As a salary slave warrior all I know is "active income." The best way to generate passive income is to take the entrepeneur route and work hard building your business in the beginning, then you can enjoy the fruits of your labor in the later stages which can come a lot sooner than a salary slave warrior such as myself. We all want easy money that comes in while we sleep but you have to work hard at it to attain passive income.

Logging in...

What Are You Doing To Build Passive Income?

Collapse

X

-

You not only watch it grow but it grows untouched instead of retiringOriginally posted by Petunia 100 View PostWhat am I doing to build passive income? Just tucking as much money as I can into investments and watching my pension benefit grow. The pension amount is still tiny. My income is not large, so my nest egg is modest.

Comment

-

-

Mostly stocks, as others have suggested. With my spare cash I've been investigating plays on "SPACS" (special acquisition companies), as these can occasionally be quite lucrative. I've also become interested in option trading, specifically selling covered calls.

Comment

-

-

Thanks for starting this discussion on building passive income – it's always great to learn from others' experiences.

Investing in stocks is a solid choice. It may not be the fastest route, but over time, it can really grow your wealth. It's all about patience and smart choices.

Being experimental is a good mindset when it comes to passive income – you never know what might work until you try.

As for me, I've been diving into how to make money on Audible Amazon. Audiobooks are gaining popularity, and there are ways to tap into this trend. It's not a get-rich-quick scheme, but with dedication, it can pay off.Last edited by AndrewMulvey; 11-03-2023, 04:07 AM.

Comment

-

-

Its not a low $$ entry investment, but I mentioned it in another thread a while back that I've started doing hard money lending. My first deal is wrapping up in 2 weeks. It originated in June so total time of the loan was about 4.5 months. Here's how it broke down start to finish:

Initial investment: $52,200

Origination fee: $1000

Interest earned: $2,509

Less some fees: -$149 ($30 wire transfer fee, rest is payment vendor fees)

Total earned: $3360

Previously this money was sitting in a 4% interest savings account. I earned more in the last 4 months than I would have over a year in the savings account. I plan to 3x my next investment with 2/3 coming from a self directed IRA for additional tax savings.

Comment

-

-

Guys,

Interest rates are high these days. If you have cash sitting in a bank account, you can always call the bank or do some internet research.

You might be able to get a better deal if you change accounts or change banks. This should marginally improve your passive income.james.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

What is "hard money lending" anyways? I've never understood that term.Originally posted by riverwed070707 View PostIts not a low $$ entry investment, but I mentioned it in another thread a while back that I've started doing hard money lending. My first deal is wrapping up in 2 weeks. It originated in June so total time of the loan was about 4.5 months. Here's how it broke down start to finish:

Initial investment: $52,200

Origination fee: $1000

Interest earned: $2,509

Less some fees: -$149 ($30 wire transfer fee, rest is payment vendor fees)

Total earned: $3360

Previously this money was sitting in a 4% interest savings account. I earned more in the last 4 months than I would have over a year in the savings account. I plan to 3x my next investment with 2/3 coming from a self directed IRA for additional tax savings.james.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

Private lenders normally lending to real estate investors.Originally posted by james.hendrickson View Post

What is "hard money lending" anyways? I've never understood that term.

Usually off market deals, places needing major rehab, and generally houses that a traditional bank may not touch.Brian

Comment

-

-

It could be a lot more than a marginal improvement. Many big banks are still paying 0.1% on savings. You can easily get 5.3% and if you can do a CD or bond you get be at 6% or even a bit more.Originally posted by james.hendrickson View PostGuys,

Interest rates are high these days. If you have cash sitting in a bank account, you can always call the bank or do some internet research.

You might be able to get a better deal if you change accounts or change banks. This should marginally improve your passive income.

On $10,000 that would be $530 vs $10. About $43/mo, probably enough to pay a small bill or two.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

High interest savings at 5%Originally posted by QuarterMillionMan View PostAs a salary slave warrior all I know is "active income." The best way to generate passive income is to take the entrepeneur route and work hard building your business in the beginning, then you can enjoy the fruits of your labor in the later stages which can come a lot sooner than a salary slave warrior such as myself. We all want easy money that comes in while we sleep but you have to work hard at it to attain passive income.

