If you’re serious about building wealth, it’s only a matter of time before you face one of the most debated questions in personal finance: Should you invest in real estate or the stock market? Both promise financial growth. Both come with risks. And both have diehard followers who claim their method is superior. But look beyond the headlines, past the sales pitches and surface-level comparisons. You’ll find that the better choice depends on more than just potential returns—it hinges on your personality, goals, risk tolerance, time commitment, and even your temperament.

Why Real Estate Has a Loyal Following

Real estate has been a trusted path to wealth for generations, praised for its tangible nature and long-term appreciation. The idea of owning a piece of the earth, earning passive income from rent, and eventually paying off a property that continues to grow in value has deep appeal. It offers a sense of security and control that no stock certificate can match. There’s something powerful about knowing you can walk through your investment, touch its walls, and improve it with your own effort.

Real estate also allows for leverage. You can use other people’s money (usually the bank’s) to buy an asset, which can significantly increase your return on investment if things go well. But most gurus gloss over how active real estate investing is. Dealing with tenants, property taxes, repairs, vacancies, and the real estate market’s fluctuations can be overwhelming, especially if you go in without a plan or under the illusion it’s “easy money.”

The Stock Market’s Silent Strength

On the other hand, stocks represent ownership in companies that make up the engine of the economy. From tech giants to consumer staples, the stock market offers a slice of thousands of businesses across the globe. One of the most compelling aspects of stocks is their liquidity. With just a few clicks, you can buy or sell your holdings, and your investment is diversified across dozens or hundreds of companies if you use index funds.

