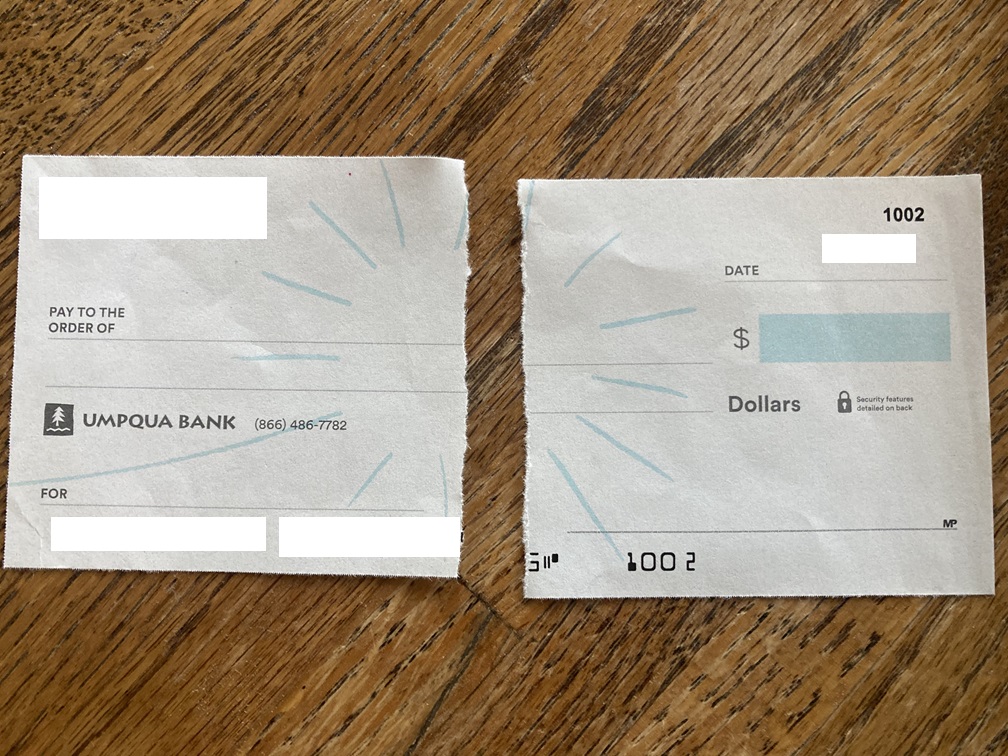

It happens to the best of us—you accidentally ripped a check that came in the mail when you opened the envelope. Or maybe your child or dog got ahold of a check you were on your way to the bank to cash. No matter how it happened, now you have a damaged check on your hands and are wondering, can you still deposit a ripped check?

The short answer is, it depends.

It depends on your bank’s policies and how damaged the check is. If critical information like the account or routing number is missing, you may not be able to deposit it.

Read on to learn more so you can get your money as soon as possible.

How Do You Deposit A Ripped Check?

First, it’s important to assess the damage. Take a look at your check and see if all the information needed to deposit it is still visible, including:

- Names of the payer and payee

- Date of issue

- Amount

- Payer signature

- Account and routing numbers

If these elements are all intact and visible, you’ll likely have an easier time depositing it.

Try Mobile Deposit

Many banks use automated systems to process mobile deposits, so a torn or ripped check may be automatically rejected. But if you usually use your bank’s app to deposit checks, try giving it a shot.

Your first instinct may be to tape your shredded check back together. But tape or glue may interfere with the magnetic ink used on the bottom line of the check, potentially causing misreads. It’s usually best to carefully align the pieces of the ripped check and then proceed with mobile deposit as normal.

Ask Your Bank About Their Damaged Check Policy

If that doesn’t work, contact your bank and ask them if they deposit damaged checks. Financial institutions aren’t required to accept them, so every bank will have different policies and protocols. As mentioned above, your bank is more likely to work with you if all pertinent information like the name of the payee and check amount is clearly visible.

If your bank is willing to take a look at your check, make sure to head to the teller first. Don’t try to use the ATM because the machine could further damage your check.

Call the Issuing Bank and Other Financial Institutions

No luck at your bank? It’s possible that the issuing bank may be willing to cash your check because it’s easier for them to verify its authenticity. Credit unions and smaller community banks are also known to be more flexible about damaged checks. But before you go out of your way to visit a new bank, be sure to call ahead and inquire about their policies.

Also, keep in mind that you may be charged a small handling fee to cash a check at a bank where you aren’t an account holder. If there aren’t any local banks that can help you out, you can visit a check cashing business as a last resort. These services cash checks for patrons who don’t have bank accounts for a fee, so they might be able to help you out.

Request A New Check

Sometimes a check is too mangled for banks to verify that it’s valid. In that case, you’ll have to go back to the person or company that gave it to you and ask for a new check.

Although it can be embarrassing to admit you mishandled your check, there’s no other way to get a new one. Remember that accidents happen and companies have to reissue lost or damaged checks all the time. They’ll easily be able to void the old check and write you a new one. They may request photo evidence to prove that the check was damaged, so don’t throw it out prematurely.

Avoiding Future Damage

Running around town trying to get a damaged check cashed is a big hassle. To prevent this from happening in the future, consider setting up direct deposit for recurring payments, or use a payment portal like PayPal. Using a letter opener for important mail can also help prevent mishaps.

When you get a check, try using your bank’s mobile app to deposit it right away. If you must store it, make sure to keep it somewhere safe where it can lay completely flat, like a desk drawer. Don’t stash it in your wallet or purse where it could get crumpled or torn. Placing the check in an envelope, plastic document sleeve, or checkbook cover can also provide an extra layer of protection.

Looking For Some Ideas To Fill Your Bank Account? Read These:

38 Ways To Make Extra Money You’ve Never Heard Of

Yes, There may Be Bills In Your Wallet Worth More Than Face Value

Can You Pay Using A Ripped Dollar Bill?

Vicky Monroe is a freelance personal finance and lifestyle writer. When she’s not busy writing about her favorite money saving hacks or tinkering with her budget spreadsheets, she likes to travel, garden, and cook healthy vegetarian meals.

Comments