52 Week Mini Challenge (click on image to print)

While this challenge only saves half the amount of the original challenge, the amount isn’t the main point of the challenge. For those who are living paycheck to paycheck, the most important thing is to begin saving something. Even a small amount is better than nothing at all. It’s the process of getting in the habit of saving on a regular basis that’s important. Once that habit becomes established, you’re in a position to save as much as you want. You can move onto the regular challenge or even try a double challenge. The first step is establishing the habit so that any amount desired can be saved in the future.

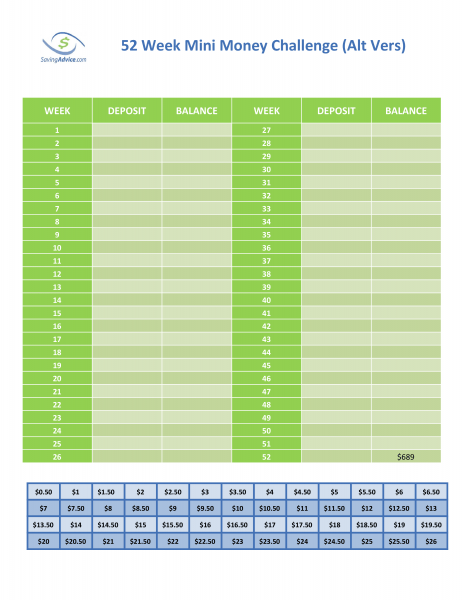

The one drawback following the above steps is that the largest amounts need to be saved at the end of the year when budgets are often at their tightest due to all the holiday activity. Even when doing a mini-challenge like this, the increased amounts at the end have the potential to be an obstacle that makes some people decide to quit. With that in mind, we have put together an alternate version which allows you to do the challenge with more flexibility during the year.

52 Week Mini Half Alternate (click on image to print)

As with all of the 52 week challenge variations and options, the most important aspect is choosing the one that best fits you and your lifestyle. By choosing the one you have the most confidence in completing, you have a much better chance of success. And as mentioned earlier, the first time doing this isn’t so much about the actual amount saved, but that you get the savings process started. Below you’ll find some more challenge options that are worth investigating and considering as well.

365 Days

52 Week Standard

52 Week Variation

52 Week Make Money

52 Week Kids

26 Bi-Weekly

24 Bi-Monthly

12 Monthly

Zero Effort Money Saving Hacks

Money challenges aren’t for everyone. You may be looking for a more hands-off approach to saving. For people that want saving to be effortless, there are smartphone apps like digit.co. Digit analyzes your account balances and automatically withdrawals small amounts of cash and places it into savings for you. Check it out at digit.co.

Jeffrey strain is a freelance author, his work has appeared at The Street.com and seekingalpha.com. In addition to having authored thousands of articles, Jeffrey is a former resident of Japan, former owner of Savingadvice.com and a professional digital nomad.

Comments