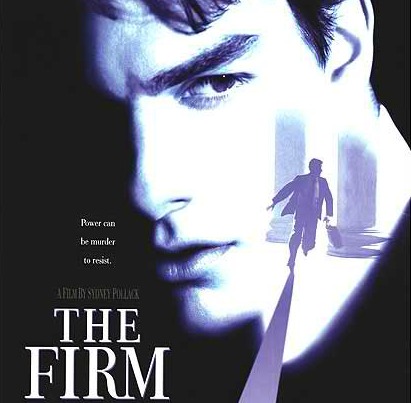

It’s an entertaining movie/book full of chases and tension, but at its core it’s an education in the ways money changes people and can, ultimately, ruin their lives. Here are a few of the lessons you can learn from watching the movie or reading the book.

If it’s too good to be true, it probably is

In the movie, Mitchell McDeere is offered a fabulous job at a law firm in Memphis. He gets a house, a great salary, new car, his student loans all paid off, and all sorts of great perks. All of this right out of law school. And in Memphis. Uh-huh. Anyone knows that this is not how it works in the real world, but Mitch takes the job and, of course, ends up working for the mob.

The Lesson: It’s an oldie but a goodie. If it sounds too good to be true, you’d better walk away. This is true of everything from job offers to late-night infomercials and investment schemes. If it’s that good it would really cost a lot more or require a lot more work to get. Nothing worthwhile is ever that easy. If you’re ever offered anything that sounds too good to be true, do your research and then do it again because you’re probably about to walk into some sort of scam.

Wanting to better yourself is fine, but beware the obsession

Mitch went to law school in part to rise above his family. His brother is in jail. He grew up poor. He wants money and security above all else. To get it he’s willing to ignore the voice in his head that tells him something’s rotten with this job. He also ignores his wife’s reservations. He’s obsessed with money to the point that it overrides his better judgment.

The Lesson: It’s fine and noble to want to rise above your past or to be the first one in the family to reach the top. However, you can’t let it cloud your judgment or become the obsession that rules your life. If you allow it to rule you, you’re more likely to succumb to bad decisions and the ugly influence of others. Better yourself, but retain your common sense.

There are more important things than money

Mitch and his wife had a happy life when they were poor and living in a crummy apartment. They didn’t have much money, but they were in love, had an uncomplicated life, and managed to have some fun. Once Mitch got the job, they spent less time together, they were monitored by the mob, he was lured into cheating on his wife, and they ended up almost divorced. Not to mention the fact that he was almost killed.

The Lesson: Money is helpful and it is certainly nice to have, but it’s not the only thing or even the most important thing. If having a lot of money means that you end up stressed, unhappy, in trouble, or having to give up other things that you love, it’s probably not worth it. Family, friends, love, your health, and an uncomplicated life are worth a lot more than money.

Sometimes money can take away your choices

“The Firm encourages children.” “Working isn’t forbidden.” “No one is divorced in the Firm. No bachelors, either.” The Firm laid out all kinds of weird expectations for their employees and their families. In part this was to nurture an image they wanted to convey, but it was also to limit choices and outside influences that might lead to the revelation of their secret mob connections or to thoughts of employees ratting them out. The more tied to family and the Firm the employees were, the less likely they were to try to escape or tell the Feds.

The Lesson: With money comes expectations that may not jibe with what you want to do and who you want to be. Society expects you to act a certain way. Your employer expects you to act a certain way. Things you may have previously enjoyed are now frowned upon. Those nights spent shooting pool with your best friends are now spent at cocktail parties entertaining clients. Your wardrobe changes from comfortable to stuffy. Your beloved car from 1975 is now replaced by a Lexus that looks like everyone else’s. If you enjoy those things and don’t mind being subtly forced to act a certain way, it can be fine. But if you value your freedom and your choices, you might be better off with less money.

Unethical conduct with money is a sure way to ruin

The Firm over bills all of it’s clients. Eventually, it is this that brings them down. Since the mob ties cannot be proven without Mitch losing his law license, Mitch uses the over billing to point out that the Firm is committing fraud. Every time that they mailed a bill for an inflated amount, they committed mail fraud which is a federal offense. It is this charge that the feds ultimately use to shut the firm down.

The Lesson: Cheating with money will eventually catch up to you. If you cheat on your taxes, over bill your clients, embezzle, run ponzi schemes, or cheat your customers, you will eventually get caught. No matter how you may try to justify it to yourself (you need to pay bills, someone’s sick and needs care, why should everyone else have all the fun, etc.), it’s wrong. You may think you’re getting away with something and doing a great job at stashing away some extra money without having to work for it, but when you’re caught you’ll wish you hadn’t been so stupid. The punishment is likely to be much worse than if you’d just stayed broke or found some other way to make money.

Money changes people

In the movie, money corrupted everyone. Avery Tolar (Mitch’s mentor) was a decent guy at heart, but the money and the job ruined him. Mitch became a workaholic and something of a jerk. The wives in the movie became the Stepford variety. And, of course, the senior partners who ran with the mob had long ago become corrupt liars and thieves.

The Lesson: Money can turn previously good people into bad people. It can also make good people better, but only if you’re careful to avoid the negative influences of money. Money can turn you into a greedy monster, it can make you act like a jerk to people who are “beneath” you, it can make you do illegal things to protect your money or get more of it, and it can make you compromise your values and ethics. Money is wonderful to have but you have to guard against the changes it can bring. If you’re going to change because of money, make sure it’s to become a more generous, compassionate, and loving person, not a jerk.

If you ever want a quick lesson on the evils and problems that money can bring, rent the DVD of “The Firm,” pop some popcorn and sit back for an education. You’ll probably soon realize that no amount of money is worth that kind of trouble.

Jennifer Derrick is a freelance writer, novelist and children’s book author. When she’s not writing Jennifer enjoys running marathons, playing tennis, boardgames and reading pretty much everything she can get her hands on. You can learn more about Jennifer at: https://jenniferderrick.com/.

Comments