Investing isn’t just about picking the right stock; it’s about time in the market. Berkshire Hathaway, under the stewardship of Warren Buffett, has long been a beacon for long-term investors. But what does a decade of patience yield in tangible terms? Let’s delve into the numbers and see how a modest investment has matured over the years.

The Initial Investment: $1,000 in 2015

In May 2015, Berkshire Hathaway’s Class B shares (BRK.B) were trading at approximately $143.00 per share. With $1,000, you could have purchased about 6.99 shares. While fractional shares weren’t as common then, for this analysis, we’ll consider the full amount invested. This investment marked the beginning of a journey with one of the most renowned conglomerates in the financial world. The company’s diverse holdings provided a solid foundation for growth.

The Growth Over a Decade

Fast forward to May 2025, and BRK.B shares are trading at approximately $513.74. Those 6.99 shares would now be worth about $3,590.97. This represents a gain of $2,590.97 over the initial investment. Such growth underscores the potential benefits of long-term investing. It’s a testament to Berkshire Hathaway’s consistent performance and strategic acquisitions.

Annualized Return: Breaking Down the Numbers

To understand the investment’s performance, we calculate the Compound Annual Growth Rate (CAGR). Using the formula:

CAGR = (Ending Value / Beginning Value)^(1 / Number of Years) – 1

Plugging in the numbers:

CAGR = ($3,590.97 / $1,000)^(1/10) – 1 ≈ 13.6%

This annualized return outpaces many traditional investment vehicles, highlighting the strength of Berkshire Hathaway’s business model.

Comparing to the S&P 500

Over the same period, the S&P 500 index has averaged an annual return of about 10%. While the index offers diversification, Berkshire Hathaway’s performance showcases the potential of individual stock investments. However, it’s essential to note that individual stocks come with higher volatility. Berkshire’s diversified holdings somewhat mitigate this risk, but investors should always assess their risk tolerance. Diversification remains a key principle in investment strategy.

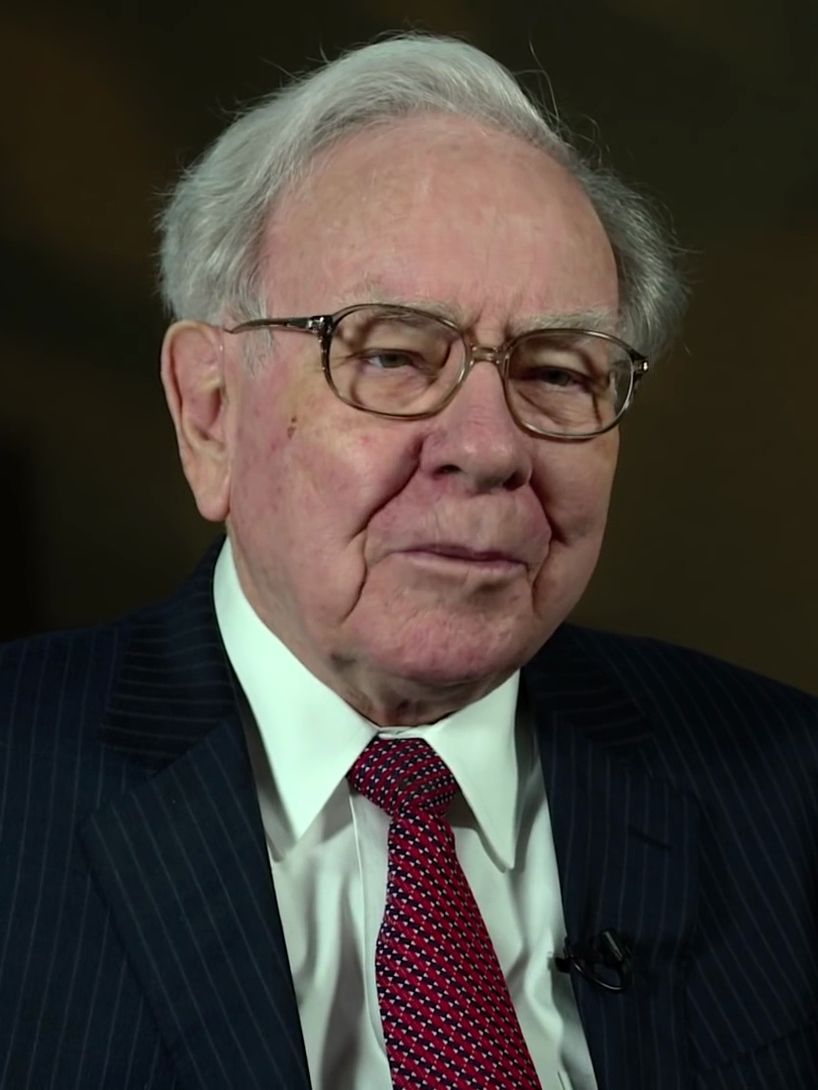

The Buffett Effect: Leadership and Vision

Warren Buffett’s leadership has been instrumental in Berkshire Hathaway’s success. His value investing philosophy and long-term vision have guided the company’s acquisitions and growth strategies. Investors have benefited from his disciplined approach and keen eye for undervalued assets. As succession plans unfold, the company’s future leadership will aim to uphold these principles. Buffett’s legacy sets a high standard for continued performance.

Reinvesting Dividends: A Non-Factor

Unlike many companies, Berkshire Hathaway does not pay dividends. Instead, it reinvests earnings into the business, seeking opportunities for growth. This strategy aligns with Buffett’s belief in compounding returns. For investors, this means relying solely on capital appreciation for returns. The company’s track record suggests this approach has been effective.

Lessons for Investors

The growth of a $1,000 investment in Berkshire Hathaway over ten years illustrates several key investment principles:

Patience Pays Off: Long-term holding can yield significant returns.

Quality Matters: Investing in companies with strong fundamentals is crucial.

Reinvestment Strategies: Companies that effectively reinvest earnings can offer substantial growth.

Diversification Within a Company: Berkshire’s varied holdings provide built-in diversification.

These lessons can guide investors in building resilient portfolios.

Reflecting on the Journey

A decade ago, a $1,000 investment in Berkshire Hathaway might have seemed modest. Today, it’s a testament to the power of long-term investing and the impact of strategic leadership. While past performance doesn’t guarantee future results, the company’s history offers valuable insights for investors. As markets evolve, the principles demonstrated by Berkshire Hathaway remain relevant.

Have you considered long-term investments like Berkshire Hathaway? Share your experiences and thoughts in the comments below!

Read More

How To Prepare For A Recession: Investing, Spending And Saving Tips To Protect Your Wealth

6 Investments That Would Have Made You A Millionaire Had You Invested 5 Years Ago

Drew Blankenship is a seasoned automotive professional with over 20 years of hands-on experience as a Porsche technician. While Drew mostly writes about automotives, he also channels his knowledge into writing about money, technology and relationships. Based in North Carolina, Drew still fuels his passion for motorsport by following Formula 1 and spending weekends under the hood when he can. He lives with his wife and two children, who occasionally remind him to take a break from rebuilding engines.

Comments