All,

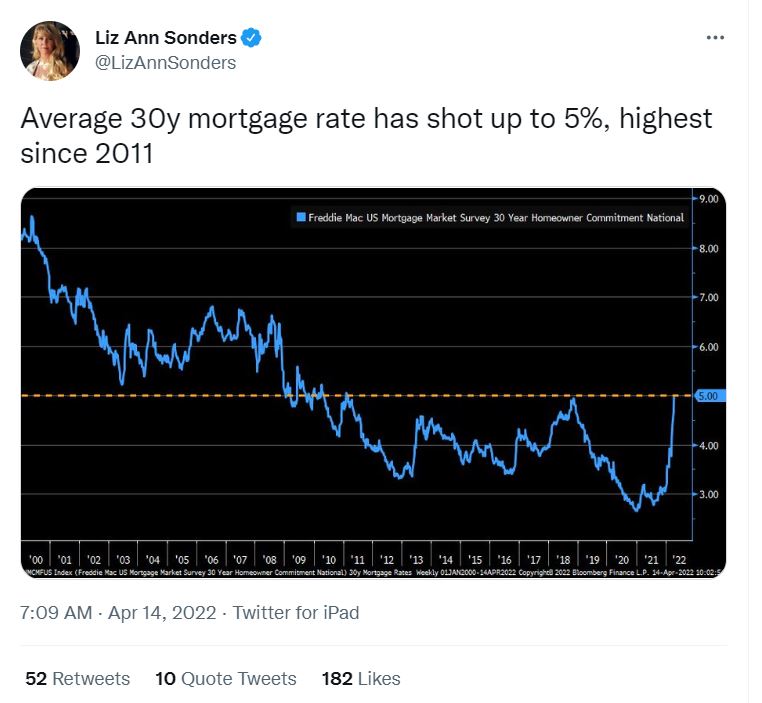

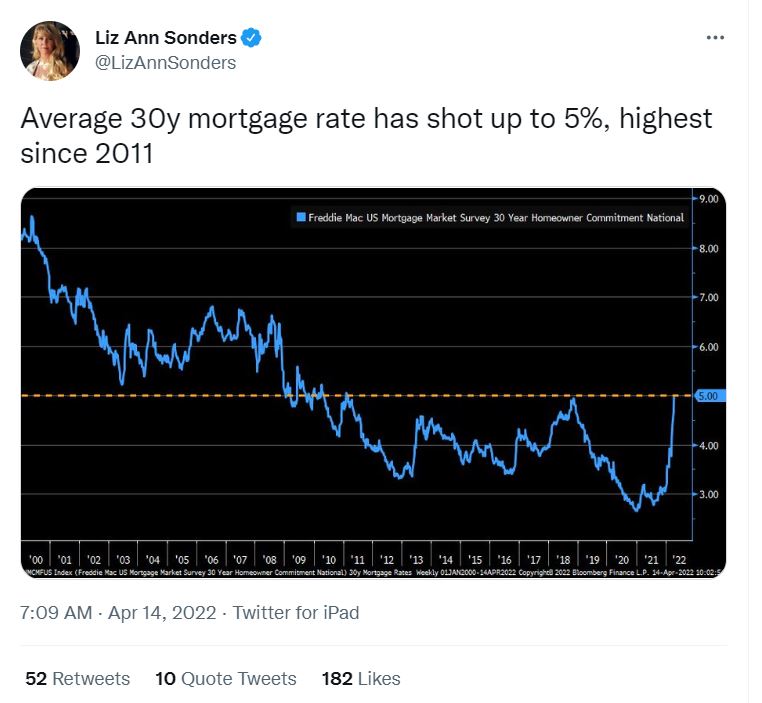

Saw this on Twitter this morning - thought it made sense to post. Evidently mortgage rates are nearing 5%. This is the highest in a decade and suggests markets are responding to anticipated interest rate increases by the Federal reserve.

Source: Liz Ann Sonders Twitter feed.

Why this matter? If your mortgage rate is under 5%, not may not be a great time to refinance.

Saw this on Twitter this morning - thought it made sense to post. Evidently mortgage rates are nearing 5%. This is the highest in a decade and suggests markets are responding to anticipated interest rate increases by the Federal reserve.

Source: Liz Ann Sonders Twitter feed.

Why this matter? If your mortgage rate is under 5%, not may not be a great time to refinance.

Comment