Comment

-

-

thats amazing!Originally posted by riverwed070707 View PostIts not a low $$ entry investment, but I mentioned it in another thread a while back that I've started doing hard money lending. My first deal is wrapping up in 2 weeks. It originated in June so total time of the loan was about 4.5 months. Here's how it broke down start to finish:

Initial investment: $52,200

Origination fee: $1000

Interest earned: $2,509

Less some fees: -$149 ($30 wire transfer fee, rest is payment vendor fees)

Total earned: $3360

Previously this money was sitting in a 4% interest savings account. I earned more in the last 4 months than I would have over a year in the savings account. I plan to 3x my next investment with 2/3 coming from a self directed IRA for additional tax savings.

but now it's crazy how much savings and fixed income is earning

Comment

-

-

Guys - just taking a moment to follow up here.

So, finding a single passive income stream that is scalable, and working on it for years or months can really pay off.

About three years ago I made a decision to build my retirement investing principle to $100,000 mostly with dividend paying stocks.

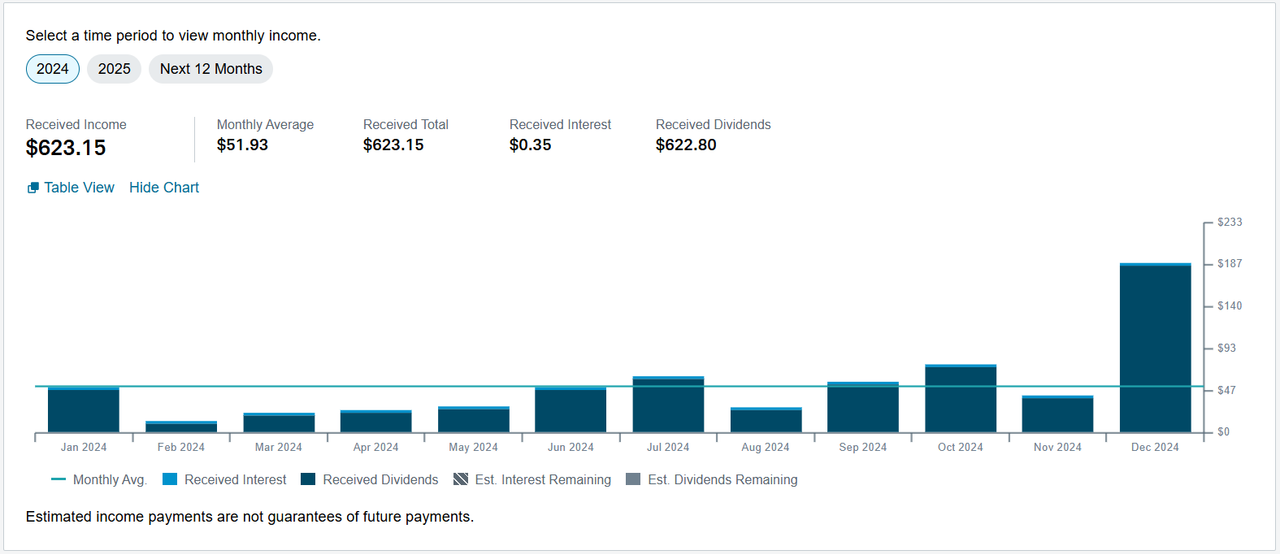

I've been at it consistently dumping as much money as I can into my retirement accounts (and my non-retirement accounts), and am starting to see results. Here is the income from my Schwab portfolio in 2024, and projected 2025 income.

This is 2024.

Here is 2025. Its basically double the numbers. A lot of the growth here was because I am consistently dumping money from my salary into my retirement, as well as hustling some extra money in my spare time (doing surveys, selling my bandwidth and selling the clutter in my house), and anytime I get family money, I put it into my stock accounts. I am also reinvesting 100% of the dividends into the market.

I prefer dividend paying stocks because they're usually profitable. Its easy to fiddle with balance sheets using accounting tricks, but a company that consistently kicks out cash every quarter has greater certainty that the company is truly profitable.

So, I pretty much just mean to share this as an example of what is working for me. Most of the people on the forums know this already, but if you are new here and are wondering how to grow your passive income. A good strategy might be to focus on one income source and aggressively grow it as much as you can.

james.c.hendrickson@gmail.com

202.468.6043

Comment

-

Comment