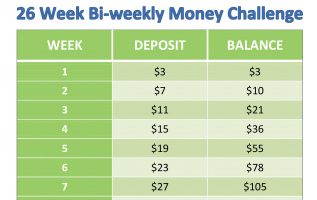

Click image to enlarge or print here (pdf)

For those who are learning about the challenge for the first time, the concept is pretty straight forward and easy to understand. The first week you begin the challenge, you need to save $1 since it’s week one. The second week of the challenge you need to save $2 since it’s week 2. The third week, $3. The fourth week, $4. You continue to match the week’s number all the way through the 52 weeks of the year at the end, you have saved $1,378.

I will actually be using a modified version of this challenge that you can print above. The modified version allows more flexibility so that when you have good weeks, you can save the larger amounts, and when you have tougher weeks, you can save the smaller amounts. The problem with the standard version is that it doesn’t allow you to have a tough week toward the end of the year. With the modified version, you always shoot for the highest amount you can save each week, and then cross off the number that you were able to actually save that week. The greater flexibility should help everyone ultimately reach the savings goal more easily. If you have kids, you might also try to get them involved by giving them their own kid’s money challenge.

In addition to keeping track of the amounts I’m able to save each week, I’ll actually take you through the process of how I went about it. This can be an important resource for those who have a difficult time creating ways to save money on their own. While not every way that I save money will necessarily apply to you, it should help some weeks, and it should also create a situation where you can get your creative juices flowing. This will hopefully give you better resources and motivation to actually achieve the goal this year. In addition, we have a section in the forums where you can actually keep track of how you’re doing if you feel you need even more motivation, or you can simply leave a comment each week to say how you have been doing. Of course, questions and comments are always welcome.

For anyone considering taking on this challenge, I encourage you to simply begin. This is truly the most important step in the process. It doesn’t matter if you are only able to save small amounts during the first few weeks or months. The fact is you’ll be saving something. And doing that something will help you create a habit. Once the habit becomes a part of your week, you’ll be able to save the larger amounts. Take the opportunity to at least try to put yourself in a better financial position at the end of next year than you currently find yourself.

Jeffrey strain is a freelance author, his work has appeared at The Street.com and seekingalpha.com. In addition to having authored thousands of articles, Jeffrey is a former resident of Japan, former owner of Savingadvice.com and a professional digital nomad.

Comments