshare is a good deal. Take the financial advice of Dave Ramsey, and remember that it’s one of the biggest travel scams out there. Below you’ll find a video with some more of Dave Ramsey’s thoughts about timeshares:

Finally, if you want to get a better handle on your finances, consider getting a copy of Dave Ramsey’s The Total Money Makeover. The book outlines some basic truths about money and is designed to improve your financial habits. The book has sold something like 5 million copies – so it is well worth the read.

If you went against Dave Ramsey’s advice and now own a timeshare that you want to get out of; reach out to Newton Group Transfer at 1-888-549-4154 today. They are standing by to make the resell of your timeshare as smooth as possible.

Jeffrey strain is a freelance author, his work has appeared at The Street.com and seekingalpha.com. In addition to having authored thousands of articles, Jeffrey is a former resident of Japan, former owner of Savingadvice.com and a professional digital nomad.

Comments