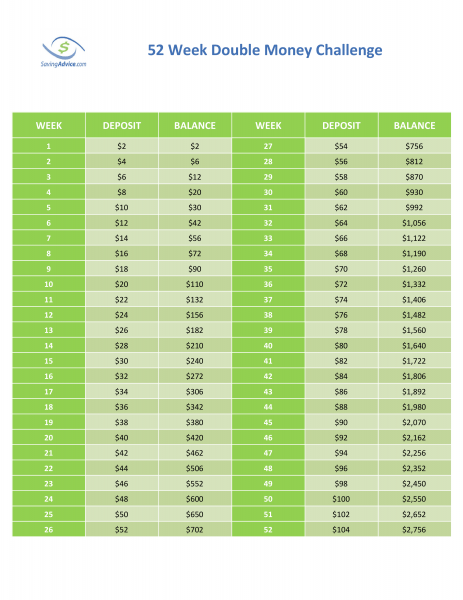

The concept for the 2x challenge is the same, but you save double the amount of the standard challenge. For example, during week one you’ll need to save $2 instead of $1. In week two you’ll need to save $4, in week three you’ll need to save $6, and in week fifty-two you’ll need to save $104. While this is certainly more difficult than the standard challenge, the benefit is that at the end of the year you’ll end up with twice the money in your savings account. Instead of $1,378, your bank account will hold $2,756.

52 Week 2x Challenge (click on image to print)

52 Week 2x Alternate Challenge (click on image to print)

As with all these challenge versions, this is another option to consider when choosing the one that best fits your needs. Finding the best fit can be an important part of the process, as it’ll increase the likelihood that you both enjoy the challenge, and ultimately reach the goal. While it can be tempting to try to save as much as possible, in most cases it’s far better to choose a smaller amount first. This will help you to get into the habit of saving money. This is more important than trying to save more and quitting in the middle because the challenge becomes too difficult. Once the savings habit has been formed and you feel confident with the challenge, that’s when it’s beneficial to move onto versions which require you to save more.

There are actually a wide variety of 52 week challenges and variations that you should consider when determining which is best for you and your personality. Below is a list of some of the alternatives to take the time to consider.

The 365 Day Money Challenge

52 Week Challenge – Standard

52 Week Challenge – Variations

52 Week Make Money Challenge

52 Week Money Challenge For Kids

26 Bi-Weekly Money Challenge

24 Bi-Monthly Challenge Chart

12 Monthly Money Challenge Chart

Fun Reading From Around The Web

Lastly, there are a ton of reasons why you want to save money. The Free Financial Advisor has a nice review article on the advantages and disadvantages of saving money. The Financial Geek has a list of nine benefits of saving money in the bank. And finally, Grant Sabatier over at millennial money has an excellent write up of how he saved 1.25 Million in 5 years.

Readers, do you have any savings tips, or have you taken a savings challenge? If so, please leave us a comment below.

Jeffrey strain is a freelance author, his work has appeared at The Street.com and seekingalpha.com. In addition to having authored thousands of articles, Jeffrey is a former resident of Japan, former owner of Savingadvice.com and a professional digital nomad.

Comments