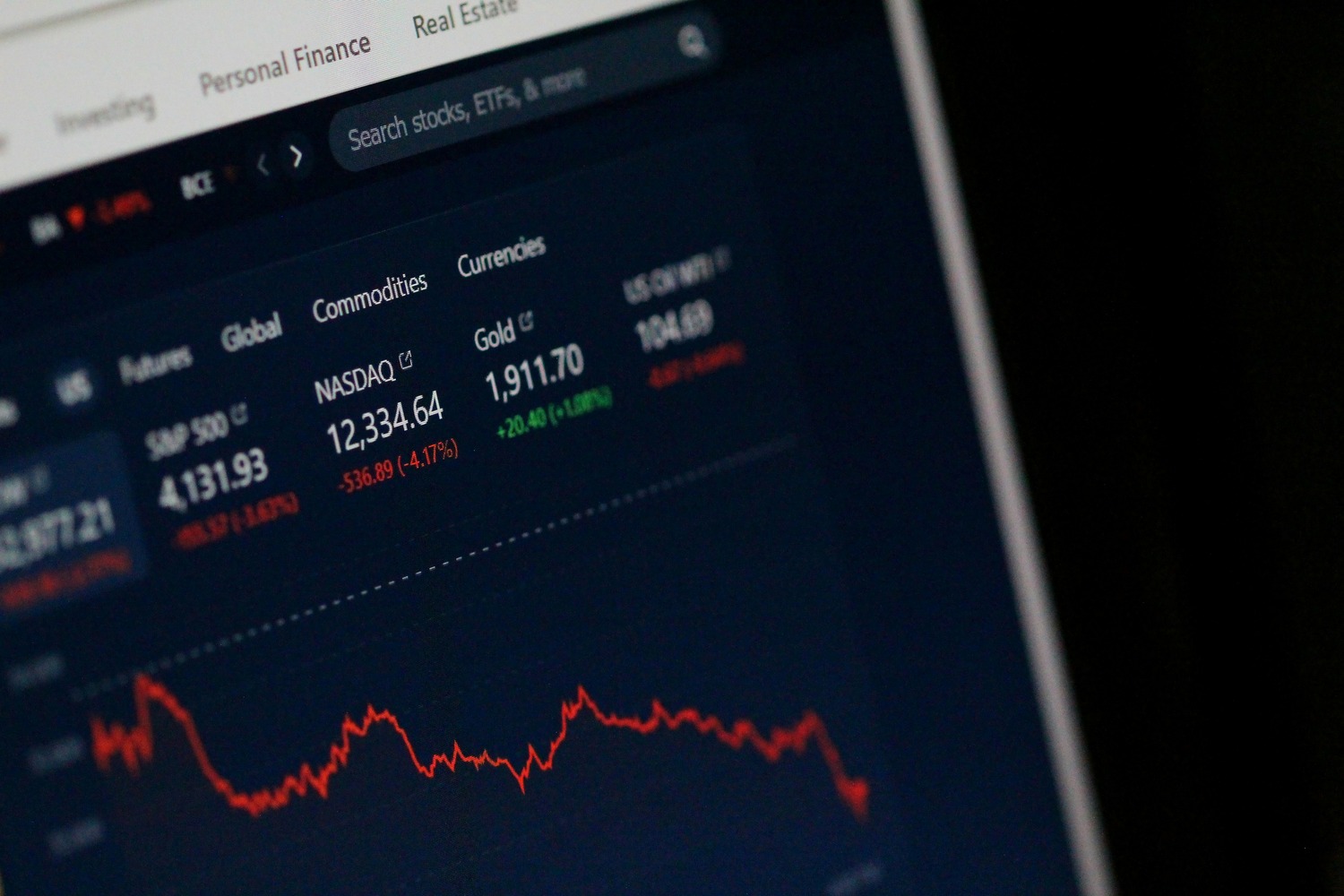

Unlike real estate, stocks require little ongoing effort. Once you’re in, there’s no leaky roof to fix or tenant drama to manage. They also come with a long history of strong returns. Historically, the S&P 500 has returned an average of 7–10% annually after inflation. But this doesn’t mean it’s a smooth ride. The stock market is emotionally turbulent. Prices swing wildly due to factors often outside your control—geopolitical events, interest rates, market sentiment—and that volatility is simply too stressful for some.

How 2025 Is Changing the Game

Both markets will be evolving quickly in 2025. In many areas, real estate has experienced major shifts due to high interest rates, reduced affordability, and rising property taxes. This has made cash flow harder to achieve for new investors unless they buy in undervalued markets or pivot to short-term rentals, which come with their own regulatory and maintenance headaches.

Meanwhile, the stock market has recovered from recent downturns and remains accessible to everyday investors thanks to apps and platforms that allow fractional shares and automated investing. But with that accessibility comes risk: too many investors are trying to time the market, chase meme stocks, or follow trends instead of building a long-term strategy.

The Capital Entry Barrier

One critical difference lies in barriers to entry. Buying a rental property usually requires a significant down payment, good credit, and the ability to qualify for a mortgage. In contrast, you can begin investing in the stock market with just a few dollars. For people who don’t have large sums of capital, stocks may be the only realistic way to start building wealth. That said, real estate offers tax advantages that stocks typically don’t—such as depreciation, 1031 exchanges, and mortgage interest deductions. These can make a massive difference in your net returns over time, especially if you’re operating at scale or holding properties for decades.

Risk: What Kind Are You Really Taking?

It’s also important to consider your risk profile and emotional response to loss. Real estate tends to be less volatile on the surface because prices don’t change minute-to-minute like stocks do. This can create the illusion of stability. But real estate carries its own kind of risk—market downturns, property damage, lawsuits, bad tenants, and interest rate spikes can all erode your investment. Meanwhile, stock investors must learn to tolerate paper losses. One bad year in the market can wipe out years of gains if you panic-sell. But those who stay the course tend to be rewarded over the long run.

Time and Effort: Active vs. Passive Investing

Another overlooked factor is time and energy. Real estate, unless outsourced to a property manager, is like running a small business. You’ll need to deal with maintenance, legal documents, tenant screening, and emergency calls. Stocks, once your portfolio is set up, require very little attention unless you’re actively trading, which isn’t recommended for most people anyway. Passive index investing, for example, can be set up once and left alone, aside from occasional rebalancing. That makes it ideal for people who want to build wealth without sacrificing their nights and weekends.

Diversification and Control

What about diversification? Real estate investors often concentrate a lot of capital into one or two properties. If something goes wrong with the local market or the roof, you could face a major loss. Stock investors can spread risk across entire sectors and economies, reducing the chances that one event sinks their entire portfolio. However, the flip side is control. Stockholders don’t get to improve the business they’ve invested in.

Real estate investors can increase the value of their assets through renovations, better management, and rent optimization. In that sense, real estate allows for more hands-on wealth-building, while stocks are more hands-off and dependent on broader market forces.

The Smartest Strategy Might Be a Mix

Ultimately, the best answer to the real estate vs. stocks debate is often this: do both if you can. There’s no rule that says you must pick one. In fact, the wealthiest individuals often diversify across both asset classes to balance risk and capitalize on different types of growth.

You might start with stocks to build capital quickly and then shift to real estate once you have enough for a down payment. Or you might invest in real estate first and use the cash flow to fund your Roth IRA or taxable brokerage account. One grows steadily in the background, the other provides more direct, leveraged income if you’re willing to put in the work.

Know Yourself Before You Choose

So, where should you build wealth? The answer depends on your income, time availability, comfort with risk, and long-term goals. Real estate might suit you better if you like stability, control, and tangible assets. The stock market could be your best friend if you prefer liquidity, automation, and diversification. And if you’re serious about reaching financial independence, the smartest move might be to master both worlds—strategically, patiently, and with a plan that fits your unique life.

Are you building wealth with real estate, stocks, or a mix of both? What’s worked or failed for you so far?

Read More:

12 Investing Traditions Wall Street Hopes You’ll Follow Forever

Simple Steps to Financial Independence: How Smart Investing Can Build Your Wealth

Riley is an Arizona native with over nine years of writing experience. From personal finance to travel to digital marketing to pop culture, she’s written about everything under the sun. When she’s not writing, she’s spending her time outside, reading, or cuddling with her two corgis.

Comments