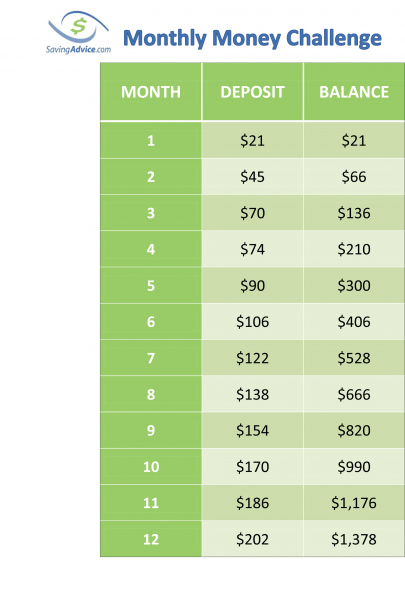

Monthly Challenge (click on image to print)

Month 1: $1 + $2 + $3 + $4 + $5 + $6 = $21 (six weeks)

Month 2: $7 + $8 + $9 + $10 +$11 = $45 (five weeks)

Month 3: $12 + $13 + $14 + $15 + $16 = $70 (five weeks)

Month 4: $17 + $18 + $19 + $20 = $74 (four weeks)

Month 5: $21 + $22 + $23 + $24 = $90 (four weeks)

Month 6: $25 + $26 + $27 + $28 = $106 (four weeks)

Month 7: $29 + $30 + $21 + $32 = $122 (four weeks)

Month 8: $33 + $34 = $35 + $36 = $138 (four weeks)

Month 9: $37 + $38 + $39 + $40 = $154 (four weeks)

Month 10: $41 + $42 + $43 + $44 = $170 (four weeks)

Month 11: $45 + $46 + $47 + $48 = $186 (four weeks)

Month 12: $49 + $50 + $51 + $52 = $202 (four weeks)

It’s not exactly pretty, but it works. This standard version runs into the issue that it’s heavy on saving money at the end of the year when money may be tightest due to the holidays. It therefore made sense to create an alternate version for this as well. This allows you to choose which of the twelve amounts to deposit each month depending on how your finances are doing that month. Once you input that amount, you cross off the box at the bottom. It simply gives you a bit more flexibility, which will hopefully allow you a better chance to complete the challenge.

Monthly Variation Challenge (click on image to print)

What this monthly version does do is give you another option to consider while searching for which challenge ultimately best fits with your personality. It also has the distinct advantage that when you get paid your monthly check, it makes it fairly easy to save this amount right then and there before all the money gets spent on other things. If you’re disciplined enough to make sure that you pay yourself first when your paycheck arrives, you should succeed at completing the challenge, and that’s really the key to this game.

For those searching for alternate variations of the 52 week money challenge, here are a number of other option to consider:

365 Day Money Challenge

52 Week Standard Save Money Challenge

52 Week Variation

52 Week Make Money Challenge

26 Bi-Weekly Money Challenge

24 Bi-Monthly Challenge Chart

52 Week Money Challenge For Kids

Getting Cash To Fill The Monthly Money Challenge Chart

To save money you need to have income. Most of the time this comes from a regular nine to five job, but a lot of people are looking to supplement their regular income. The internet has an unending amount of ideas to do this, but here are a few lists you may not have read. Walletsquirrel has 70 creative ways to make extra money, Gathering Dreams has a good list of ways to make $100 per day. Finally dollarsprout has a comprehensive list of 190 side hustle ideas.

Here are couple of ways to make extra money that you might not have thought of.

- Getting free shares of stock. A lot of brokerages are offering shares of stock as an incentive for signing up. These are Robinhood, Public, Firstrade and Webull. The idea here is to sign up with all of them, get the shares of stock and either sell the stock or collect any dividend payments and add those to your savings total. Signing up with all of them could get you between $50 and $200.

- Selling your data. Due to regulatory changes a number of data brokerages have started that pay you to share your personal data with them. How it works is you let them track your spending, social media and other information. In return, you get paid a specific amount. Its usually just a couple of bucks a month. Even though its low, its mostly passive, so you don’t have to work too hard for it. Companies to look into are Nielson Opinion Rewards, Reklaim, datacy and SavvyConnect.

Readers, are you having any trouble saving? Do you have any ideas for making money that we might not have heard of? Leave us a comment below.

Jeffrey strain is a freelance author, his work has appeared at The Street.com and seekingalpha.com. In addition to having authored thousands of articles, Jeffrey is a former resident of Japan, former owner of Savingadvice.com and a professional digital nomad.

Comments