Guys,

I just want to say..."wow, when the stock market works, it really works".

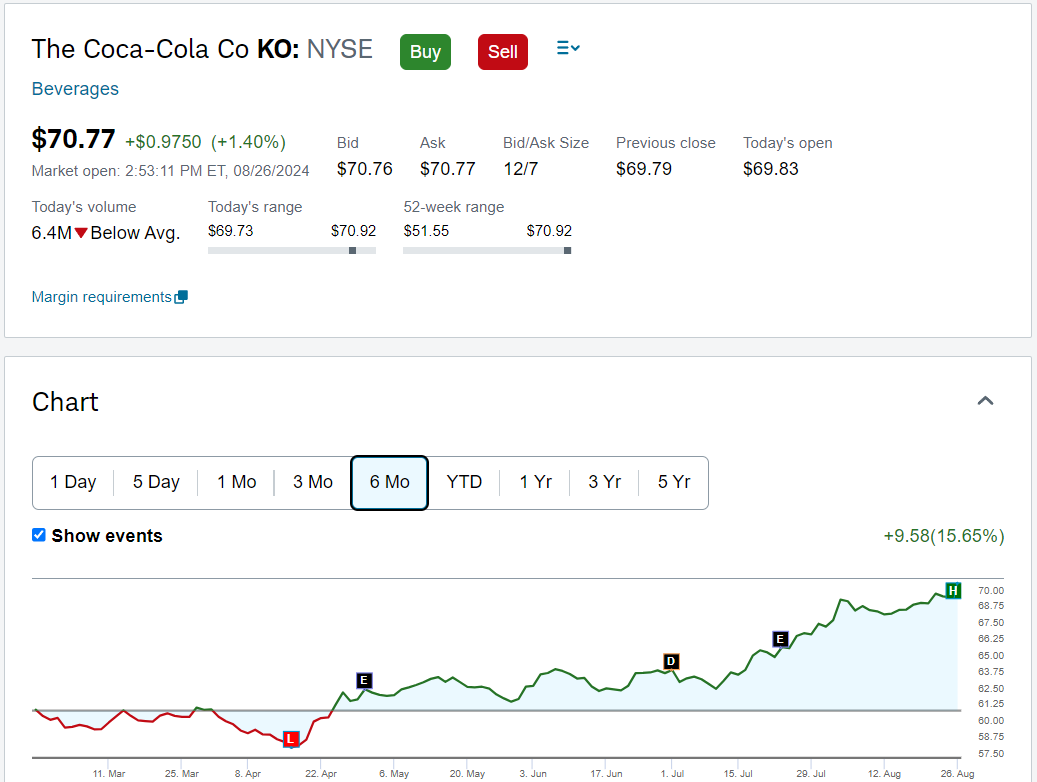

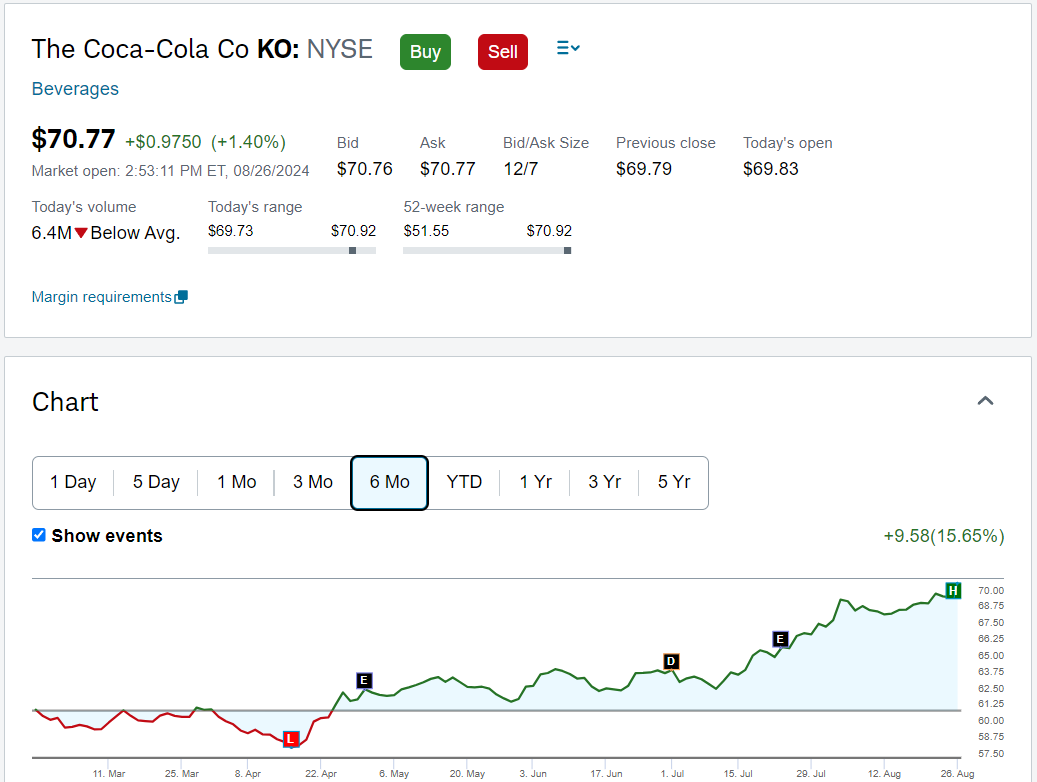

I've been slowing accumulating as much Coca Cola stock as I could get my hands on...and this morning it broke $70 per share.

I also took a concentrated position in Barnes and Noble Education, - its also up by 30% since I bought it.

Now, granted, I've also been putting a ton of money into index funds/mutual funds...its just when you get a solid price movement in a particular company, its can have a serious wow factor.

I just want to say..."wow, when the stock market works, it really works".

I've been slowing accumulating as much Coca Cola stock as I could get my hands on...and this morning it broke $70 per share.

I also took a concentrated position in Barnes and Noble Education, - its also up by 30% since I bought it.

Now, granted, I've also been putting a ton of money into index funds/mutual funds...its just when you get a solid price movement in a particular company, its can have a serious wow factor.

Comment