It seems like a distant dream at this point but I often find myself thinking of spending my days drinking iced tea and working on a project that I enjoy.

Unfortunately, to get to that point, I need to put away a lot of money. If I’m planning to retire at 65 and assuming I’ll live to be in my mid-nineties, I’ll need to be making approximately as much as I’m making now, for thirty additional years. Phew!

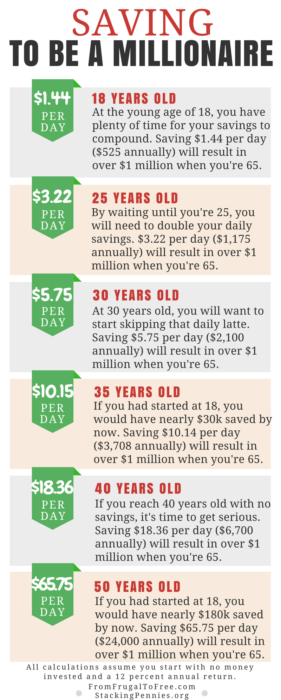

That sounds like a lot of money. A million dollars or more, to be exact. So, how do I possibly get that much money without winning the lottery or hitting it big in Vegas?

The answer my friends is to live a frugal life and start saving NOW. If you start saving now, no matter how old you are, you are taking proactive steps to retire sooner rather than later. Don’t rely on your pension or social security, don’t expect a crazy windfall from a deceased relative or a lottery win. You can become a millionaire by taking small steps daily.

Traditionally, investment gurus have told us to save a certain percentage of our paycheck. The majority recommend you save between 10% and 25% of each paycheck, and having it automatically withdrawn and placed into a retirement account at every pay period.

But what if there is a simpler way? What if what we really need is a mind shift. Instead of saving a certain percentage, what if we saved a simple dollar amount each day. A small stipend off our usual expenditure. Small things, like making your coffee at home instead of visiting your favorite barista. Or purchasing snacks in bulk, rather than visit the vending machine. These small changes add up to an impressive amount over time.

Let’s start at the beginning. Let’s say we are 18. Woohoo! Pre-kids life. Your teenage years is certainly not the time most would be thinking about putting money away for my retirement, (let’s face it, at 18, clothes and gadgets are seemingly more important than retirement).

But if we started at 18, we would have nearly $30,000 saved by the time of our 35th birthday. And that’s by saving only $1.44 per day. That’s less than a can of soda at a vending machine. Heck, walk the streets of NY, and you may find $1.44 in change laying on the sidewalk. If that same 18-year-old kept saving $1.44 per day until he was 65, he would be a millionaire.

There are a number of good platforms that can help you optimize these. For example, SoFi invest has a number of good articles on 401(k) investing. Other companies such as M1 Finance and Schwab also do a good job with self-directed 401(k) and IRA accounts.

Time is such an important factor in saving; Waiting only a few years can make a big difference. If that 18-year-old had waited until they were 25, they would need to save more than double per day what they had to at 18. Waiting until you’re 35 years old means you have to save close to 8x per day what you would have had to at 18. And if you wait for all the way until 50 years old, you’ll need to save 45x more per day, than at 18.

That’s not to say that all hope is lost if you didn’t begin saving early. I didn’t start saving at 18, but I took proactive steps when I was 30 to plan for retirement. Since I didn’t start early, I have to make up for it now. Let’s do some math. If I save $6 per day, at 12% interest, I’ll be a millionaire by the time I’m 65. That sounds pretty good to me, how about you?

NOTE: This article assumes you start with no money invested, and it assumes a 12 percent annual return.

Photo: Self Inspiration

Mr. Beatles is a married family man. When he started his debt reduction journey he was $50,000 in debt. This was the consequence of living a consumer driven lifestyle that was paid for by credit cards and mass overspending. Mr. Beatles lives on the East Coast with his family, where he actively manages his debt through aggressive side hustles, careful asset management and strict budgeting.

Comments